- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA survey: 79% of experts say JobKeeper should continue or expand

- Half of experts (48%) think JobSeeker payments should be increased post-COVID

- Only 37% of Aussies now expect a pay rise, as positivity about wage growth remains at 0%

- Positive sentiment for housing affordability has matched its all-time high of 59%

2 June 2020, Sydney, Australia –Economists don't think the government should put the brakes on JobKeeper just yet, according to Finder, Australia's most visited comparison site.

In this month's Finder RBA Cash Rate Survey™ – the largest of its kind in Australia – 43 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

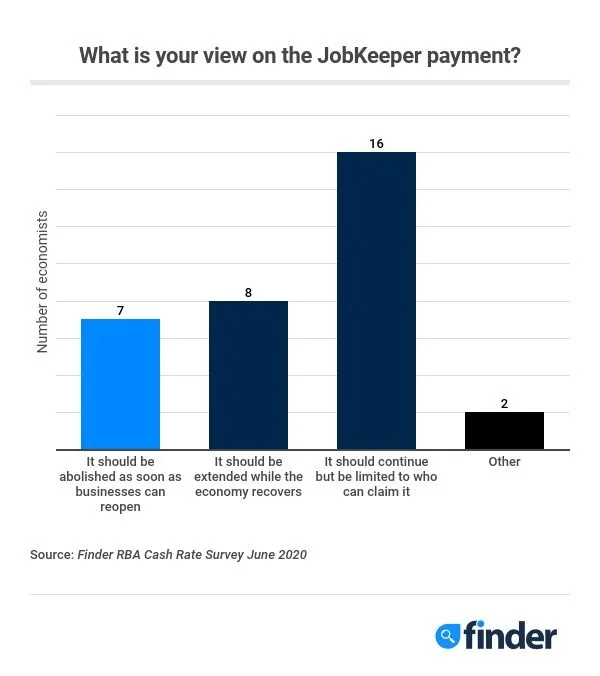

While all experts surveyed (43/43) correctly predicted the cash rate to hold at 0.25%, 4 in 5 of those who weighed in on JobKeeper (79%, 26/33) said that the program should either be extended or continued.

A quarter of respondents (24%, 8/33) said the program should be extended, while half (48%, 16/33) said it should continue but be limited.

Only a fifth of experts (21%, 7/33) said that the JobKeeper payment should be abolished as soon as businesses can reopen at full capacity.

Graham Cooke, insights manager at Finder, said that ending the program now would be premature.

"Pubs and restaurants are finally allowed to have 50 people in some states from this week, but social distancing rules will still be strictly enforced, heavily reducing capacity.

"The domestic travel industry, already singed by destructive bushfires, is also yet to find a way out of the COVID-19 crisis.

"We are a long way off from a full recovery – we won't see full operation until 2021 at the earliest.

"This is why the JobKeeper payments will likely have to continue beyond the initial six-month duration," Cooke said.

Noel Whittaker of Queensland University of Technology (QUT) said he is pessimistic about the economy once the government money stops flowing.

"We are living in most uncertain times. In September when the stimulus payments stop, and the loan holidays stop, things may get very bad," Whittaker said.

While experts were fairly consistent about the future of JobKeeper, economists were more divided about JobSeeker.

About half (48%, 16/33) said that the JobSeeker payment should be increased post-COVID, with the other half (52%, 17/33) disagreeing.

Christine Williams of Smarter Property Investing said the 10-15% unemployment rate won't snap back for a while.

"Once we are in full swing, those who want to return to the workforce will, those that don't, won't. This will lead to an unnatural unemployment percentage for a couple of years," Williams said.

Economic Sentiment Tracker

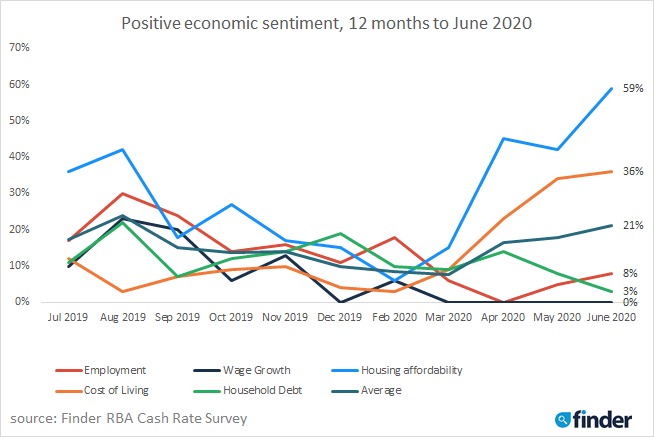

Finder's Economic Sentiment Tracker gauges experts' confidence in five key indicators: housing affordability, employment, wage growth, cost of living and household debt.

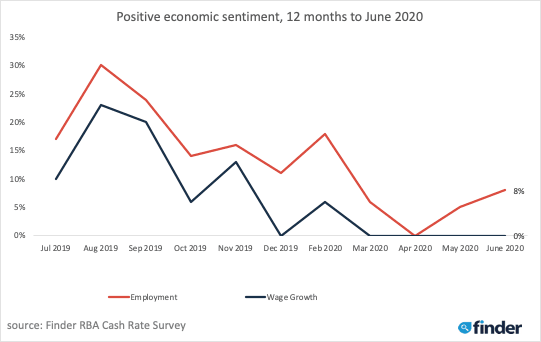

This month, positive sentiment about employment improved slightly, while wage growth positivity stayed at 0% for the third consecutive month.

A separate Finder consumer survey of more than 13,200 respondents, which has been conducted monthly since May 2019, found that the percentage of those feeling negatively about their employment situation has risen from an all-time low of 17% in January 2020 to an all-time high of 27% in May 2020.

The survey also found that the number of Australians expecting a pay rise in the next 12 months dropped from a high of 48% in February 2020 to just 37% in May 2020.

Cooke said it's going to be a while before people feel confident about wage growth.

"As businesses reopen and the economy starts to recover, highly skilled workers will have the confidence to ask for a pay rise.

"For entry-level and public service workers, the road may be longer– competition from battered sectors like tourism and aviation mean there are fewer jobs and more workers," Cooke said.

On the bright side, positive sentiment for housing affordability has matched its all-time high of 59%, rising from 6% in February 2020.

"When experts are positive about housing affordability, there are two ways to look at it: on the one hand, houses are potentially losing value, but on the other, it's a great time to score a bargain," Cooke said.

"We have seen prices fall by up to 1% already but this could be just the tip of the iceberg. Many economists are expecting this figure to increase tenfold.

"If you are in the market for a home, keep in mind that a certain amount of foreign investment is currently being kept at bay by the international travel ban, meaning there is less competition than usual, but this won't last forever.

"Additionally, talk of removing or replacing stamp duty in some states may be causing some potential buyers to hold off. The actual change, if applied, could reverse the downward trend in prices.

"When you factor in record low rates and record unemployment, there are deals to be had right now."

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion: "The impact of coronavirus will create a lasting demand impact and rates will stay low for an extended period of time. The RBA is likely to target longer-term bond yields in preference to negative rates."

Shane Oliver, AMP Capital: "The cash rate is already at the RBA's effective lower bound and Governor Lowe has reiterated that negative interest rates are 'extraordinarily unlikely', so rates won't be cut. But with the economy taking a big hit from the coronavirus shutdown, economic activity has fallen well below potential, and this will take a long time to fully reverse, which means high unemployment and low inflation for several years to come, so the RBA can't raise rates. We don't expect the cash rate to start increasing again for three years at least."

Alison Booth, ANU: "The economic indicators suggest a rate cut in near future, but the timing is uncertain. Unemployment is increasing, participation and hours of work are declining, investment and household consumption will continue to be declining. Lowering interest rates may encourage people to spend more, though the amount rates can drop is very curtailed and any effect would be very marginal."

John Hewson, ANU: "RBA will hold for a couple of years, but bond selling task may start to force market rates up."

Malcolm Wood, Baillieu: "RBA forward guidance and zero global rates."

Rebecca Cassells, Bankwest Curtin Economics Centre: "The RBA won't increase the interest rate until we see strong signs of economic recovery – this may be some years away. Until then, they will keep the cost of borrowing as low as possible."

David Robertson, Bendigo and Adelaide Bank: "No further cuts needed – we are on our effective floor for interest rates. The next increase is several years away when employment reverts to pre-COVID-19 levels."

Sarah Hunter, BIS Oxford Economics: "I don't think the cash rate will rise until 2023 (so, I'm not really unsure) – the recovery from COVID-19 will have a long tail and the RBA will be looking to support the economy throughout."

Ben Udy, Capital Economics: "To be clear, I'm not unsure of the timing. I think the RBA will remain on hold until beyond 2022."

Peter Boehm, CLSA Premium: "Still unclear how long it will take to get a line of sight on where the economy is heading – I can't see rates increasing for the foreseeable future, especially with potential recessionary pressures on the horizon."

Saul Eslake, Corinna Economic Advisory: "You didn't have an option for later than Q4 2022, otherwise, I might have chosen that. The RBA has repeatedly stated, since its March meeting, that it will keep the cash rate at its present level until sustainable progress is being made towards the inflation target and full employment – and I suspect it may not be until the second half of 2022 that those criteria are satisfied."

Craig Emerson, Craig Emerson Economics: "No one can predict the course of a global pandemic and its economic impacts."

Trent Wiltshire, Domain: "The RBA will keep the cash rate unchanged for at least the next two years as the unemployment and underemployment rate will remain elevated for an extended period due to the COVID-19 recession."

John Rolfe, Elders Home Loans: "I do not think the RBA will lower the cash rate any further. There would be no benefit to anyone other than the banks, and they are in a strong position. I believe the next rate will be up – perhaps as early as at the end of Q1 2021 if there is no second wave of COVID-19 in Australia."

Angela Jackson, Equity Economics: "The RBA will hold cash rates until the economy recovers and unemployment is around the 8% mark. Uncertainty around the path of COVID-19 makes predictions on when this occurs difficult. Best case scenario, 3rd or 4th quarter of 2020-2021."

Mark Brimble, Griffith Uni: "The current situation will need to play out further before a direction is clear. Either way, it is likely to be lower for much longer."

Tony Makin, Griffith University: "The official interest rate has apparently reached its floor level. The main story now is the quantum of government bonds that the RBA has been buying as a result of the COVID-19-related spike in the budget deficit. Textbook monetary economics tells us this increases the money supply accordingly. Central banks around the world are doing likewise. Whether this means a subsequent and unexpected global inflation surge remains to be seen. But history shows it could happen after a lag of several years."

Stephen Miller, GSFM: "I do not think the RBA wants to cut the cash rate further. Any easing of monetary policy will take a different form."

Peter Haller, Heritage Bank: "The RBA has made it clear that the cash rate will be at 0.25% for an extended period of time."

Leanne Pilkington, Laing+Simmons: "The RBA has stated its view that rates are at their lowest point, and there's no appetite for negative rates. The banks themselves have access to cheap credit at the moment, which is reflected in the low rates charged to customers. The economy remains in a fragile place and while some businesses cautiously re-open, we see the holding pattern continuing for the foreseeable future."

Nicholas Gruen, Lateral Economics: "They should cut to zero (no reason not to), but they've said they won't."

Mathew Tiller, LJ Hooker: "The RBA is unlikely to drop rates further and is expected to continue to support the economy via its other stimulatory measures."

Geoffrey Kingston, Macquarie University: "Inflation could be picking up at this point."

Jeffrey Sheen, Macquarie University: "The economy should have recovered sufficiently in two years."

Stephen Koukoulas, Market Economics: "The fall-out from the health crisis is still unfolding. It is not possible to be confident about monetary policy pressures until that is resolved."

John Caelli, ME Bank: "The RBA will keep the cash rate unchanged for an extended period of time until the full impacts of COVID-19 are known."

Michael Yardney, Metropole Property Strategists: "We are now in the low-interest-rate environment for at least three years; the RBA doesn't want to spook the market with negative interest rates."

Mark Crosby, Monash University: "Further rate cuts are likely to have no effect, and I think it will be a while before a full recovery from COVID-19 leads to increasing rates – in other words, the RBA is likely to do nothing on rates until 2022."

Julia Newbould, Money: "Depending on what other stimuli are employed, it might be time to raise the rates by then."

Susan Mitchell, Mortgage Choice: "I expect the Reserve Bank to hold the cash rate at its monetary policy meeting in June. RBA board members seem resolute in their mission to support the economy as they target full employment and the inflation target. April Labour Force data from the Australian Bureau of Statistics shows that this goal will not be achieved in the near term, with a tragic loss of employment over the month. That being said, April Payroll data from the ABS provided a glimmer of hope that the deterioration may not continue into May. While social distancing rules had a detrimental effect on property sales, data from CoreLogic shows that the loosening of restrictions has seen volumes lift again, which may be bolstered by an extremely low cost of borrowing for the foreseeable future."

Dr Andrew Wilson, My Housing Market: "Rate to remain steady for foreseeable future. Contemporary, effective monetary policy set to go the way of the dinosaurs."

Andrew Reeve-Parker, NW Advice: "Interest rates are at historic lows at the moment, but by 2022, I expect the economy to be running ahead of trend."

Rich Harvey, Propertybuyer: "COVID-19 has placed policymakers in a very difficult situation. RBA has already indicated they will not go to negative interest rates and there is little impact reducing a further 0.25%."

Matthew Peter, QIC: "The RBA and other global central banks will keep rates at their lower bound for some years to come. It is unlikely that we will see a rise in policy rates within the coming four years."

Noel Whittaker, QUT: "No way they were increasing them – and it's pointless to drop them. There are too many uncertainties to make any kind of forecast – I am pessimistic."

Cameron Kusher, REA Group: "They have stated that there will be no increase in the cash rate until unemployment is on its way to full employment and they are comfortable inflation will be within 2-3%. That looks a long way off. They also seem extremely reluctant to take the cash rate any lower than it currently is."

Sveta Angelopoulos, RMIT university: "The RBA is unlikely to change the cash rate until the economy is well into recovery and even then, only if it feels it is overheating."

Christine Williams, Smarter Property Investing Pty Ltd: "Given the medical and financial climate we are in, I believe rates will be kept on hold."

Janu Chan, St.George Bank: "RBA is unlikely to move the cash rate any time soon. It sees the cash rate at its effective lower bound, and for the cash rate to increase, we would need to see a very meaningful decline in unemployment. Spare capacity in the labour market will remain for some time."

Besa Deda, St.George Economics: "The RBA has indicated that it will not raise the cash rate before removing the three-year bond yield target. It will take time for the unconventional policies to be unwound, and these will only be unwound once the economy recovers which is not expected until later this year and next."

Mala Raghavan, University of Tasmania: "Due to the uncertain times ahead and the worldwide ability to contain the pandemic, it will be difficult to predict the effectiveness of an accommodative monetary policy (irrespective of conventional or unconventional measures). What is probably needed for the way forward is well-coordinated fiscal and monetary policy measures – first, the focus should be on containing the health crisis, and then subsequently the focus should be on stimulating the economy."

Other participants: Bill Evans, Westpac; Jason Azzopardi, Resimac

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel