Plus500 Australia is a well-recognised provider of Contracts for Difference (CFDs), offering stock (CFD), commodity and forex CFD trading for retail traders. With over 2800 CFDs and a variety of Futures , Plus500 is a solid all-round trading option.

Plus500 Australia review: Global CFD trading platform

Our verdict

Trade more than 2800 CFDs instruments including stocks, commodities and crypto.

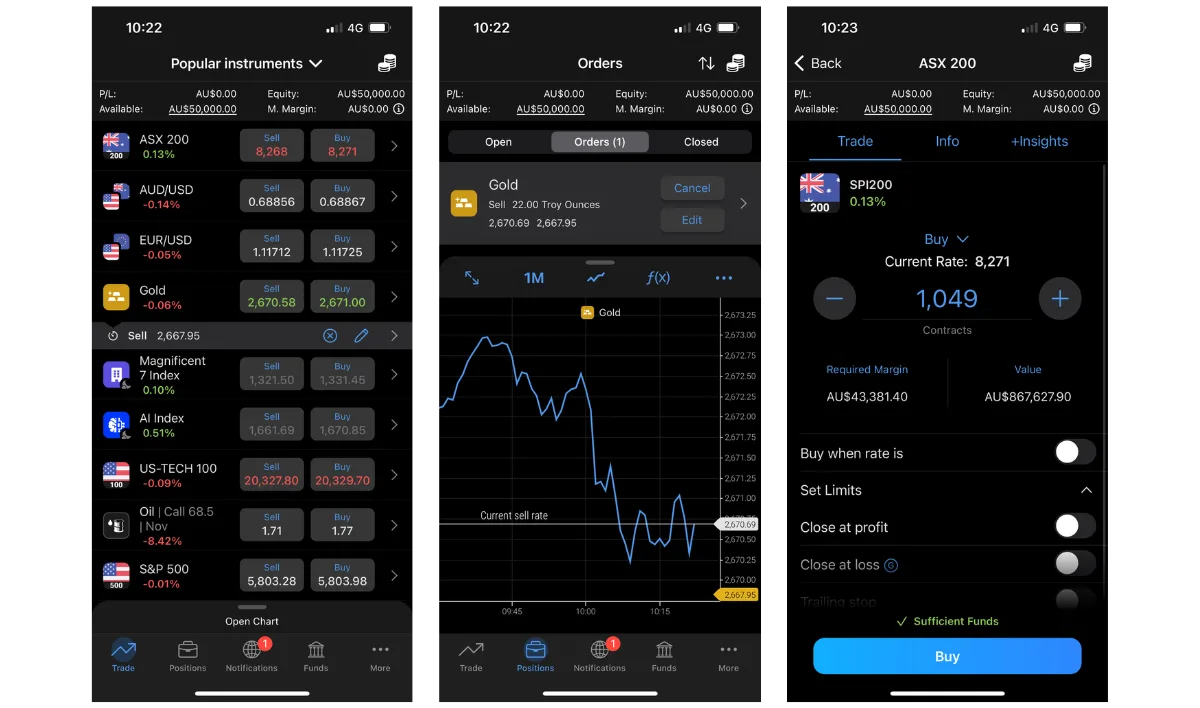

Plus500 is a globally recognised and highly trusted CFD platform which is accessible via your online browser, Windows 10 and iOs or Android mobile phones.

On the plus side, Plus500 allows you to trade with a number of advanced features and offers comprehensive educational resources, including a free demo account, a vast trading academy, and exclusive access to external trading webinars for premium clients. Additionally, it is available in multiple markets and does not charge a sign-up fee.

On the downside, you can only trade CFDs and the CFD platform comes with an inactivity fee.

Pros

-

Range of markets to trade. Opening an account with Plus500 Australia gives you access to a broad range of investments, including both share market CFDs market options.

-

You can trade multiple international markets. With Plus500, you're not limited to Australian markets and can invest in various markets all over the world.

-

No commissions. There is no sign-up fee for using the Plus500 platform. Trading costs are also covered within the spread, meaning no commissions.

-

Free demo access. For Australians who are new to trading CFDs with Plus500, a free demo account can help you to understand how it works before risking your own money.

Cons

-

Limited asset options. Plus500 Australia specialises in CFD trading. Notably, share trading and futures are exclusively available to users in the US, limiting options for traders in other regions.

-

There's limited physical support. You are limited in expert support and advice with Plus500 compared to other online platforms. It only has email and online chat services.

Details

Product details

| Type of broker | Online |

| Available markets | 70 global currency pairings, commodities, cryptocurrency, index CFDs, stock CFDs, ETF CFDs, options |

| Commission | $0 |

| Minimum opening balance | 100 |

| Platforms | Plus500 Trading Platform |

| Support | Email, Live chat and WhatsApp |

Plus500 background

Headquartered in Israel, Plus500 holds licenses in multiple jurisdictions and services clients the world over. Plus500 is well known in the CFD trading space, with a listing on the London Stock Exchange. Plus500 was the sponsor of footballing powerhouse Atletico Madrid from 2015 to 2022. Today they are the official partner of NBA team the Chicago Bulls.

If you're an Australian trader, then it's worth noting that the company's Australian subsidiary, Plus500 AU LTD is licensed (ACN 153301681) by the Australian Securities and Investments Commission (ASIC) and has an office presence in Sydney.

What are the key features of a Plus500 Australia CFD trading account?

Here are some of the main features from Plus500:

No commissions and tight spreads

Plus500 doesn't charge commissions on trades. Instead, it runs a spread-only model that ensures traders' costs are clear when they enter and exit trades. The spread is variable and up-to-date prices are always streamed live to your trading platform.

Trade commodities including stocks and forex CFDs on 1 platform

You'll have access to more than 2,800 CFDs via Plus500's proprietary platform. You're able to trade them all long and short on margin.

Trading account accessibility

You can access your Plus500 trading account via a cloud-based trading platform, desktop platform, smartphone app (iOS and Android) and even dedicated tablet apps (iOS and Android). Trade your way, wherever you may be.

Free demo account

Using pretend money, you can learn how to effectively trade CFDs before committing your own money on a live account. Additionally, the demo account amount is self-adjustable, allowing traders to set it to their desired amount for a more tailored practice experience.

Advanced trading tools

A number of tools are accessible on the Plus500 trading platform to help you manage your risk and get the best possible price. These include stop loss orders, stop limit orders, trailing stop orders, limit setting, price alerts and guaranteed stops.

Research and education features

Plus500 provides educational resources to its traders. Key offerings include a comprehensive trading academy and a versatile free demo account, which is self-adjustable, allowing traders to customise the amount to their preference. These tools are designed to enhance trading knowledge and skills, preparing users effectively for live trading

Australian regulated platform

Plus500 is licensed (ACN 153301681) in Australia by the Australian Securities and Investments Commission (ASIC) and it follows strict regulatory requirements. This includes holding all client funds in a segregated trust account which cannot be used for hedging purposes.

What markets can I trade with Plus500 Australia?

Plus500 Australia offers services and options that will please practically every type of investor. Through the Plus500 trading platform, you are able to gain access to financial market data including real-time data to help guide your trading decisions. Once you have been signed up you will have access to:

- Shares CFDs. Australian and global share CFDs are available from over 20 different countries. This includes shares listed on exchanges in the United States, Germany, the UK, France and more. Some of the most popular share market CFDs are Telstra, Woolworths and Facebook.

- Forex CFDs. You can trade foreign exchange markets (forex) on the Plus500 platform and pay no commissions and tight spreads on your activity.

- Index CFDs. There are dozens of indices available to trade on the Plus500 platform, acting as a key diversification for your investments. Pick from the Australia 200, the S&P 500, the Italy 40 and many more.

- Commodities CFDs. Trade a number of commodity market CFDs on leverage, with an account as small as $100. Popular commodities markets available on the Plus500 platform include gold, silver and oil.

- ETF CFDs. Trade CFDs that track the price of some of the most popular Exchange Traded Funds (ETFs) such as the VXX volatility index. Access ETF markets with low spreads and free stops and limits on all ETF CFD orders.

- Options CFDs. Call or put option CFDs are available on markets such as the Dax 30, S&P 500, CAC 40, MIB 40, and the AEX 25. No commissions and tight spreads are charged as you're still trading CFDs and not holding the underlying asset itself.

- Cryptocurrency CFDs. Plus500 lets you trade a wide range of cryptocurrency CFDs. Features of the trading platform including price alerts, stop loss and trailing stop orders, are also well suited to the volatile nature of cryptocurrency, all there to help you manage risk.

What customer support and information is available from Plus500 Australia?

If you need customer support there's a few options available to you including:

- Instant live chat

- WhatsApp messaging

- FAQ section

As for market data itself, up to the minute prices and spreads can be accessed through your online trading platform 24 hours a day, 5 days a week.

What are the spreads and fees from Plus500 Australia?

- No Commissions. Unlike other CFD platforms that also charge commissions on each trade, Plus500 does not charge commissions on trades, only the spread. The spread is variable between products, with up-to-date spreads always displayed within your trading platform.

- Holding a trade overnight. As is standard practice, an overnight funding amount is either added to or subtracted from open trades when holding a position overnight. Check the 'Overnight Funding Time' on the market details within your trading platform.

- Inactivity fee. In the event that your Trading Platform is inactive for 3 months, you will incur a fee of $10. This is to offset the cost incurred in making the service available to you, even though it's not being used.

- Currency conversion fee. Plus500 charges a currency conversion fee for new clients of up to 0.7% of the trade’s realised profit and loss (starting January 2020).

Customer reviews of Plus 500 App

| Apple App Store app reviews | 3.9/5 stars based on over 4,000 reviews |

| Google Play Store reviews | 3.7/5 stars based on over 108,000 reviews |

How do I open an account with Plus500 Australia?

If you're ready to open a CFD trading account with Plus500, you'll need to click 1 of the 'go to site' links on this page and fill out the sign up form on the Plus500 website page that opens.

While accessing a demo account will take you 30 seconds with a name and email address, in order to open a live account, you'll need to provide:

- Your name

- Your contact details

- 100 points of ID

- Details of your chosen deposit method

Once your account has been approved by the Plus500 Australia account services team, you will then be able to fund your account.

Frequently asked questions

Sources

Your reviews

AAAAFinder Finder

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.