Pepperstone is a popular Australian CFD forex and commodities broker. If you choose to open an account with Pepperstone, you'll gain access to more than 90 currency pairs and other CFD markets, such as commodities, stocks and indices. With ECN accounts and spreads in the forex majors from 0 pips, Pepperstone has a trading solution for all levels of traders.

Pepperstone review: Australian forex and CFD broker

Our verdict

Access 90+ forex currency pairs and other CFD markets with tight spreads and low commission.

Pepperstone is an Australian-owned, internationally recognised trading platform whose claim to fame is that it has cheap fees and incredibly quick order execution. It also offers a range of tradable CFD assets across forex markets, soft and hard commodities, indices and even crypto markets. Pepperstone was named the Best Forex broker for beginners in the 2024 Finder Awards.

However, if you are looking to simply buy and hold shares, this isn't the platform for you. Instead, it is built for active traders that want to take advantage of leverage.

Pros

-

Choice of markets

-

Choice of platforms

-

Tight spreads

-

Algorithmic and Smart Trader Tools

Cons

-

You can't purchase shares using Pepperstone

-

Forex and CFD trading carry a high risk

-

Doesn't provide interactive training courses

Details

Forex details

| Type of broker | Online |

| Number of currency pairs | 60+ |

| Minimum Spreads for Major Currencies | 0.0 pips |

| Commission | $0 |

| Retail Maximum Leverage | 30:1 |

| Professional Maximum Leverage | 500:1 |

| Platforms | MetaTrader 4 MetaTrader 5 cTrader TradingView Pepperstone Trading Platform |

| Support | Phone, email, live chat |

| Go to site |

CFD details

| Type of broker | Online |

| Available CFD markets | Australian Stocks, Commodity CFDs, Cryptocurrency CFDs, ETFs, Forex, Global Stocks, Indices (CFDs only) |

| Commission - ASX 200 Shares | $5 or 0.07% |

| Minimum Opening Deposit | $0 |

| Minimum trade size | 0.01 lots |

| ASX live data fee | $0 |

| Platforms | MetaTrader 4 MetaTrader 5 cTrader TradingView Pepperstone Trading Platform |

| Support | Phone, email, live support |

| Go to site |

Congratulations, Pepperstone Forex Trading!

Pepperstone Forex Trading was a big winner in the 2025 Finder Awards.

- Winner, Best Beginner Forex Trading Platform Pepperstone Forex Trading

- Highly commended, Best Advanced Forex Trading Platform Pepperstone Forex Trading

- Winner, Best Commodities Forex Trading Platform Pepperstone Forex Trading

- Winner, Best Forex Trading Platform Pepperstone Forex Trading

Full list of 2025 share trading platform winners

Founded and based in Melbourne, Pepperstone is an ECN forex broker. The company's rapid rise has seen it expand offices to London, Dubai, Kenya, Cyprus, Germany and the Bahamas.

With a localised presence, Pepperstone is able to offer increased levels of customer support across a number of languages.

What are the key features of Pepperstone forex trading?

A Pepperstone forex trading account has several features that will appeal. The standout feature is Pepperstone's ECN, no-dealing-desk business model. It ensures that trading costs are kept low and its reputation for putting the trader first is maintained.

Electronic Communication Network (ECN)

Pepperstone is an ECN forex broker. This means that when it comes to order execution, there is no dealing-desk intervention. Instead, its prices are sourced from a list of liquidity providers and only the best prices are shown. This means spreads are tighter and ensures your goals are aligned with the broker, putting to bed the prospect of being stop hunted.

Regulated in Australia, UK and 5 other jurisdictions

Pepperstone is authorised and regulated by the Australian Securities and Investment Commission (ASIC) in Australia as well as the Financial Conduct Authority (FCA) in the UK. It is also regulated by the Dubai Financial Services Authority (DFSA) in the UAE, the Cyprus Securities And Exchange Commission (CySEC) in Cyprus, the Capital Markets Authority of Kenya (CMA) in Kenya, the Securities Commission of The Bahamas (SCB) in The Bahamas and the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany.

The oversight of all regulatory bodies ensures that Pepperstone meets the required capital requirements, is following correct compliance guidelines and offers a course of action for clients who feel aggrieved.

Low barriers to entry

There's no official minimum deposit when it comes to signing up to Pepperstone, but it does recommend a minimum deposit of $200 before you make a trade.

You can fund your account using the following payment options: credit card, bank transfer, PayID, PayPal, BPAY, Skrill, FasaPay and Neteller. In addition, China UnionPay can be used to make withdrawals.

Number of ways to trade

You can access your Pepperstone trading account from your desktop computer and laptop via downloadable software or through your chosen web browser. There are also apps available that allow you to trade on Apple and Android mobile devices. This means that no matter where you are, you can remain logged in across platforms and always ensure you have access to your trading account.

What markets can I trade with Pepperstone?

While Pepperstone is primarily known as a forex broker, it offers access to a whole range of other markets through CFDs. Whether you're a forex, indices, commodities, shares or cryptocurrency trader, Pepperstone allows you to keep on top of them all from one trading platform.

Important: All assets are traded via CFDs with Pepperstone.

Trading CFDs/FX carries risk and is not suitable for everyone. Refer to the Pepperstone PDS and TMD. Pepperstone Group Limited, AFSL 414530.

Trade forex with Pepperstone

Pepperstone provides access to over 90 forex pairs including majors, minors and exotics.

Commodities

The broker offers options across major metals, energy, soft commodities and spot gold/silver in different currencies.

Indices

For those interested, Pepperstone allows you to trade on the movement of the major stock market index around the world. These include markets across North America, APAC and Europe.

Shares

Pepperstone also offers a range of share options across the Australian, US, UK, Hong Kong and European markets. However, these are share CFDs, meaning you do not actually own the shares themselves. Instead, you track the price movements of the underlying shares.

Trade cryptocurrency with Pepperstone

Pepperstone also offers cryptocurrency CFD trading, accessible directly alongside their regular forex and CFD markets, all within the same trading platform. Some of the more popular cryptocurrencies to trade against the US dollar include Bitcoin, Ethereum, Ripple, Dash and Litecoin.

What trading platforms can I use with Pepperstone?

Pepperstone offers access to your account through a number of different trading platforms:

- MetaTrader 4. The MT4 platform is the most popular forex trading platform among retail traders. MT4 offers a user-friendly, highly customisable platform to trade from.

- MetaTrader 5. The next-generation platform from MetaQuotes, MT5 builds on the look, feel and functionality of MT4. MT5 also allows you to hedge positions and gives you access to advanced pending orders and a new set of custom indicators.

- Pepperstone Trading platform. You can also trade via Pepperstone's propiratery platform, which offers responsive features, including one click trading.

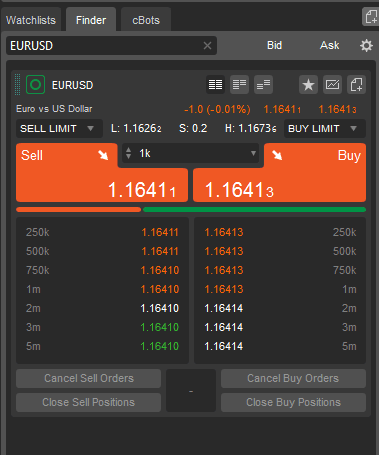

- Pepperstone cTrader. The Pepperstone cTrader platform gives you direct access to interbank markets and has a suite of algorithmic trading options direct from the platform.

- WebTrader. Access your MT4 account from Pepperstone's cloud-based trading platform. There is no need to install MT4 and if you're at work or on a shared computer, WebTrader ensures you still have access to your account with full functionality.

- TradingView. You can connect your Pepperstone account to TradingView via a cTrader integration.

- Mobile apps. MT4, MT5 and cTrader all have mobile apps that allow you to log into your Pepperstone account anywhere, anytime.

- Social trading. Pepperstone partners with a range of social platforming tools helping investors gain access to strategies from the world's best traders. However, social trading is currently not available to Australian customers.

Key features of the cTrader platform

Pepperstone's cTrader platform isn't as well known as the popular MetaTrader 4 and MetaTrader 5 platforms, but some of the platform's features include the following:

Wide range of asset classes

The Pepperstone cTrader platform offers traders a diverse selection of asset classes to choose from, including forex, commodities, stock market indices and cryptocurrencies. There are over 1,200 instruments to trade, which is more than enough for your average trader.

Market finder tool

Within cTrader, there is a handy feature called the market finder tool. Found on the left-hand side of the screen, it's essentially a search bar where you're able to simply type the name of the market that you're looking to trade (for example EUR/USD or Gold).

You're then able to easily look over all of the available related markets to trade and pick the one where you see the best opportunity. There are many types of contracts (spot, futures and options), so it's important to know which one to choose before you take a position as this can affect the success and volatility of your trade.

(Source: Pepperstone)

Simple charts

The charts on the Pepperstone cTrader platform are quite basic compared to the likes of TradingView, MarketDelta and ProRealTime, but their simplicity means that anyone can use them.

User-friendly tools

Although limited, the drawing tools for trend lines, support and resistance, and Fibonacci retracement are simple and easy to use and the default colour scheme is great.

The colour scheme is also easily customisable, so if you don't like a black background on your charts, then there is a simple switch on the top right for the lighter (white) scheme.

Advanced analysis tools

The cTrader platform offers candlesticks, line, bar and dot charts. Candlestick charts are the most popular, but the others are just as simple and easy to use. You can also find lots of chart customisation options when you right-click on the charts.

You can add all the usual indicators, including the ever-popular relative strength index (RSI), moving average convergence divergence (MACD) and moving averages. There are also options to change the colours of the chart and the lines, and if you're a social media whiz, you can even take snapshots of your work.

If you're interested in learning how to trade using some of the indicators available on the Pepperstone cTrader platform, then it is worth checking out our guide featuring strategies for CFD and forex traders.

(Source: Pepperstone. Drawing tools on the right.)

Functional layout

My favourite part of the cTrader platform has to be the functionality of the layout. You can keep an eye on your trades via the bottom panel, look for more with the finders section and have charts open all on the same screen. The execution is seamless and as far as my tests are concerned, Pepperstone's execution through the platform is fast and reliable.

How does the cTrader platform compare to MT4 and MT5?

Pepperstone gives you the choice of trading on cTrader or MT4, so here's how I think cTrader stacks up.

MetaTrader 4 and MetaTrader 5

Nearly every major forex broker in the world offers its users MT4 and MT5 trading platforms. Pepperstone is no different here and the sheer popularity of these legacy platforms within the retail trading community speaks volumes about their usability.

MetaTrader 4 may appear slightly more intimidating to a new trader compared to cTrader, but it is highly functional and the charts are simple and effective. Charting analysis on MetaTrader has more options for customisation than cTrader thanks to the ability for traders to search and download custom MT4 indicators and expert advisors.

It's worth noting that as the Pepperstone accounts are the same, there is little to no difference between spreads when you choose to trade on cTrader or MT4.

Overall, I feel the Pepperstone cTrader platform is a quality choice for both beginners and advanced traders.

What account types are available with Pepperstone?

Depending on your personal circumstances or trade volumes, Pepperstone offers traders a choice between multiple account types. The following are the 2 most popular forex trading accounts:

- Standard STP account. This is Pepperstone's classic account. There are no commissions charged on trades from this account.

- Razor account. Pepperstone's raw account type offers spreads as low as 0 pips, but it charges a $3.50 commission per lot traded (100,000 base currency) via MT4, MT5, TradingView, and Pepperstone proprietary platforms, and $3 commission per lot traded at cTrader.

Pepperstone also offers the following special account types, but you must request access:

- Islamic forex account. The Pepperstone Islamic account features everything that the Standard STP or Razor accounts offer, but also features a type of administration fee in place of swaps and commissions.

- Active trader program. Active forex traders can access a host of premium account features, including a dedicated relationship manager, a segregated customer account and advanced reporting tools.

Is Pepperstone good for beginners?

Pepperstone offers a good range of educational components for those looking to learn more about CFD trading. Apart from a demo account, traders can access free educational videos, register for live webinars and get their hands on market commentary.

It also provides what is known as "social trading", which basically allows you to follow the trade decisions of other traders on the platform. However, social trading availability depends on jurisdiction and is not available in Australia.

What customer support options are available from Pepperstone?

If you ever have a problem with your trading account, Pepperstone offers comprehensive 24-hour customer support through a number of mediums (18 hours on weekends):

- Live support centre. This is the support section of the Pepperstone website, featuring a range of frequently asked questions.

- Live chat. The live chat feature is probably Pepperstone's most handy support option. Get no-hassle, quick answers to all of your trading and account queries.

- Email. For more detailed support queries, you may need to email support@pepperstone.com. This allows you to attach documents and easily keep track of the conversation.

- Telephone. The Pepperstone office phone number is 1300 033 375, featuring options to speak to sales and support staff.

What are Pepperstone's spreads?

As Pepperstone is an ECN forex broker, spreads shown on the MetaTrader 4 platform are variable. Quotes are sourced from a list of partner banks and liquidity providers, so they're always changing depending on market conditions.

If you're trading on a Pepperstone Razor account, then you can be assured that the prices you're seeing are sourced directly from the interbank market and absolutely zero mark-up is applied. This is why during peak times, such as the London open, you can often see spreads on EUR/USD as low as 0.

What are the pros and cons of trading forex with Pepperstone?

Pros

- 1,200 tradable instruments. Pepperstone provides high-speed CFD access to forex, stocks, cryptocurrencies, commodities and indices.

- Trading platforms. Access your Pepperstone trading account on your PC, Mac or Apple or Android mobile device and via the web.

- Choice of account types. There are multiple account types available to suit every type of trader.

- Customer service and help. Pepperstone provides 24-hour customer support and a comprehensive online help centre to provide assistance whenever you need it.

- Award-winning broker. Pepperstone has won multiple Finder Awards for its online forex trading services.

Cons

- Risky. As is the case with leveraged trading, losses can exceed deposits. Make sure you understand the risks before you start trading forex.

How do I open an account with Pepperstone?

If you'd like to open a forex trading account with Pepperstone, you'll need to click one of the "Go to site" links on this page. This will take you to the Pepperstone website where you can fill out an online application.

To apply, you will need to provide the following:

- Your name

- Your contact details

- Date of birth

- Chosen account type

Once you apply, you will receive an account confirmation and choose between a demo or a live account. You'll then be able to set up your trading account and provide additional information.

After your account has been approved by the Pepperstone account services team, you will then be able to fund your account.

Frequently asked questions

Sources

Your reviews

Dane Finder

Writer

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

Finder only provides general advice and factual information, so consider your own circumstances, or seek advice before you decide to act on our content. By submitting a question, you're accepting our Terms Of Service and Finder Group Privacy & Cookies Policy.

This site is protected by reCAPTCHA and the Privacy Policy and Terms of Service apply.

Angus Kidman Finder

September 15, 2024

Pepperstone lists MT5 (MetaTrader 5) as amongst its supported clients. Hope that helps!

Martin

July 24, 2024

Hi there, Is it possible to trade the ASX listed VBTC ETF on the Pepperstone platform ?

If so, what is the minimum contract size and can this also be leveraged.

Cheers

Martin

Thomas Stelzer Finder

September 16, 2024

Hi Martin,

Thanks for your question. Unfortunately, you aren’t currently able to trade the VBTC ETF with Pepperstone. However, you can trade cryptocurrency CFDs, including Bitcoin.

Regards,

Tom

Domscat

August 27, 2024

does pepperstone able to integrate my MT5 platform?