Finder’s RBA survey: Cash rate holds but rents could rise as much as 9.5% in 2024

Homeowners can rest a little easier this Christmas as the RBA held the cash rate at its final meeting of 2023.

In this month's Finder RBA Cash Rate Survey™, 38 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

The majority of experts (82%, 31/38) correctly predicted a cash rate hold – keeping it at 4.35% in December.

Graham Cooke, head of consumer research at Finder, said it's been a tough year for homeowners.

"The soaring cost of living has wreaked havoc on many families in 2023, with nearly 80% of Aussies affected.

"Everything from housing to groceries, petrol and energy costs more, and economic conditions are some of the worst in decades.

"While we expect the RBA could start cutting the cash rate late next year, we could see at least one more hike before that happens," Cooke said.

Aussies with a $600K mortgage are forking out roughly $1,349 more per month than they were before the RBA started lifting the cash rate in May last year.

That's an additional $16K over a year in mortgage repayments alone.

Average Aussie mortgage repayments

| Cash rate | Average home loan rate* | Average monthly repayment | Average monthly increase | Average annual repayment | Average annual increase | |

|---|---|---|---|---|---|---|

| Apr-22 | 0.10% | 2.41% | $2,339 | - | $28,068 | - |

| Dec-23 | 4.35% | 6.25% | $3,688 | $1,349 | $44,256 | $16,188 |

| Source: Finder, RBA. *Owner-occupier variable discounted rate. Repayments based on the average loan of $598,867 (ABS data analysed by Finder). |

Rents could rise as much as 9.5% in 2024

Panellists expect rental prices to continue to increase throughout Australia by the end of next year.

The sharpest increase is forecast for Perth, where panellists predict rental costs will rise by an average of 9.5% by the end of 2024.

Taking into account these price forecasts, Finder analysis shows the average minimum household income required to afford a house in Perth will be just over $108K, or almost $95K for a unit.

Hobart is expected to see the smallest jump in price, with the panel predicting an average increase of 3%.

You'll need an average minimum household income of $98K to afford a house in Hobart, or $84K for a unit.

| City | Increase | House – average minimum income required to rent | Unit – average minimum income required to rent |

|---|---|---|---|

| Perth | 9.50% | $108,231 | $94,939 |

| Melbourne | 6.80% | $92,548 | $88,846 |

| Sydney | 6.50% | $127,339 | $114,420 |

| Brisbane | 6.50% | $106,183 | $92,333 |

| Darwin | 5.50% | $117,035 | $95,091 |

| Adelaide | 5.00% | $94,640 | $80,990 |

| Hobart | 3.00% | $98,193 | $83,911 |

| Source: Finder's RBA Cash Rate Survey, November 2023. CoreLogic (August 2023 data, released in November 2023). |

Graham Cooke said Aussies with a mortgage weren't the only ones strapped for cash.

"Finder's Consumer Sentiment Tracker shows 42% of renters are currently struggling to pay their rent, which is higher than the 37% of mortgage holders in the same position.

"Much of the conversation around rate rises focuses on homeowners, but it's actually renters who are proportionally feeling the impact more, as they deal with flow-on rent increases.

"Further rent increases won't be welcome news for those struggling," Cooke said.

Mark Crosby from Monash University pointed to the limited housing supply as a key issue.

"Lack of supply is likely to continue to impact the rental market, especially as migration continues to put pressure on this market."

Leanne Pilkington from Laing+Simmons agreed.

"The rental market in Sydney is grossly undersupplied, there's little to encourage more investment in residential property and many landlords are selling – removing long-term rental stock from the market.

"This will exacerbate the supply-demand imbalance and ensure upward rental pressure," Pilkington said.

Wages not keeping pace

The wage price index rose by 4% year-on-year in the September quarter after 10 consecutive quarters of increases.

Despite this, two-thirds of the panel who weighed in* (67%, 18/27) believe increases in wages are not helping offset the higher interest rates on mortgages.

Three-quarters of experts (75%, 21/28) also believe there should be an increase to the minimum wage next year.

Craig Emerson from Emerson Economics noted, "Real wages are barely rising".

Nicholas Frappell from ABC Refinery said that real wages are more or less stagnant.

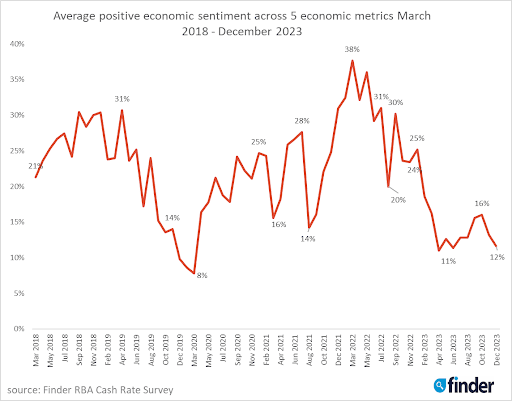

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators: housing affordability, employment, wage growth, cost of living and household debt.

Average positive sentiment across these metrics has fallen to a low 12% in December.

Cost of travel becoming prohibitive to more Australians

With the cost of airfares having sharply increased since pre-COVID, almost 2 in 3 experts (65%, 13/20) expect fewer Australians to take international and domestic vacations this holiday season compared to last year.

According to data from Finder's Consumer Sentiment Tracker, 1 in 10 (11%) Australians say they can't afford to go on a holiday in the next 12 months.

When asked what needs to change in the Australian airfare market to bring down prices, the panel largely cited allowing for more competition from foreign airlines and increasing investment into airports to increase capacity.

Mark Melatos, associate professor of economics at the University of Sydney, said more real competition was needed – particularly in when it comes to air travel.

"Not more domestic airlines, but freer markets for landing slots and greater allowance for international airlines to service domestic routes," Melatos said.

Nalini Prasad from UNSW Sydney agreed.

"There needs to be more competition by allowing more outside airlines to fly into Australia," Prasad said.

| Are you planning a holiday in the next 12 months? | |

|---|---|

| I can't afford to go on a holiday | 11% |

| Yes, within Australia | 25% |

| Yes, internationally | 15% |

| Yes, both within Australia and internationally | 14% |

| No | 20% |

| I'm not sure yet | 15% |

| Source: Finder survey of 1,056 Australians, November 2023 |

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Tomasz Wozniak, University of Melbourne (Hold): "After last month's forecasts indicating both HOLD and RAISE decisions, this month, they settled quite firmly on HOLD. The level of 4.35% is likely to stay unchanged by the second quarter of next year. This seems in line with Michele Bullock's communication, although the domestic sources of inflation talk could indicate otherwise. My forecasts are available at: forecasting-cash-rate.github.io"

Matthew Greenwood-Nimmo, University of Melbourne (Hold): "I think the latest inflation data gives the bank room to hold in December."

Adj Prof Noel Whittaker, QUT Business School (Hold): "Michelle Bullock has made no secret of the fact that she won't be scared to increase rates if inflation doesn't come down. Her stated xview is that inflation hurts everybody but rate rises only hurt one section of the community. But, having said that, inflation did come down last week so the trend is in the right direction. Given the pressure on household budgets which will happen when the Christmas bills arrive in January, I think they will hold and adopt a wait-and-see attitude."

Anthony Waldron, Mortgage Choice (Hold): "I expect that the Reserve Bank will keep the cash rate on hold at its last monetary policy meeting for 2023. The Australian Bureau of Statistics' monthly CPI indicator rose 4.9% in the 12 months to October, down from the previous month and well below the peak of 8.4% in December 2022. Hopefully this gives households some much-needed breathing room."

Shane Oliver, AMP (Hold): "While recent RBA commentary has been hawkish it lacks the sense of urgency seen prior to the November meeting and since then we have seen softer data for retail sales, home prices and inflation so there is no "smoking gun" to justify another hike."

Mark Crosby, Monash University (Hold): "The latest inflation number shows inflation trending in the right direction, and I expect a few months of RBA holding to assess the ongoing strength of the economy."

Tim Reardon, Housing Industry Association (Hold): "The adverse impact of the rate increases are about to flow through to fewer homes under construction which will ease the labour shortage and stop obscuring the impact of rate rises to date."

Leanne Pilkington, Laing+Simmons (Hold): "The October CPI data showed a sharper-than-expected fall in inflation which will hopefully provide the RBA the room it needs to leave the cash rate unchanged and enable people to come to terms with household budgets which have had to adjust considerably in recent times."

Harry Murphy Cruise, Moody's Analytics (Hold): "The lower-than-expected October print is an early Christmas present for households and businesses. Combined with the monthly fall in retail sales through October, it is clear that higher interest rates are quelling demand and – by extension – inflation. That should be enough to save the Reserve Bank Board from having to be the Grinch of Christmas when it meets next week."

Nicholas Gruen, Lateral Economics (Hold): "With the latest rise, and relatively good news in the inflation figures, the bank will watch and wait."

Geoffrey Kingston, Macquarie University Business School (Hold): "The fall in the October CPI, though small, will probably see the Bank sit tight in December. There is a perceptible slowing of the economy, to the extent no more hikes may be needed, although a further hike can't be ruled out. With the slowdown becoming more pronounced in the second half of 2024, September may see a cut."

Tim Nelson, Griffith University (Hold): "Inflation data proved lower than many expected. However, the quarterly numbers will provide more insight so the RBA is likely to pause until next year."

Brodie Haupt, WLTH (Hold): "Inflation falling all but rules out a rate rise in December."

Evgenia Dechter, UNSW (Hold): "Inflation is declining. Other domestic and global indicators also project a slowdown in the Australian economy. However, immigration inflow remains high, creating an upward pressure on prices in the short run."

Kyle Rodda, Capital.com (Hold): "Trimmed mean inflation remains too high and real yields are negative, pointing to further need to tighten policy."

Cameron Kusher, REA Group (Hold): "The monthly CPI indicator will give the RBA a level of comfort that they don't have to increase the cash rate in December. The February meeting is certainly live and the decision will be dependent on how the December 2023 quarter CPI data looks upon its release."

Peter Boehm, Pathfinder Consulting (Hold): "Despite the RBA's observation that Australia's inflation rate is home grown i.e. not driven by international factors, the current rate of 4.9% is well below expectations of around 5.2%. Even though items like food and energy costs are still rising, I think it unlikely the RBA will increase the official cash rate in December because there is no need to do so right now. Consumer spending is slowing and belts are tightening – increasing the cash rate will probably do more harm than good. If inflation ticks up, you should expect a rate rise in Feb 2024."

Mathew Tiller, LJ Hooker Group (Hold): "Inflation continues to ease, as indicated by the latest monthly CPI data, with the effects of previous rate rises beginning to impact households. The upcoming release of quarterly CPI data at the end of January 2024 will be crucial in determining whether interest rates have reached their peak."

Garry Barrett, University of Sydney (Hold): "Latest CPI shows decline in inflation, and came in lower than I anticipated."

David Robertson, Bendigo Bank (Hold): "The tightening bias is intact, but the RBA should keep rates on hold in December. Next year the risk remains for one more increase as quarterly CPI data is released – most likely in May. Rate cuts are expected in 2025."

Craig Emerson, Emerson Economics (Hold): "The economy is slowing sharply and inflation is falling."

Nicholas Frappell, ABC Refinery (Hold): "Continuing resolve from the RBA to move inflation back to the long term range suggests at least one more hike."

Jeffrey Sheen, Macquarie University (Hold): "The surge in Australia's inflation in 2022 lagged other advanced countries, and its decline will lag the falling rates elsewhere. The RBA has tightened sufficiently to gradually achieve its inflation target range. It should now hold until mid-2024."

Rich Harvey, Propertybuyer (Hold): "The RBA has clearly indicated in their last statement on monetary policy in November that inflation must be squashed and are likely to pull the trigger again in early 2024 if the trend line for underlying inflation is too slow to get back under 3%."

Dale Gillham, Wealth Within (Hold): "I believe the RBA will wait for a few months to see how the economy reacts to this last rise before making any decisions on an increase."

Tony Sycamore, IG Markets (Hold): "Inflation remains still too high, highlighted by hawkish RBA communique last week. This means unless Q4 inflation data in late Jan surprises to the downside, a rate hike in early February is likely on the agenda."

Stephen Halmarick, Commonwealth Bank (Hold): "Deceleration in inflation."

Jakob Madsen, University of Western Australia (Hold): "Inflation is still running high."

Stephen Miller, GSFM (Hold): "Inflation will prove more intractable than currently appreciated."

Cameron Murray, Fresh Economic Thinking (Hold): "Follow global trends (declining inflation and peaking interest rates in the US)."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "I'm responding to this survey ahead of the release of the October monthly CPI, but I don't think the RBA will have been surprised by anything that has happened since the November meeting or will happen in the lead-up to the December meeting. As the minutes of the November meeting make clear, the meeting in February next year is 'live' if the December quarter CPI again exceeds expectations: but otherwise I think the RBA could be 'on hold' throughout 2024."

Stephen Koukoulas, Market Economics (Hold): "Weak growth and lower inflation will force the RBA to cut."

Sean Langcake, Oxford Economics Australia (Increase): "The Q3 CPI data raised enough concerns about inflation for the RBA to reluctantly resume the hiking cycle. We don't see a single hike as being enough to allay their concerns given the breadth of underlying inflation pressures. The board could wait until February for another CPI print. But they would be better off cracking on with the job in December."

Stella Huangfu, University of Sydney (Increase): "CPI inflation is still high (4.9%). It is way above the RBA's targeted range: 2–3%. The holiday shopping season is coming. Also, given that the RBA is not meeting in January, they should hike in December as a precautionary measure."

Mark Melatos, Associate Professor of Economics at the University of Sydney (Increase): "Inflation remains above the RBA's target band and could potentially remain elevated for an extended period due to the impact of rising rents, geopolitical tensions and the depreciating Australian dollar. There is inconclusive evidence as to the extent of the dampening impact of monetary tightening on consumption. Moreover, house prices appear to have significantly decoupled from incomes and shrugged off the rate increases to date."

James Morley, The University of Sydney (Increase): "Even with the surprise lower inflation for October, the RBA will want to ensure domestic policy is working to bring services inflation down. I think they will raise rates this month and have signalled that the economy is doing well enough to handle a higher rate. But weak retail sales and lower inflation, if continued, will mean they can pause in February."

Nalini Prasad, UNSW Sydney (Increase): "Inflation pressures remain strong. The RBA has signalled that they are worried about services inflation. That continues to be strong."

Andrew Wilson, My Housing Market (Increase): "RBA needs to play catch up following 5 premature rate pauses from May to October."

Ask a question