- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Home run: Mortgage approvals soar to pre-COVID-19 levels

- ABS data shows a $1.2 billion spike in owner-occupier purchases between June and July

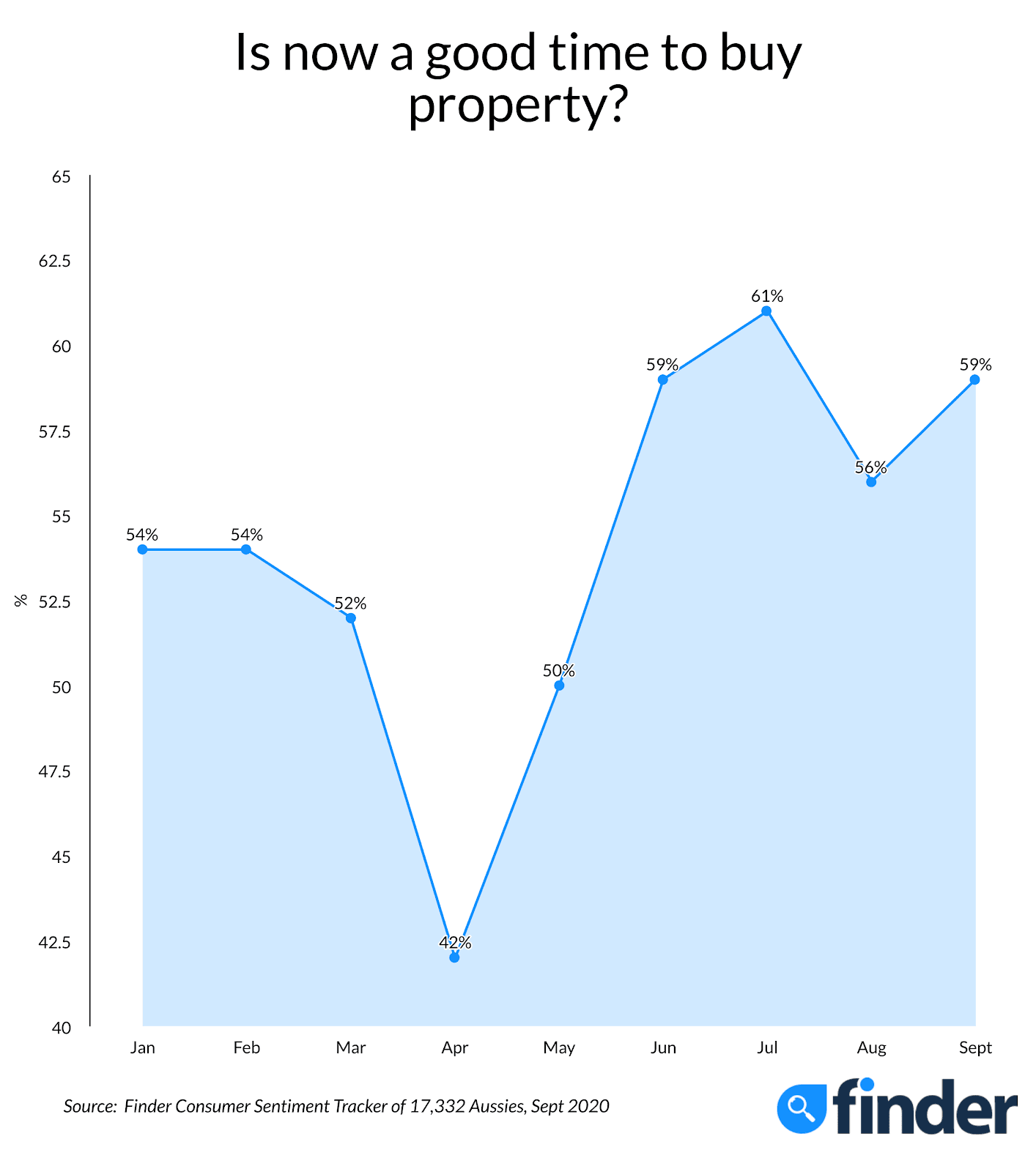

- 59% of Australians believe now is a good time to buy property

- Tips for boosting your borrowing power

30 September 2020, Sydney, Australia – Not even coronavirus can dampen Australia's love affair with property, according to new research by Finder, Australia's most visited comparison site.

Finder analysis of ABS housing finance data shows Australian mortgage approvals jumped to pre-pandemic levels in July.

The data shows a spike in owner-occupier purchases to the tune of $1.2 billion between June and July.

The number of mortgages approved also rose to 28,322 in July up from 25,713 in June, the largest monthly increase since the coronavirus first arrived in Australia.

Graham Cooke, insights manager at Finder, said the figures signal fresh energy in the housing market.

"Judging by the surge in activity, plenty of Aussies are fired up about property again.

"The housing market is also benefiting from the pent-up demand released with the restarting of auctions and inspections in several places.

"The full economic impact of COVID-19 has yet to be realised, but Aussies are unshakable in their love of housing," he said.

| Date | Total value | Number of loans |

|---|---|---|

| Jan 2020 | $ 12,107,500,000 | 24,109 |

| Feb 2020 | $ 11,076,300,000 | 23,090 |

| Mar 2020 | $ 13,199,500,000 | 26,687 |

| Apr 2020 | $ 12,099,500,000 | 23,638 |

| May 2020 | $ 11,539,600,000 | 22,941 |

| Jun 2020 | $ 12,532,300,000 | 25,713 |

| Jul 2020 | $ 13,725,100,000 | 28,322 |

The research shows 11,018 first home buyers have got a foot in the property market in July, which is 20% more than May.

Finder research of more than 17,000 consumers revealed more signs of exuberance with its latest Consumer Sentiment Index.

The data shows 59% of Australians believe now is a good time to buy property, broadly in line with the pre-pandemic monthly average.

Cooke said the growth in owner-occupier lending should continue when borders open.

"Think of all the interstate relocations that normally happen before a new school year starts that have been stifled," he said.

Cooke said since the pandemic started, households have saved more cash due to limited spending opportunities and fear of infection.

"There are hundreds of Aussies with a deposit saved, watching properties and the housing market and ready to strike.

"It's important for house hunters to get the most bang for their buck, so look at interest rates and loan features before putting in an offer," Cooke said

Do you believe now is a good time to buy property?

Tips for boosting your borrowing power

- Save a bigger deposit. The more you have saved, the stronger your position. A good savings history will also tell a potential lender that you're likely to be able to keep up with regular repayments. If you're a first home buyer, you may be entitled to the First Home Owners Grant (FHOG), which can form part of your deposit.

- Sort out your debts before applying. Debts count against your borrowing power, especially high-interest debts. You don't need to instantly pay off all your debts (you don't want to deplete your deposit savings) but making regular repayments to reduce them is essential.

- Cut back on your spending. A few months of careful spending will make you a stronger applicant. Draw up a budget and examine areas where you can cut back.

- Talk to multiple lenders. Every lender will give you a different borrowing power estimate, and it's wise to look at multiple options (don't apply, just enquire).

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel