- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA Survey: Aussie economists predict regulators will ban credit card surcharges – October, 2018

- 72% of panellists expect Australian regulators to ban credit card surcharges altogether

- Today represents the 24th consecutive time the RBA has held the cash rate

- Experts predict next rate rise toward late 2019

2 October, 2018, Sydney, Australia – Expecting Australia to follow in the footsteps of UK regulators, 72% of the thirteen experts and economists surveyed in the finder.com.au RBA survey say a country-wide ban on credit card surcharges is in the near future.

A removal of such fees – which have been routinely levied on everything from low-cost flights and taxis to cinema tickets and takeaway meals – could be welcome news for many Australians with 94% of the country believing they are a rip-off, according to a recent finder.com.au survey.

Furthermore, finder.com.au calculated credit card surcharge fees for coffee purchases alone could be collectively costing Australians $110 million per year.

This potential ban comes as the Reserve Bank of Australia (RBA) today announced a hold the cash rate for the 24th consecutive time, an outcome which was accurately predicted by 31 members from the finder.com.au RBA survey.

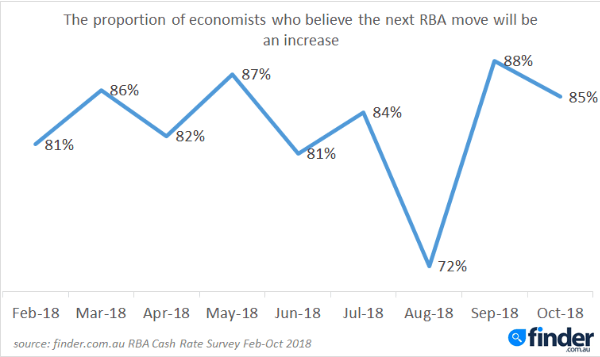

Expectations of a rising cash rate remain strong, with 85% of panellists forecasting the next move to be in an upwards direction.

Of the three economists who predict the next move to be a decrease, two (Jordan Eliseo of ABC Bullion and Dr Andrew Wilson of My Housing Market) predict a bottom rate of 1%, which is 50 basis points lower than today’s rate. Malcolm Wood of Baillieu Holst predicted the rate to bottom-out even lower, at 0.75%.

Graham Cooke, Insights Manager at finder.com.au said a decrease could be dangerous for the economy.

“Most economists are expecting a rise in the near future, but some outliers are forecasting rates to go even lower. An RBA cash rate of 1% or less would be unprecedented, and leave the RBA with very little room to stimulate the economy if there was to be an economic downturn,” Mr Cooke said.

Out-of-cycle rate hikes have been widely reported across three of the big four banks plus many smaller lenders due to increased international funding costs. With this in mind, experts were asked if they expect rate hikes to be enforced across savings accounts.

Despite anticipation from the public, the majority of experts and economists (81%) expect there to be no effect for savings products.

“We have seen the recent out-of-cycle rate hikes from the banks causing some Australians to inquire as to whether there could be any follow-on effect on savings.

“The simple answer is no. Banks are increasing home loan interest rates in order to generate more capital to cover the increased cost of borrowing from international markets.

“Increasing savings interest rates would simply erode the benefit here, and cause banks to raise home loan rates further,” Mr Cooke said.

Following the launch of finder.com.au’s Fee Free Shop campaign, which aims to celebrate businesses which do not charge any credit card fees, respondents were asked if they expected Australian regulators to follow in the footsteps of UK regulators by banning credit card surcharges.

Interestingly, a decisive 72% of panellists believe card surcharges will be eliminated.

“If our economists are correct, we could see the end of credit card surcharges across the board in the next few years. Until this happens, however, Aussies can turn to finder’s Fee Free Shop database to find a shop close to them where they can pay on card at no extra charge,” he said.

There are currently 521 shops in the database, ranging from cafes to bookstores, with more being added every day.

You can view an interactive map of retailers where credit cards are not charged fees at: https://www.finder.com.au/credit-cards/fee-free-shops

Here’s what our experts had to say:

Jordan Eliseo, ABC Bullion: "The RBA will be encouraged by recent economic data, including better than expected employment and growth figures. Having said that, low wage growth and underemployment are still factors, whilst the negative wealth effect from falling house prices has months, if not years to play out. This, coupled with the likely slow down in employment growth in the months ahead will keep the RBA on hold for months to come."

Shane Oliver, AMP Capital: "While economic growth ran above trend over the year to the June quarter and growth should be supported by business investment, infrastructure spending and exports going forward uncertainty remains around the outlook for consumer spending, house prices are likely to fall further and wages growth and inflation remain low."

Alison Booth, ANU: "Fundamentals haven't altered enough to warrant change."

John Hewson, ANU: "Can't risk moving in current and prospective environment."

Malcolm Wood, Baillieu Holst: "Given heightened economic and political uncertainty, and inflation below the target band, steady policy is the most appropriate."

Richard Robinson, BIS Oxford Economics: "Inflation and wages low. No inflationary pressures."

Paul Dales, Capital Economics: "The unemployment rate is still too high and inflation is still too low to warrant higher interest rates. What's more, the Royal Commission, the possibility of Labor government and the US-China trade war are extra reasons not to rock the boat."

Saul Eslake, Corinna Economic Advisory: "RBA has made it increasingly clear that it is in no hurry to start raising rates. Although economic growth is now running 'above trend', unemployment and underemployment are still higher than the RBA wants, and inflation is lower than the RBA wants - and it expects progress on both of these fronts to be only 'gradual'. The RBA seems unconcerned by recent 'out of cycle' movements in some lenders' mortgage rates."

Tim Moore, CUA: "Unless we see a strong trend in unemployment dropping toward the magic 5% level, we can expect to continue seeing low inflation levels and low wage growth, which will keep the RBA on the sidelines. Whilst the RBA has clearly communicated the next move is likely to be up, they have also given the caveat that they do not see this occurring anytime soon. Whilst the economy is continuing to show strength, there are still a few weaknesses and we are way off any concerns of the economy overheating."

Peter Gilmore, Gateway Bank: "Whilst the unemployment rate has fallen, inflation remains subdued, and mortgage stress is on the rise, so the RBA will hold."

Mark Brimble, Griffith Uni: "With higher fuel prices and out of round rate rises the RBA may consider reducing the cash to equalize the impact, but is unlikely to do so this month."

Geordan Murray, HIA: "There is minimal of evidence of inflationary pressures. The RBA and ARPA seem content with the impact of their interventions with respect to cooling growth in housing credit, particularly among higher risk borrowers. Low interest rates are no longer a significant cause of property market concerns. Households have been propping up growth in consumption by reducing the rate savings. The rate of household savings is now down to only 1%. In the absence of wage growth, declining home prices are likely to result in more cautious household spending (i.e. slower growth in household consumption). In this environment it is unlikely that discretionary household spending contributes too much to inflation. The cash rate is likely to remain low to facilitate further improvement in non-mining business investment."

Alex Joiner, IFM Investors: "Despite the economy expanding at an above trend rate the RBA continues to wait for inflationary pressure to build that are underpinned by an acceleration of wages growth. It will need to see at least some evidence of these factors emerging in the data before it can confidently signal that a rate rise should be expected in the near term."

Michael Witts, ING Bank: "[We will see a] continuation of the trend of recent months."

Peter Boehm, KVB Kunlun: "Whilst the RBA's cash rate is likely to go up sometime in the future, there are no compelling reasons for this to occur in the near future. This is because the present level of economic growth does not indicate a need to slow things down. In fact, raising rates now could have negative consequences for the economy by for instance, putting further pressure on highly geared mortgage borrowers and the housing market generally through even higher loan rates."

Leanne Pilkington, Laing + Simmons: "Most of the majors and a raft of smaller lenders have already taken matters into their own hands and adjusted their rates despite the RBA’s hold position. Consumers are right to be sceptical about the attempts to justify these adjustments, especially against the backdrop of easing house prices. But there’s no justification for the RBA to exacerbate the situation."

Mathew Tiller, LJ Hooker: "No significant surprises in domestic economic indicators over the past month, will see the RBA hold steady during the October board meeting. The RBA will be keeping a keen eye on a number of global economic developments to determine their impact on the outlook for the Australian economy. That’s said there is little chance of a change in the official cash rate in the short term, especially given the banks have done the heavy lifting by increasing interest independently of the RBA."

John Caelli, ME: "There is no compelling case to put up rates yet. Excess capacity remains in the labour market, and concerns remain around inflation and household debt levels. Furthermore, the latest RBA minutes clearly indicate the next move will be up."

Michael Yardney, Metropole Property Strategists: "The RBA will be in holding pattern for quite some time yet. There is no pressure on them to move rates either way.”

Mark Crosby, Monash University: "RBA will continue to wait until next year at this point."

Jacqueline Dearle, Mortgage Choice: "I expect the RBA to hold the official cash rate at 1.5% in October due to a combination of factors close to home, such as low inflation, an acceptable unemployment rate and stagnant wage growth. On an international level, Trump’s trade tariffs on Chinese imports may create a drag on global growth, which may impact on the Australian economy and jobs. Additionally, further upward pressure on the cost of wholesale borrowing for our own financial institutions is expected, as U.S. Federal Reserve Chairman Jerome Powell has told Congress he wants to increase America's interest rates. This may result in further out-of-cycle rate rises which will have a ripple effect across our economy and impact Australian property owners. Combined with tightened lending standards and a softening housing market, this will also help anchor the rate for now."

Dr Andrew Wilson, My Housing Market: "Although recent data remains positive overall with lower jobless rate, declining budget deficit and a steadying dollar, concerns are increasing regarding rising trade barriers imposed particularly by US and China. Increased fuel costs will also be concerning the RBA with wages yet to rise as expected. Rates will remain on hold and the case for a near-term cut - although clearly an outside chance - is strengthening."

Jonathan Chancellor, Property Observer: "The central bank don't have it going all their way, but there's no way they see any trigger in what's happening and not happening across Australia. Falling house prices is fine, though the board has noted they are becoming more widespread especially across Sydney and Melbourne."

Matthew Peter, QIC: "The RBA will be on remain on hold. However, with the Australian economy firming and the labour market tightening, the RBA will be in a position to begin rate hikes sometime in the second quarter of 2019."

Noel Whittaker, QUT: "No reason to move either way."

Nerida Conisbee, REA Group: "While there have been some recent positive signs in the economy, it still isn't strong enough to start increasing rates."

Christine Williams, Smarter Property Investing P/L: "Whilst the Royal Commission is still in progress I don't think the Reserve Bank will move."

Brian Parker, Sunsuper: "Still plenty of spare labour market capacity, and not enough evidence that wage and price pressures are strong enough to force a hike."

Clement Tisdell, UQ-School of Economics: "Economy is not overheated and the RBA would like to do what little it can to restrain increases in the rate of interest charged by the private sector given the level of debt."

Other participants: Bill Evans, Westpac. Nicholas Gruen, Lateral Economics.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel