- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Market low cuts time needed to save house deposit

- Time required to save a house deposit reduced by up to 21 months

- Sydney, Darwin and Melbourne have seen the biggest property price drops

- Tips for maximising your house deposit

10 October, 2019, Sydney, Australia – Sydneysiders desperate to crack the property market may now be able to sooner reveals new research by Finder, Australia's most visited comparison site.

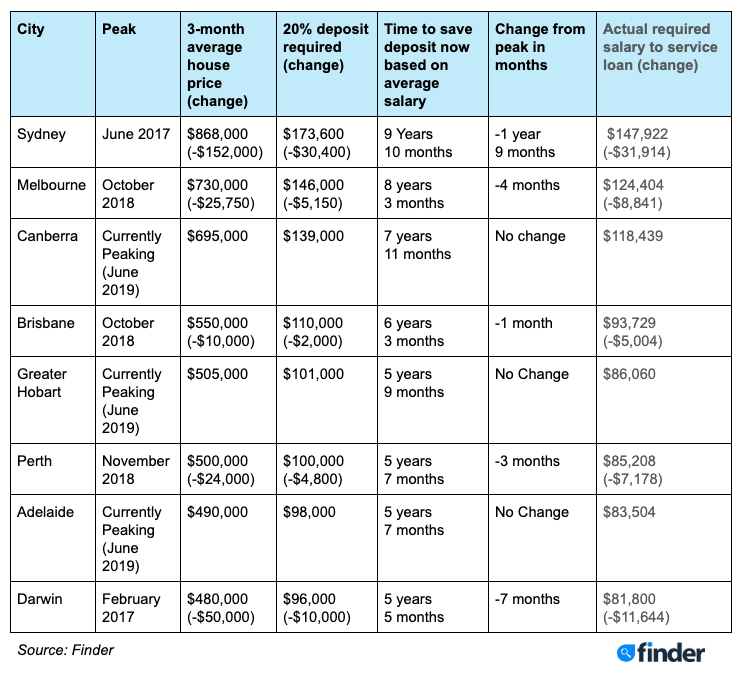

Finder analysed changing property prices across Australia's major capital cities between the market peak in June 2017, up until June 2019.

The research found that Sydney is leading the charge in property price drops, with house prices falling by $152,000 on average since 2017.

For the average Sydney couple, this decline in value has shaved 21 months off the time needed to save a 20% house deposit. This is assuming they each earn $1,695 per week and put 10% of their weekly income towards a deposit.

Bessie Hassan, money expert at Finder, said that reduced property prices and record-low interest rates are creating the perfect storm for first home buyers - for now.

"Aussies who have saved for years might be finding they're able to afford a larger place, or put down a bigger deposit than expected because of the dip in the market.

"But prices are increasing and auction clearance rates are heading back to pre-decline highs. This means buyers need to strike while the iron is hot if they want to nab a bargain," she said.

Darwin took out second place, with property prices falling by $50,000 on average since 2017. This is shaving seven months off the time required for couples to save a deposit.

Melbourne, which did not experience as significant a drop in prices, has only seen four months off the deposit saving time, while Canberra, Greater Hobart and Adelaide are currently peaking, meaning zero change to the deposit saving time-frame.

However the research also found that units tell a different story, with price drops evident across almost every major capital city in Australia.

"Units are often the more affordable option, especially in larger cities. But with many abandoned building projects and delayed developments, even these prices may be artificially high in some places.

"Remember that even though property prices are reduced, it can still take up to eight years to save enough for a deposit. Prospective buyers should be prioritising their savings wherever possible," Hassan said.

Time required to save a deposit for the average house, Current vs Peak

Tips for maximising your house deposit

- Minimise your rent. If you're looking for a new place or your thinking of extending your lease, you could be in a good position to negotiate a lower amount.

- Lower your everyday spend. You can easily do this by switching to a cheaper gym membership, transferring to a prepaid plan or cancelling your Netflix subscription - every bit helps.

- Ask for a payrise. If your performance review is coming up, why not ask your boss for a raise? This is an effective way to boost your savings, and Finder research shows that 58% of Aussies who ask for a payrise, get one!

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel