- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

46% of Millennials turn to personal loans

- Almost one in five Gen Y have taken out a personal loan to finance a car

- Emergency loans make up only 5% of applications

- Cheapest personal loan interest rates

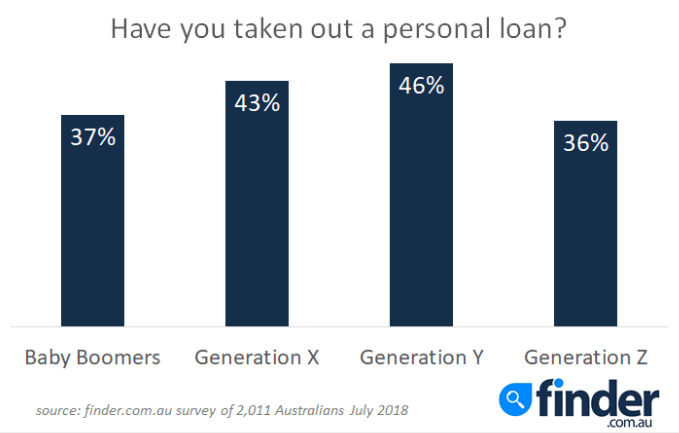

17 October 2018, Sydney, Australia – Millenials are loading up on personal loans with new research revealing almost half (46%) have signed up for one, according to finder.com.au, the site that compares virtually everything.

That proportion is greater than any age cohort – with cars (19%) and holidays (5%) the main reason Generation Y (aged 24 - 38) turn to them.

Only 5% of Millenials have taken out a loan for unforeseen expenses such as medical emergencies, car accidents and household mishaps.

Kate Browne, Personal Finance Expert at finder.com.au, said Millennials are driving the borrowing.

“They are entering a stage in their life they’re starting to earn more money and have built up a credit history that appeals to lenders,” she said.

Browne said used responsibly, personal loans can be a valuable tool.

“Personal loans can have a lower interest rate than credit cards and a repayment schedule means your debt comes with an end date.

“That said, taking out a personal loan for a consumer-driven shopping spree is very different to taking out a personal loan for a renovation which will add value to your home.”

“Remember, the bigger the loan, the bigger the repayments so it is important to take the time to compare personal loans in order to find one that’s right for you,” she said.

The survey of 2,011 Aussie adults showed two out of five (42%) of all Australians have taken out a personal loan.

Just over a third of respondents (37%) have used a personal loan for planned purchases such as cars, holidays, renovations, education and special occasions such as weddings.

“Planning for the unplanned is key to ensuring a personal loan is not your only option when things go wrong,” said Ms Browne.

“Regardless of if it’s a broken bone, busted car radiator or burst pipe, the last thing you want to worry about in an emergency is how you’re going to pay for it.”

Browne said the dwindling reliance on loans for emergencies may indicate we’re getting better as a nation at saving.

“Given only a small portion of Aussies are relying on lenders for financial help when things turn pear-shaped could mean we’re getting savier with our money.”

Overall more Queenslanders (46%) had taken out a personal loan than any other state or territory and were most likely to turn to one to fund an emergency expense.

Four of the most competitive unsecured loans currently on finder.com.au:

| Loan | Interest Rate | Comparison Rate |

|---|---|---|

| Harmoney Unsecured Personal Loan | From 6.99% | From 7.69% |

| Australian Military Bank Fixed Rate Personal Loan | From 7.93% | From 8.77% |

| SocietyOne Unsecured Personal Loan | From 7.50% | From 9.51% |

| Citi Personal Loan Plus | From 8.99% | From 9.96% |

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel