- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

1 in 2 parents not financially baby-ready

- 12% regret not owning property before starting a family

- Research shows older parents are just as underprepared as younger parents

- Get on the front foot with a savings plan

24 October 2018, Sydney, Australia – There's arguably no perfect time to have kids, but new research from finder.com.au, the site that compares virtually everything, shows thousands of Australian parents wish they’d been more financially prepared before having children.

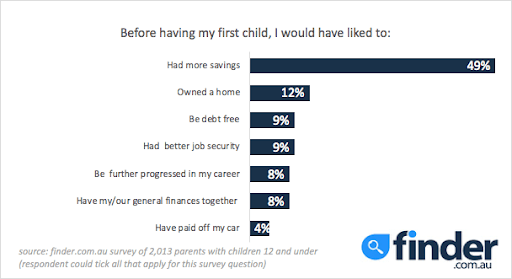

The survey of 2,013 parents with children aged 12 and under reveals 49% wanted to have more savings before starting a family.

One in eight parents (12%) wished they had bought a home before welcoming a child while

almost one in ten (9%) would have liked to have had better job security.

Kate Browne, Personal Finance Expert at finder.com.au said starting a family changes every aspect of your life including your finances.

“Parenthood comes with many new costs which might come as a shock to some young couples,” she said.

“Even once you’ve set up the baby’s room with a cot and change table and made all of the big purchases such a stroller and a car seat, there are numerous ongoing costs which need to be budgeted for – nappies, baby wipes, the list goes on.”

Getting out of debt pre-baby was something 9% would have liked, while 8% regret not having their finances in better order pre-kids.

According to Australians Bureau of Statistics (ABS) data analysed by finder.com.au, 30.5 was the median age of first-time mums in 2016.

The finder.com.au research showed older parents were no more prepared than younger parents in their twenties.

“Despite many parents waiting until they are in their thirties or forties to have children, these parents aren’t necessarily more financially secure,” she said.

First-time parents who wish they had more savings

| Age Group | Percentage |

|---|---|

| 20s | 46% |

| 30s | 51% |

| 40s | 49% |

She said it can be very difficult financially to stop work or make the switch from full-time to part-time work to raise a family but getting on the front foot can make it easier.

“If one or both of you take time off or reduce your hours, this could mean you’ll be earning less at a time when you’ll potentially be needing more.”

“A sizeable nest egg is a good idea – no matter what life stage you’re at.”

Browne urged want-to-be parents to not only have a birth plan but also a savings plan.

“You’ll never fully be prepared but there are some things you can do to plan ahead.

“Looking at your finances and making a budget should help you feel more prepared and less worried about how you will support yourself and your new bundle of joy,” she said.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel