- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA Survey: Rate cut coming in Feb 2020

- Two-thirds (64%) of experts and economists predict a cut at 2020's first RBA meeting

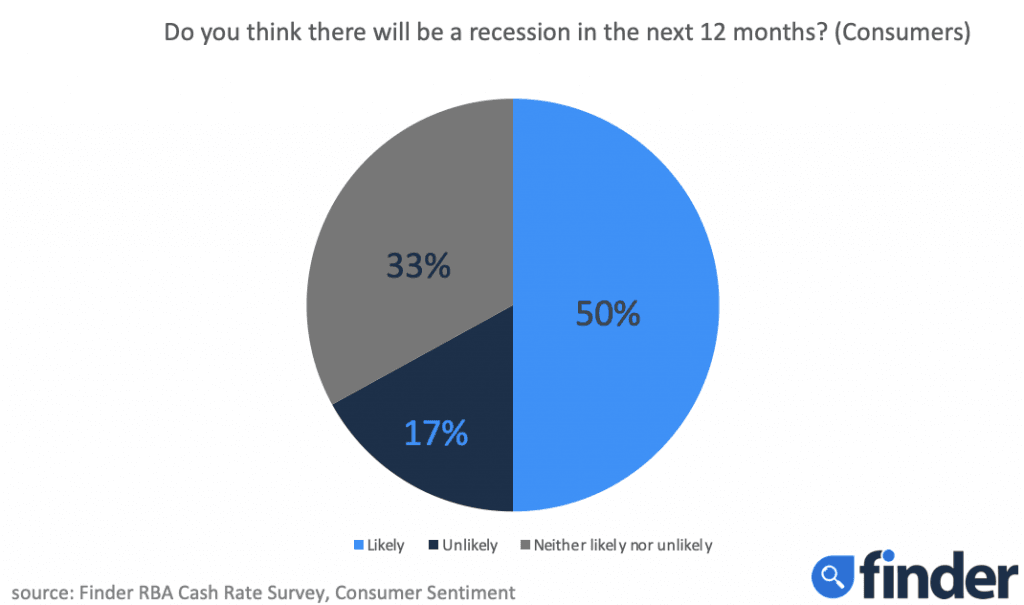

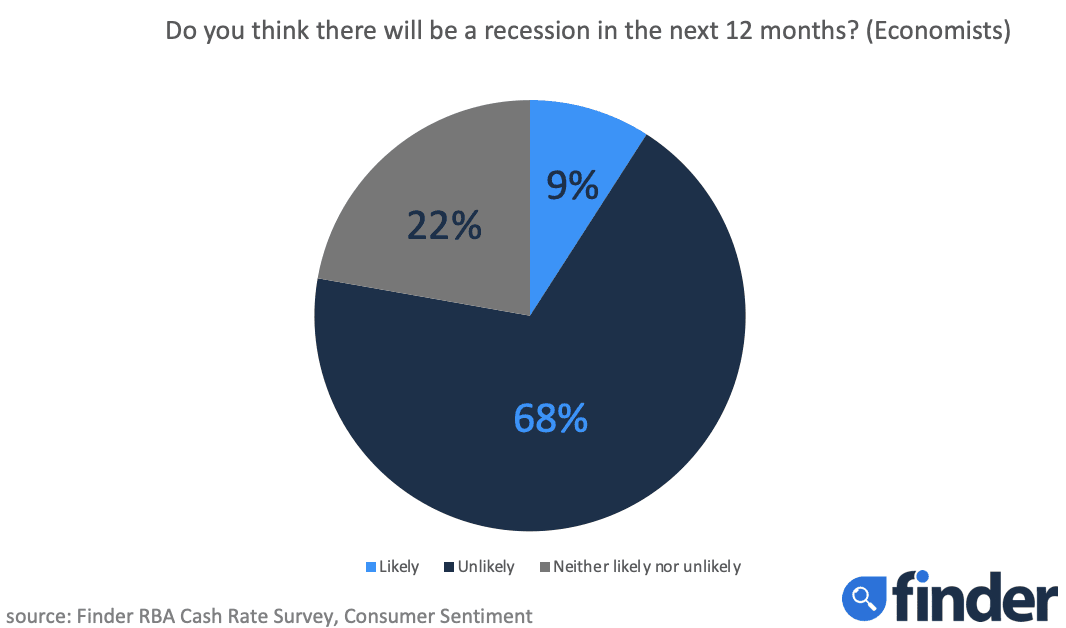

- 50% of consumers think a recession is coming in the next 12 months compared to just 9% of experts

- More than half (56%) of experts think households are holding back spending in fear of recession

4 November, 2019, Sydney, Australia – The Reserve Bank of Australia (RBA) is likely to cut the cash rate at its first meeting of 2020, according to Finder, Australia's most visited comparison site.

In the latest Finder RBA Cash Rate Survey™ – the largest of its kind in Australia – 38 experts and economists weighed in on future cash rate moves, recession fears and economic indicators.

While all experts and economists predict a hold on Melbourne Cup Tuesday (38/38), nearly two-thirds (64%, 21/33) expect the cash rate to drop to 0.50% in February 2020.

One-fifth (21%, 7/33) expect a fourth cut in 2019 to happen at the December meeting.

Graham Cooke, insights manager at Finder, said despite the rate falling from 1.50% in May to a predicted 0.50% by February 20201, the general consensus is that the RBA's cuts have had little impact thus far.

"We've seen multiple references to the RBA firing blanks with these cuts and running out of bullets in the process.

"If true, it's hard to believe that flogging the same horse will produce a different outcome.

"The RBA has not spoken fondly about negative interest rates in other countries, so I'd expect extra cash to be printed before we see a zero or sub-zero cash rate," Cooke said.

Susan Mitchell from Mortgage Choice said September labour force and unemployment figures released by the ABS provided breathing room for the RBA.

"The latest economic data is enough to put the breaks on the RBA's cutting spree for now.

"That being said, the Consumer Price Index undershot the RBA's target range – growing 0.5% over the September quarter, lifting the annual rate to 1.7% – which builds the case for further monetary policy stimulus in the short term," Mitchell said.

Recession fears: Experts vs consumers

Experts and economists continue to say that a recession is unlikely or very unlikely (69%, 22/32), with 22% (7/32) being non-committal (neither likely nor unlikely) and just 9% (3/32) think a recession is likely.

Consumers however, are much more fearful.

The Finder Consumer Sentiment Tracker™ established in May 2019, surveys more than 1,000 Australians each month and thus far has found that of the 6,078 surveyed, 50% expect a recession in the next 12 months.

Experts and economists have noted this worry and as a result, more than half of them (56%, 17/27) think households are holding back on spending in fear of recession.

Cooke said there is recession talk at large, both domestically and internationally.

"While slow wage growth and underemployment seem like cause for concern for consumers, Australian economists can see the light at the end of the tunnel.

"Market behaviour is hugely driven by psychology and we need to be careful not to talk ourselves into a recession," Cooke said.

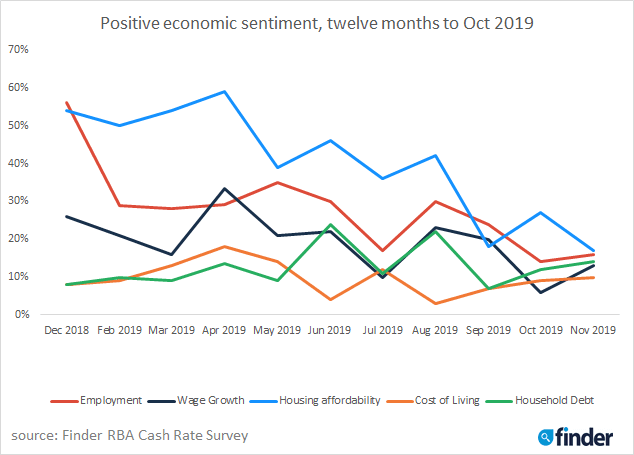

Results from Finder's Economic Sentiment Tracker, which gauges five key indicators – housing affordability, employment, wage growth, cost of living and household debt – continue to remain low.

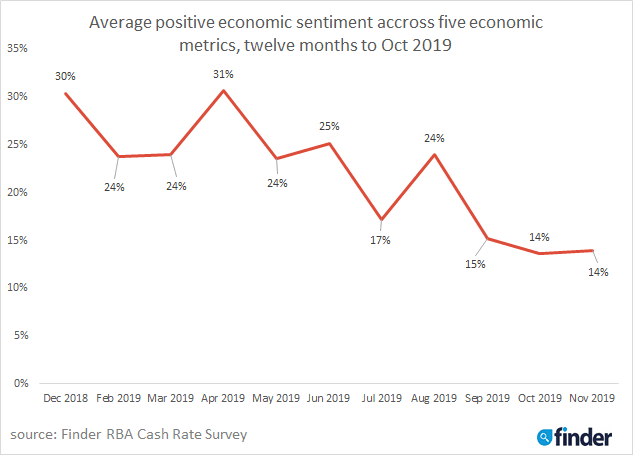

"Finder's Economic Sentiment Tracker has been bouncing around a bit of late, with the average positivity across all 5 metrics trending down over the last 12 months.

"The average percentage of economists who felt positive across 5 economic metrics covering employment, wage growth, housing affordability, cost of living and household debt has fallen from 30% in December 2018 to only 14% this month.

"I've never before seen all five of these metrics in the teens," Cooke said.

Introduced in March 2018, this month's tracker set an all-time low for economic sentiment in housing affordability (17%).

1Note: The RBA doesn't meet in January

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion: "The Reserve Bank may want to see how recent aggressive cuts feed through to the real economy (or not...) and recent cuts have tended to instill pessimism rather than boost consumer sentiment."

Shane Oliver, AMP Capital: "While September quarter inflation was low and economic data has generally remained soft, recent RBA commentary highlighting a gentle upturn in growth and greater tolerance for low inflation suggests a lack of urgency to ease for now."

Alison Booth, ANU: "Interest rates have just been lowered and I don't think the fundamentals yet warrant any further change."

John Hewson, ANU: "Unsure of economic conditions saving firepower."

David Robertson, Bendigo and Adelaide Bank: "A very low inflation read next week may change this, however for now the RBA can watch the data evolve (especially jobs). They have noted the diminishing effectiveness of monetary policy as rates get closer to zero."

Marcel Thieliant, Capital Economics: "We expect inflation to fall further below the RBA's target in Q3. But the decline in the unemployment rate in September and more upbeat comments by Governor Lowe suggest the Bank isn't in a rush to ease policy further."

Craig Emerson, Craig Emerson Economics Pty Ltd: "The cash rate is getting very close to ground zero."

Tim Moore, Credit Union Australia: "Most recent labour report and CPI print in line with expectations have taken the urgency out of further easing in the near term, giving the RBA time to assess the impact of the three recent cuts before providing a last round of easing in early 2020."

Malcolm Wood, EL&C Baillieu: "Guidance from the Governor that we should not assume more cuts, and that the economy is gradually improving."

John Rolfe, Elders Home Loans: "Almost run out of puff. Need to consider quantitative easing."

Mark Brimble, Griffith Uni: "The RBA is likely to want to see the impact of recent cuts. Markets have calmed also."

Tim Nelson, Griffith University: "Following recent easing, the RBA is likely to need time to assess the impacts before acting further."

Tony Makin, Griffith University: "Time still needed for previous cut to work through the economy. There's a risk cutting too soon could be counterproductive for consumer and business confidence."

Peter Haller, Heritage Bank: "Encouraging employment data had reduced the need for the RBA to deploy further easing in the near term."

Alex Joiner, IFM Investors: "A stabilisation of the labour market gives the RBA some time to assess the impact of its policy easing to date."

Peter Boehm, KVB Kunlun: "The Reserve Bank is trying to fire up economic activity by shooting interest rate cuts into the economy, but it seems it is firing blanks, because the latest rounds of cuts may be doing little to encourage economic growth. In fact, the cuts are likely doing more harm than good. For instance, house prices have been increasing (making it harder for first time buyers to get into the market), existing mortgage holders are maintaining repayments at current levels to help reduce their debt quicker, and therefore not spending this "freed up" cash, there's been little or no impact on the unemployment rate, corporate investment has not rebounded, business confidence is low, and the continuing reduction, and signalling of future rate reductions is sending negative messages to consumers about their economic outlook, which is doing nothing for consumer confidence, and has resulted in somewhat subdued retail sales. And then of course, pensioners and retirees who rely on savings income are being hit particularly hard by low, or even negative (in real terms) interest rates. So if the Reserve Bank is shooting blanks, what's the point of shooting more blanks into the economy? The reality is the private sector alone is not going to revive the economy. The government has to start spending. And until that happens, the Reserve Bank should hold rates where they are, until a movement either way, has a reasonable chance of having some positive economic impacts."

Leanne Pilkington, Laing+Simmons: "It was both interesting and comforting to hear the RBA governor effectively rule out the possibility of negative interest rates in Australia. Key economic indicators remain subdued and the three cuts this year have not yet had a widespread impact, though cheaper finance has certainly helped fuel demand in the real estate market. We think the RBA will hold for now and leave the door ajar for potentially another cut next year."

Nicholas John Gruen, Lateral Economics: "Because they'd like it to go lower, but my guess is that they'll play it cute and give it another month."

Mathew Tiller, LJ Hooker: "The RBA will hold rates steady in order to assess the impact of the last two cuts. The early signs for the economy, as a whole, have not been overwhelmingly positive with the biggest positive impact, of the rate cuts, been felt by property markets across the country. Property prices are now slowly increasing, auction clearance rates are back above 75% and LJ Hooker agents are reporting a major uplift in attendance at open homes."

Geoffrey Harold Kingston, Macquarie Business School: "While the Bank remains on a slight easing bias, the September job numbers were decent. This will probably stay its hand."

Jeffrey Sheen, Macquarie University: "Though the RBA has prepared the public for lower rates and possible unconventional monetary policy, I think they will (and should) hold their fire for the time being."

Stephen Koukoulas, Market Economics: "There is some stimulus in the economy and it appears to be recovering from the low point at the middle of 2019."

Michael Yardney, Metropole Property Strategists: "The RBA will wait and see how the effects of its recent three interest rate cuts pan out."

Mark Crosby, Monash University: "RBA will most likely wait to assess global conditions and local response to recent cuts."

Katrina Pai, Moody's Analytics: "The RBA has already cut rates by 75 basis points so will wait for the stimulus to filter through."

Susan Mitchell, Mortgage Choice: "The latest economic data is enough to put the breaks on the RBA's cutting spree for now. September labour force figures would have been welcome news to RBA Board members. ABS data revealed that the unemployment rate declined in September and even though it is far off the Bank's target, the latest figures provide some breathing room for policy makers. That being said, the Consumer Price Index undershot the RBA's target range, growing 0.5% over the September quarter, lifting the annual rate to 1.7%, which builds the case for further monetary policy stimulus in the short term."

Dr Andrew Wilson, My Housing Market: "RBA likely to take wait-and-see approach following three cuts in five months with concerns weaker sentiment may be offsetting stimulatory effect encouraging saving not spending. Latest CPI data neutral for another short-term cut and jobless rate lower a positive. RBA indicates easing to continue – but now early 2020."

Alan Oster, NAB: "Still looking to see what impact recent policy changes have had on the economy."

Jonathan Chancellor, Property Observer: "The bank is watching the impact of its past three cuts."

Matthew Peter, QIC: "With the labour market holding up and a stabilisation in global market sentiment around the prospects of recession and a rebound in the Australian housing market, the RBA can afford to take a breather in their current easing cycle."

Noel Whittaker, QUT: "The reserve bank governor has given hints [of a hold]."

Nerida Conisbee, REA Group: "We have now had three cuts in quick succession. At this stage, it is likely the RBA will take a wait and see approach. With monetary policy not as effective as it has been historically, we should expect to see a greater focus by Government on other ways to boost economic growth, including tax cuts and Government spending."

Christine Williams, Smarter Property Investing: "I believe the RBA will sit for a couple of months to see what effect the last reduction has had on the economy. I feel the next reduction will be February 2020."

Nelson Aston, St George Bank: "The fall in unemployment in September points to an increased likelihood of the RBA standing pat in November."

Besa Deda, St.George Bank: "We think the RBA will next cut in February 2020 with some risk they will move sooner (in December 2019)."

Mala Raghavan, University of Tasmania: "The RBA just brought down the cash rate in October and thus I think they will not immediately bring down the interest rate in November."

Other participants: Bill Evans, Westpac. Clement Tisdell, UQ-School of Economics.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel