- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA Survey: Royal Commission fallout to see small lenders favoured – November, 2018

- 80% of panellists expect the Royal Commission to impact small businesses' access to credit

- Today represents the 25th consecutive time the RBA has held the cash rate at 1.5%

- Experts predict next rate rise in late 2019, early 2020

6 November, 2018, Sydney, Australia – Anticipating a tightening of lending practices following the Royal Commission, 80% of the twenty experts and economists polled in the finder.com.au RBA survey say that it will be increasingly difficult for small businesses to access credit.

Half the experts predict businesses to turn to smaller lenders rather than relying on the big four banks. This echoes the sentiment from earlier research regarding consumer lending, which found Australians are expected to turn to lesser-known and online lenders following fallout from the Royal Commission.

Graham Cooke, Insights Manager at finder.com.au, said the increased scrutiny from the Royal Commission on the larger institutions means now is the time for smaller lenders to shine.

“Increased oversight creates stricter lending criteria which usually means the smaller players can’t access cash as easily.

“There is a big opportunity here for smaller lenders to gain an edge over the big banks due to the increasingly competitive market.”

| Impact of Royal Commission | % |

|---|---|

| Small businesses will find it more difficult to access credit | 80% |

| Small businesses will be increasingly reliant on smaller or specialist lenders | 50% |

| More small businesses to close due to problems accessing finance | 25% |

| Some small businesses will be hiring fewer employees due to lack of access to funding | 25% |

| We will see a rise in fintechs | 20% |

| There may be a lack of innovation in the sector as new businesses fail to start up | 15% |

| It will have little or no impact on small businesses | 10% |

Beyond access to credit, a quarter of the experts tipped potential business closures and a drop in hiring rates in 2019 as likely impacts of the Royal Commission.

This consensus on small business credit comes as the Reserve Bank of Australia (RBA) today announced a hold on the cash rate at 1.5% for the 25th consecutive time, an outcome accurately predicted by all 32 members from the finder.com.au RBA survey.

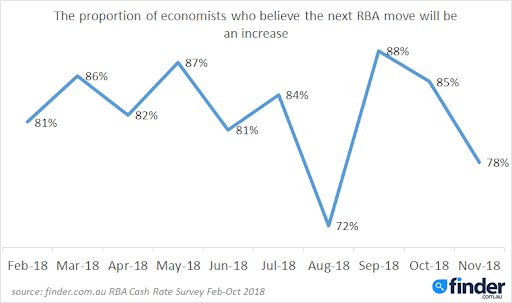

While expectations of the next cash rate move to be an increase remain strong, the certainty for an upward change has waned in recent months. Of the 27 expert responses, only 21 (78%) predicted a rise, down from 88% in September.

Surprisingly, six experts (22%) are predicting a rate cut, with four citing a final cash rate of 1%.

Dr Andrew Wilson, Chief Economist from My Housing Market said the RBA may be tangled in a web of its own design.

“Drums are beating louder for a cut, but the RBA have somewhat painted themselves into a corner with recent consistent statements that the next move is likely to be up.

“Ordinary inflation data, unions marching in the streets demanding higher wages, stock market crumbling and housing markets tanking. If the next wages index remains benign, then a louder cut chorus will be heard,” Wilson said.

Cooke said for the first time, Finder analysis shows one in four economists saying there will be no rise until 2020.

“This will be good news for mortgage holders who will already have taken a financial hit from increasing energy and petrol prices.

“If we don’t see any movement until 2020, this will represent an unprecedented 29 months with a static cash rate.”

Here’s what our experts had to say:

Alan Oster, NAB: "Still waiting to see what happens to wages and the consumer."

Alex Joiner, IFM Investors: "Inflation data for the third quarter came in slightly weaker than the market expected and decelerated again away from the bottom of the RBA’s target band. This is broadly in line with the Bank’s expectation however underscores that despite good economic growth the inflationary pulse in the economy is weak. In the absence of either a material pick up in wage growth and inflation the RBA simply has no reason to alter its currently policy path."

Alison Booth, ANU: "The fundamentals have not yet altered enough to warrant any change."

Brian Parker, Sunsuper: "Enough downside risks to the economic outlook and to inflation to keep RBA on hold."

Christine Williams, Smarter Property Investing: "Employment has reduced slightly. Housing pricing has slowed and or reduced slightly from an investor perspective. My opinion due to the impact of stamp duty payable for investor purchases."

Clement Tisdell, UQ-School of Economics: "No major changes in the economy that would warrant a change. These days, this rate is more a signalling device than anything else."

Dr Andrew Wilson, My Housing Market: "Drums are beating louder for a cut but RBA have somewhat painted themselves into a corner with recent consistent statements that next move likely to be up. Ordinary inflation data, unions marching in the streets demanding higher wages, stock market crumbling and housing markets tanking. If the next wages index remains benign then a louder cut chorus will be heard - clock ticking.”

Geordan Murray, HIA: "Inflationary pressures are still below the target band and there is still excess capacity in the labour market, so rates are likely to be left on hold. It will be interesting to see what the RBA make the latest update to the labour force figures which showed the national unemployment rate dropped to 5.0 per cent, with rates in NSW and Victoria are 4.4 and 4.5 per cent, respectively. Housing credit growth is continuing to slow and home prices in Sydney and Melbourne are easing, it will be interesting to see what the RBA makes of these developments in the context of their earlier concerns about the risks posed by these two markets."

Janu Chan, St.George Bank: "Low inflation and slow wage growth continue to point to scope for the RBA to leave the cash rate on hold."

John Caelli, ME: "The RBA are still looking for further falls in unemployment and higher inflation. Current settings are considered appropriate to support this."

John Hewson, ANU: "Uncertain data - economy slowing."

Jonathan Chancellor, Property Observer: "We are only starting to see serious shocks in the property market. And if it escalates the accompanying uncertainly will trigger a drag on the wider economy too. The RBA will be watching closely. Its prior modelling found increases in uncertainty can trigger a downturn characterised by lower employment growth, weaker retail sales growth, and a fall in consumer confidence."

Jordan Eliseo, ABC Bullion: "When assessing the economy as a whole, its a mixed scorecard for the RBA. They will be pleased with recent developments in the labour market, though persistently low inflation, and continued falls in the housing market are obvious areas of concern. On balance, there is no immediate case to move rates in either direction, hence the likelihood that they'll remain stuck at 1.5%."

Leanne Pilkington, Laing+Simmons: "We can’t see any reason for a Cup Day surprise this year. The subdued housing market, particularly the major markets of Sydney and Melbourne, combined with a weak inflation rate beneath the target range should continue to keep rates low in the short to medium term."

Malcolm Wood, Baillieu: "While the RBA is bullish on growth, the housing downturn and inflation below target will lead them to leave rates on hold."

Marcel Thieliant, Capital Economics: "While the unemployment rate is now close to the RBA's estimate of the natural unemployment, the RBA will want to see more evidence that wage growth is picking up. What's more, the RBA will want to see how the housing downturn is affecting consumer spending, to what extent the Royal Commission is restraining credit growth, and whether the trade war is restraining export growth."

Mark Brimble, Griffith Uni: "The economy remains delicately poised. With increasing fuel prices and lending rates, credit availability declining and asset prices easing, both sentiment and activity are vulnerable."

Mark Crosby, Monash University: "The RBA has signalled it will be holding rates steady this year and into early 2019."

Mathew Tiller, LJ Hooker: "There was no discernible change in domestic economic indicators over the past month, ensuring that the RBA will hold the cash rate steady in November. A number of global economic developments may yet have an impact on the outlook for the Australian economy. That’s said, there is little chance of a change in the official cash rate in the short term, especially given the ongoing soft inflation numbers and the slowdown in the housing market; due to higher interest rates and tighter lending restrictions by the banks."

Matthew Peter, QIC: "Rising risks to the global economy, the domestic housing downturn and modest underlying inflation mean that the RBA is in no hurry to raise rates. However, a robust economy, strong employment growth and a falling unemployment rate mean that the RBA will not want to postpone normalising the cash rate indefinitely and will pull the trigger on a first rate hike in the second half of 2019."

Michael Witts, ING Bank: "The economy is unfolding as the RBA has anticipated therefore no action required by the RBA."

Michael Yardney, Metropole Property Strategists: "The RBA must be a little worried with the current crisis in consumer confidence. If anything it may want to err on the side of caution and lower rates, but it is likely to take a wait and see approach."

Nerida Conisbee, REA Group: "There has been some great economic news lately, particularly that unemployment has hit 5%. While this is the rate at which the RBA believes will kick start wages growth and inflation, this is yet to happen. As such, rates are likely to stay on hold this month."

Nicholas Gruen, Lateral Economics: "They've telegraphed it for ages."

Noel Whittaker, QUT: "No reason to raise or lower. $ is down, property prices are falling and the economy is OK."

Peter Boehm, KVB Kunlun: "There are no economic or financial reasons to move rates at this stage."

Peter Gilmore, Gateway Bank: "Although unemployment has fallen, consumer confidence will be shaken by the house price and stock market falls."

Peter Haller, Heritage Bank Limited: "There is no economic case for changing the cash rate at this point in time."

Saul Eslake, Corinna Economic Advisory: "Although most recently reported economic growth figures were 'above trend', and the unemployment rate is 5% - the level traditionally regarded as signifying 'full employment' - the above trend growth is unlikely to be sustained in the near-term, the unemployment figure was probably 'rogue', there is still a lot of spare capacity in the labour market by other measures, the RBA itself has started to 'wonder out loud' that unemployment probably needs to be lower for longer than history suggests before wages growth starts to pick up - and, most importantly of all, the latest CPI data show 'underlying' inflation still running below the RBA's target range."

Shane Oliver, AMP Capital: "The fall in the official unemployment rate to 5% helped by above trend economic growth is good news. But the slide in home prices in Sydney and Melbourne risks accelerating as banks tighten lending standards which in turn threatens consumer spending and wider economic growth and inflation and wages growth remain low. Against this backdrop, it remains appropriate for the RBA to leave rates on hold."

Stephen Koukoulas, Market Economics: "RBA is continuing to ignore its inflation target otherwise it would be cutting."

Tim Nelson, Griffith University: "RBA believes current state of monetary policy is acting to gradually reduce unemployment with inflation in check. "

Other participants: Bill Evans, Westpac.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel