- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Oh my fraud: Online credit card fraud jumps to $249 million

- More than 1.8 million fraudulent transactions in 2018

- Card not present fraud up 76% from 2017

- Tips to keep yourself safe

31 January, 2019, Sydney, Australia – Online shoppers are being targeted by cyber criminals more than ever before, according to new research by Finder, Australia's most visited comparison site.

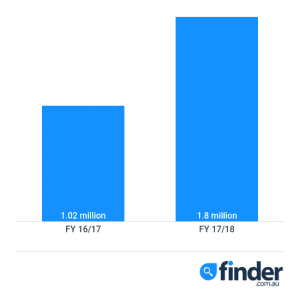

An analysis of fraud statistics from the Australian Payments Network reveals "card not present" fraud surged from 1.02 million transactions in the 2016/17 financial year to 1.8 million transactions in the 2017/18 financial year. This represents an increase of a staggering 76% year on year.

Angus Kidman, editor-in-chief at Finder, said it's concerning how many people are falling victim to online credit card scams.

"Unfortunately many of us have experienced unauthorised transactions on our credit card, or know someone who has.

"Fraudsters acquire credit card details, make a small purchase to ensure the card will work and then start making much bigger purchases until the scam is uncovered and the card is cancelled," he said.

Aussies were conned out of $249 million in the 12 months from 1 July 2017 to 30 June 2018. This represents a 28% jump, which is $54 million more fraud in one calendar year.

Kidman said security issues are the online payment industry's biggest challenge.

"You should be just as concerned about leaving your credit card unattended at a bar as you are about using it online," he said.

Online fraud now accounts for 85% of all fraud on Australian cards and is up from 82% year on year.

Kidman said customers should act quickly if they notice any suspicious activity on their card.

"Credit card fraud can happen to anyone. There are security measures in place to protect you like zero-liability policies to indemnify you against fraudulent charges made on your card".

Source: Australian Payments Network, Finder

Five tips to protect yourself from credit card fraud

- Look for “https” not “http” when online. If you’re using your credit card details online, look for “https://” at the beginning of the website address instead of the previously prevalent “http://”. The added "S" means extra security.

- Review your statements. Go through your statements carefully, and if you spot a suspicious transaction, report it immediately.

- Don’t sign blank receipts. Some hotels still require their guests to sign blank receipts when they check in. Never do this, and ask the person you’re dealing with to enter an amount instead. When you check out, make sure the receipt is ripped up or shredded.

- Don’t provide details via email. Never provide your credit card or bank account details via email. No reputable seller deals this way, and remember that emails aren’t very secure.

- Check your credit. Obtain a credit report to verify that your details have not been used to open any fraudulent accounts.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel