- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

6.5 million to reconsider health cover in 2018

- 1 in 2 Australians with private health insurance will review their cover before 1 April

- Premiums to rise by more than double inflation and wage growth in 2018

- finder.com.au shares tips on how to beat the 3.95% price hike

25 January 2018, Sydney, Australia – With an average premium increase of 3.95% announced this morning, 2018 could be the year millions of health insurance members switch or ditch their cover, according to new research by finder.com.au, the site that compares virtually everything.

The finder.com.au survey of 2,274 Australians shows a startling half (48%) of those with private health insurance - the equivalent of 6.5 million members - will review and make changes to their cover if their premium increases by 4% in April.

The research finds one in four (27%) with private health insurance plan to change health insurers to get a better deal, while 12% will make a clean break and ditch it altogether.

A further 9% will remove their extras cover and stick with a private hospital only policy to keep costs down.

According to market analysis by finder.com.au, the average annual health insurance premium in Australia will rise from around $3,388 to $3,523 – an increase of approximately $134 – with the 3.95% premium increase.

Sophie Walsh, Insurance Specialist at finder.com.au, warns that yet another premium increase this year may mean the cost will outweigh the benefits for thousands of policyholders.

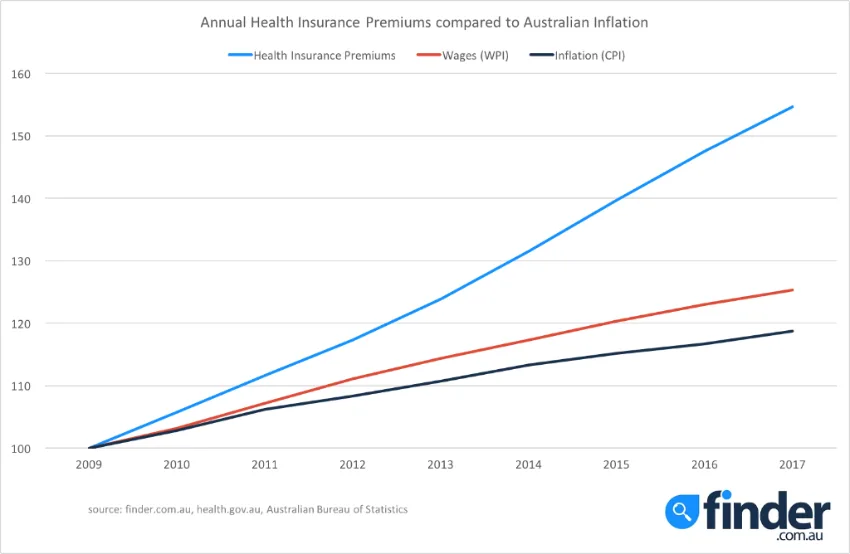

"While 3.95% is the lowest increase since 2001, this is still well above inflation and wage growth last year – 1.8% and 1.9% respectively, so for many Australians it could be the straw that breaks the camel's back."

Health insurance continues to rise well above wage growth and inflation

“Death and taxes are no longer the only certainties in life – massive health insurance price rises have also joined the club.

“With insurers increasing their annual premiums by more than double the rate of wage growth, it’s more crucial than ever to shop around and make sure you’re getting the best deal to avoid paying for cover you don’t need,” says Ms Walsh.

Which funds offer the best value?

“While the average increase is 3.95% each health fund will raise its premiums at a different rate, so if you receive a notice that your policy is going up by more than the average it’s worth shopping around to see if a different provider can offer you a better price.”

For example, not-for-profit insurer HCF had the lowest average increase last year out of the big four funds, raising its premiums by just 3.65% in 2017, while outside of the big four, CBHS had the lowest average increase, with its premiums going up by just 3.29% last year.

A complete breakdown of each fund and their premium increases since 2010 can be found at finder.com.au/health-

finder.com.au tips for beating the health insurance price hike:

- Don’t pay for cover you don’t need - Look at what you’ve claimed for over the last 12 months. Are you paying for extras cover that you don’t use? If yes, then you might be better off switching to a lower cover with less extras or taking out a hospital only policy.

- Pay your annual premium before 1 April - By paying 12 months up front before the price hike, not only will you be able to lock-in a price based on 2017 costs but many health funds advertise additional incentives, for example HIF offers a 4% discount for annual payments.

- Mix and match - For a policy tailored specifically to your needs at a competitive price, you could be better off taking out hospital cover with one insurer and extras cover with a different health fund.

For more information visit finder.com.au’s guide to switching health funds and compare policies from over 30+ health insurance providers.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel