- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

’Tis the season for spending: 5 million paying with plastic this Christmas

- Christmas credit card usage rises to 27%, up from 19% in 2017

- Credit card spending to reach $5 billion

- Compare more than 300 credit cards on finder.com.au

20 December, 2018, Sydney, Australia – More Aussies are relying on their credit card this Christmas, shows new research by finder.com.au, the site that compares virtually everything reveals.

A finder.com.au survey of 2,013 people found one in four Australians (27%) – equivalent to 5.2 million people – are turning to their credit cards this festive season.

This figure is up from one in five (19%) in 2017 which represents an extra 1.5 million Aussies paying with plastic in 2018.

Further finder.com.au research shows that the average Aussie will spend $1,325 this year. If this credit card-dependent group put 75% of their Christmas-specific spend on card, this could amount to over $5 billion added to December’s national credit card spend.

Money Expert for finder.com.au Bessie Hassan said credit cards have become vital for some during the spending season.

“Christmas is an expensive time of year and credit cards can be a real lifesaver for some – Aussies using a rewards card may even get something back this giving season.

“Just as you would shop around for Christmas gifts, it pays to shop around for credit cards too – as well as looking at purchase rate, you should also consider the fees and features of the card.”

Between November and January the average Australian credit card holder spends a whopping $4,750, of which $1,325 is expected to be used to cover Christmas costs.

Hassan cautioned that interest from 2018 Christmas spending could end up costing consumers if repayments aren’t made in time.

“Taking a year to pay off $1,325 could cost you $100 or more in interest alone, so you might consider switching to a card with a 0% purchase rate for Christmas."

“There are a number of cards to choose from with 0% purchase rate periods, and some are even 14 months long.”

“The free purchase rate period will give you a bit of breathing space during the festive season, but remember these terms do expire so be careful not to be caught out with a high revert rate,” she said.

Young shoppers (Generation Z) are the most reliant on credit cards with 33% admitting plastic is their payment method of choice, compared to 22% of Baby Boomers.

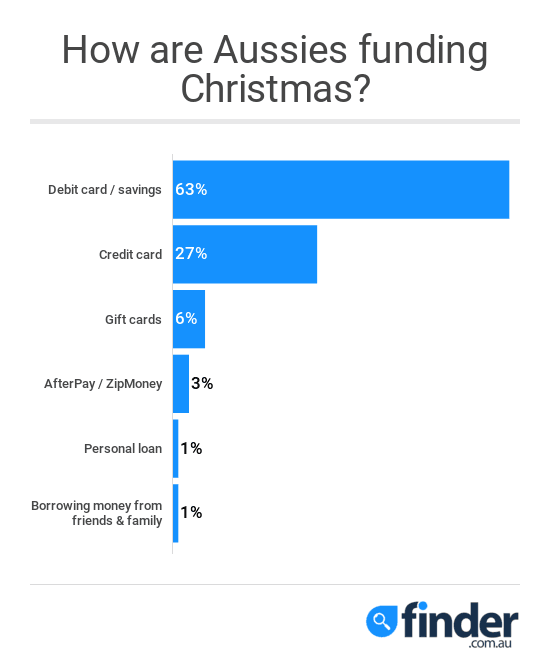

The research also shows most shoppers (63%) are dipping into their savings to finance the festive season, while some thrifty Aussies (6%) have diligently bought gift cards throughout the year as a way of saving up for Christmas.

Some are turning to ‘buy now, pay later’ methods, others (1%) favour a personal loan, and a small proportion (1%) are asking friends and family for money.

You can weigh up more than 300 credit cards on finder.com.au, including this handy guide on what to look out for when picking a credit card.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel