Tune into these money tips

Finance expert Ted Richards looks at what you can learn from your favourite songs about money.

Learning about finance can sometimes be pretty boring, but some of the world's most famous and successful songwriters have handed out financial lessons in their lyrics.

You've probably sung along to these songs many times, so let's tune into them now for some interesting lessons about saving and investing and reminders of what not to do.

I Get Money – 50 Cent

I, I get money, money I got.

In this song, the rapper gloats about his financial status as "I get money" is repeated over and over. It's an important reminder that even though you may be comfortable financially now, it doesn't mean this will always be the case.

Our brains are wired to be more focused on the here and now than what might happen in the future, and our minds also tend to believe that things will stay the same.

50 Cent himself is the perfect example of how this mindset is dangerous. He wrote this song on the way up in 2007 and had an estimated fortune of $155 million in 2015. He then made a lot of bad investments and filed for bankruptcy in 2016, just a year later! Money he had but money he lost.

Don't take your money for granted, save for the future – and your retirement.

Money, Money, Money – ABBA

I work all night, I work all day, to pay the bills I have to pay

Ain't it sad

And still there never seems to be a single penny left for me

That's too bad

This is a key reminder about the importance of budgeting, avoiding "lifestyle creep" and making your money work for you, no matter how small the amount.

At least ABBA has one thing right here – you pay your bills first when possible, before allocating money anywhere else. These days each member of ABBA's net worth is believed to be around $300 million so it turns out there were a few pennies left for them in retirement!

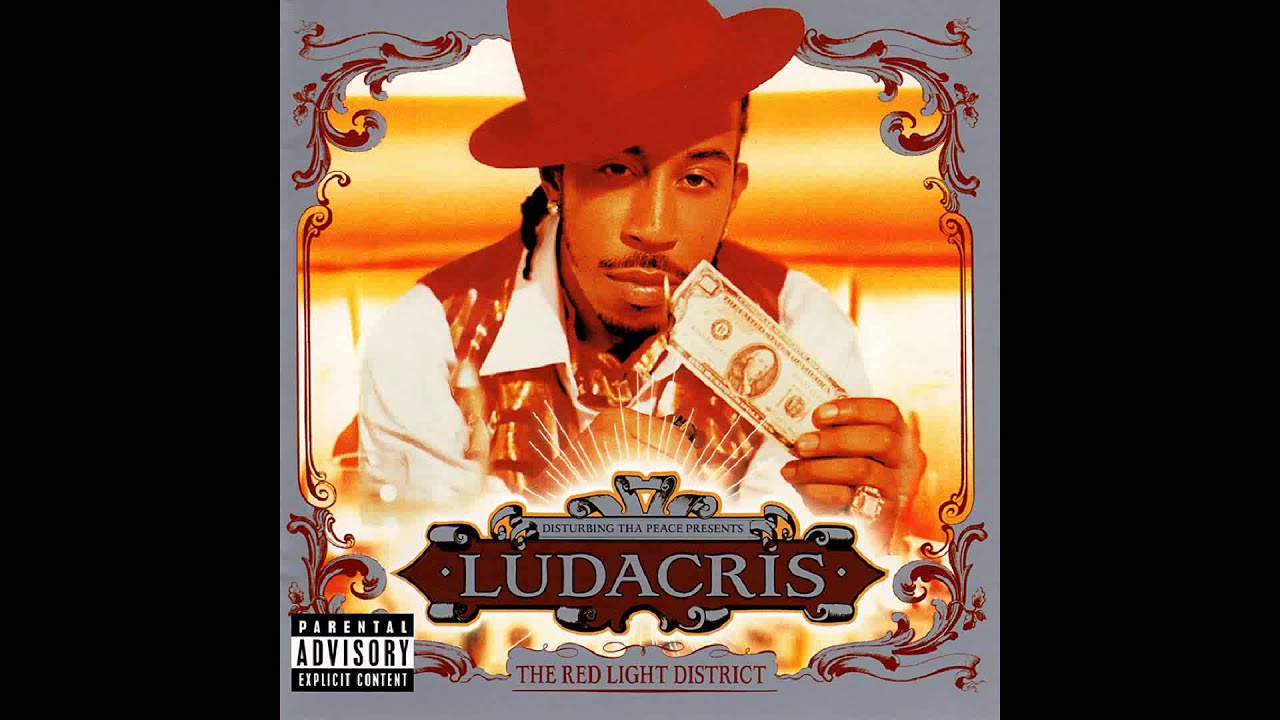

Large Amounts – Ludacris

Given a million dollars, what you gon' do?

Map your life for your kid's kids or would you spend it overnight?

This song goes on to explain how Ludacris already has a financial fund set up for his one-year-old daughter (along with four or five retirement funds). For all of the rap songs about money, this one shares some good wisdom, particularly around investing for children from a young age and reaping the rewards of compound interest over time.

Money's Too Tight – Simply Red

I been laid off from work.

My rent is due.

My kids all need

Brand new shoes.

Simply Red reminds us here about the importance of having an emergency fund. This could be a separate savings account or transaction account with whatever nickname you want. For example, the Barefoot Investor is a big supporter of the Mojo fund, where you aim to build up three months' worth of salary for a rainy day.

Can't Buy Me Love – The Beatles

I don't care too much for money, money can't buy me love.

There are two lessons in this one. Sure, it's a great reminder that above all, things like love, health and happiness are what's really important in life.

However, it's also interesting to acknowledge that repeated studies have shown a correlation between savings and happiness.

For example, a 2015 analysis of data from the Household, Income and Labour Dynamics in Australia (HILDA) Survey found that people who saved regularly generally reported higher life satisfaction levels than those who usually spend all their income. Similar results were found in a University of Cambridge and University of California study in the UK in 2016.

In fact, in many studies, the more interviewees had in savings, the happier they were.

Savings give you control over your life, so while money can't buy you love or happiness, it can certainly allow you to have freedom in your own life – and that's powerful.

Ted Richards is the Director of Business Development at online investment service Six Park and host of investment podcast The Richards Report.

Disclaimer: The views and opinions expressed in this article (which may be subject to change without notice) are solely those of the author and do not necessarily reflect those of Finder and its employees. The information contained in this article is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Neither the author nor Finder have taken into account your personal circumstances. You should seek professional advice before making any further decisions based on this information.

Watch: Ted Richards on the 5 emotions every investor should avoid

Read more Finder X columns

-

All the big savings account interest rate rises: ING, AMP, Westpac + more

6 Feb 2026 |

-

Australian credit card debt soars 10% in a year: How can you escape the trap?

6 Feb 2026 |

-

4 cashback home loan offers to ease the pain of RBA rate hike

4 Feb 2026 |

-

Finder’s RBA Survey: Easing cycle ends as RBA delivers first rate hike since 2023

4 Feb 2026 |

-

Ubank Save is increasing its bonus rate up to 5.35% p.a.

3 Feb 2026 |

Image credit: Getty Images

Ask a question