Finder’s RBA survey: Homeowners breathe a sigh of relief as cash rate holds

Australian homeowners have been given a breather from what would have been an 11th consecutive cash rate hike from the RBA.

In this month's Finder RBA Cash Rate Survey™, 42 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

This month, 2 in 5 (38%, 16/42) correctly predicted the cash rate would hold. This is the second-lowest percentage of correct predictions since May 2022.

Graham Cooke, head of consumer research at Finder, said the decision was anyone's guess this month.

"Homeowners deserve a break from the relentless increase in pressure, and can finally breathe a sigh of relief," Cooke said.

More than a third (36%) of Aussie homeowners said they struggled to pay their mortgage in March, according to Finder's Consumer Sentiment Tracker.

The panel now forecast that the cash rate will peak on average at 4%, with 70% of those who weighed in* (26/37) saying it will peak between April and July this year.

If the cash rate were to peak at 4%, that would mean $15k more in interest on the average home loan of $600k.

Average Aussie mortgage repayments

| Date | Cash rate | Average home loan rate* | Average monthly repayment | Average monthly increase | Average annual repayment | Average annual increase |

|---|---|---|---|---|---|---|

| Apr-22 | 0.10% | 3.45% | $2,697 | - | $32,364 | - |

| Apr-23 (full rate rise applied) | 3.60% | 6.47% | $3,788 | $1,091 | $45,456 | $13,092 |

| 4.10% (predicted peak) | 4.10% | 6.97% | $3,948 | $1,251 | $47,376 | $15,012 |

Source: Finder, RBA. *Owner-occupier variable discounted rate. Repayments based on the average loan of $601,252 (ABS data analysed by Finder).

Michael Yardney from Metropole Property Strategists felt strongly towards a pause.

"We're clearly living in uncertain times and the Reserve Bank of Australia should pause its record-breaking run of interest rate hikes in April as it assesses the effect of the 10 rises it has already delivered," Yardney said.

Shane Oliver from AMP agreed after 10 rate hikes it's now time for a pause.

"Economic data is showing increasing signs of cooling activity and peaking inflation and banking turmoil has increased the risk of a global recession," Oliver said.

House prices have fallen, but most experts believe the market has not hit rock bottom yet

Data from CoreLogic shows Australian home prices fell 8.7% in January year-on-year.

The panel forecast on average that home prices will fall a further 4% by the end of 2023 in Sydney, Brisbane, Hobart and Darwin.

Less of a decline is expected in Melbourne, Canberra, and Adelaide, with prices likely to fall by 3%, and 2% in Perth.

This would put median prices at the end of 2023 at $954,866 in Sydney, $720,808 in Melbourne, and $672,815 in Brisbane.

This is slightly lower for Hobart ($641,440), Adelaide ($628,099), Perth ($550,638), and Darwin ($480,219).

An overwhelming majority of those who weighed in* (81%, 22/27) believe it is harder now for first home buyers to get on the property market compared to January 2022.

Graham Cooke said the news is a bitter pill to swallow for many first home buyers attempting to get onto the property ladder.

"Many first home buyers are already struggling to save for a deposit, which is getting easier - but the increased repayments may mean many and will be priced out of the market without sufficient help," Cooke said.

Mala Raghavan from the University of Tasmania said rising interest rates combined with a short supply of housing stock is making it much harder for first home buyers to enter the property market.

Nicholas Frappell from ABC Refinery agreed.

"Higher rates have constrained the scope for buyers to borrow by a greater proportion than the decline in property prices since January 2022, leading to a relative decline in affordability," Frappell said.

2 in 3 experts feel negative towards housing affordability

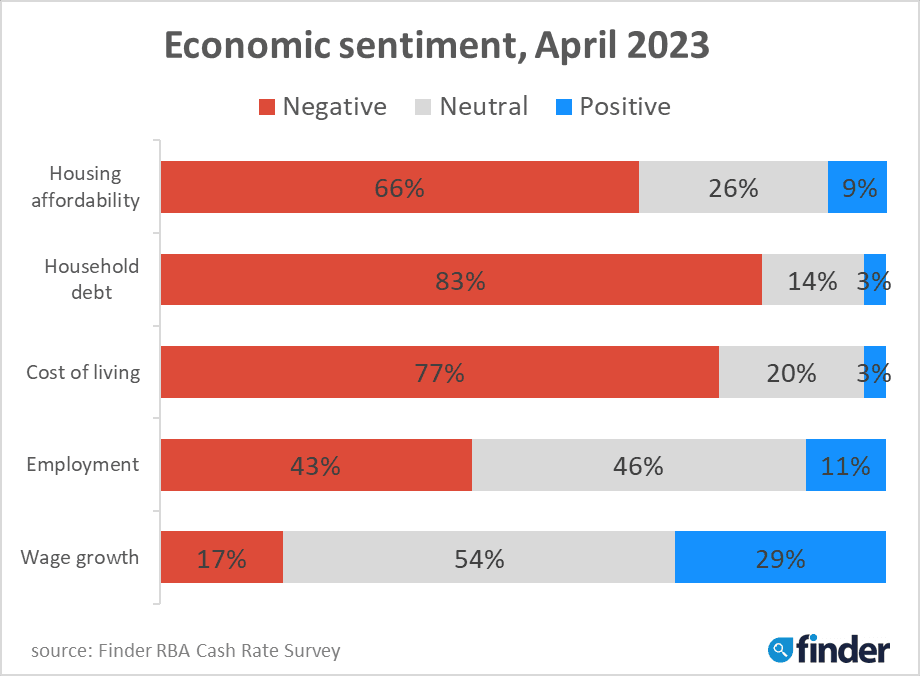

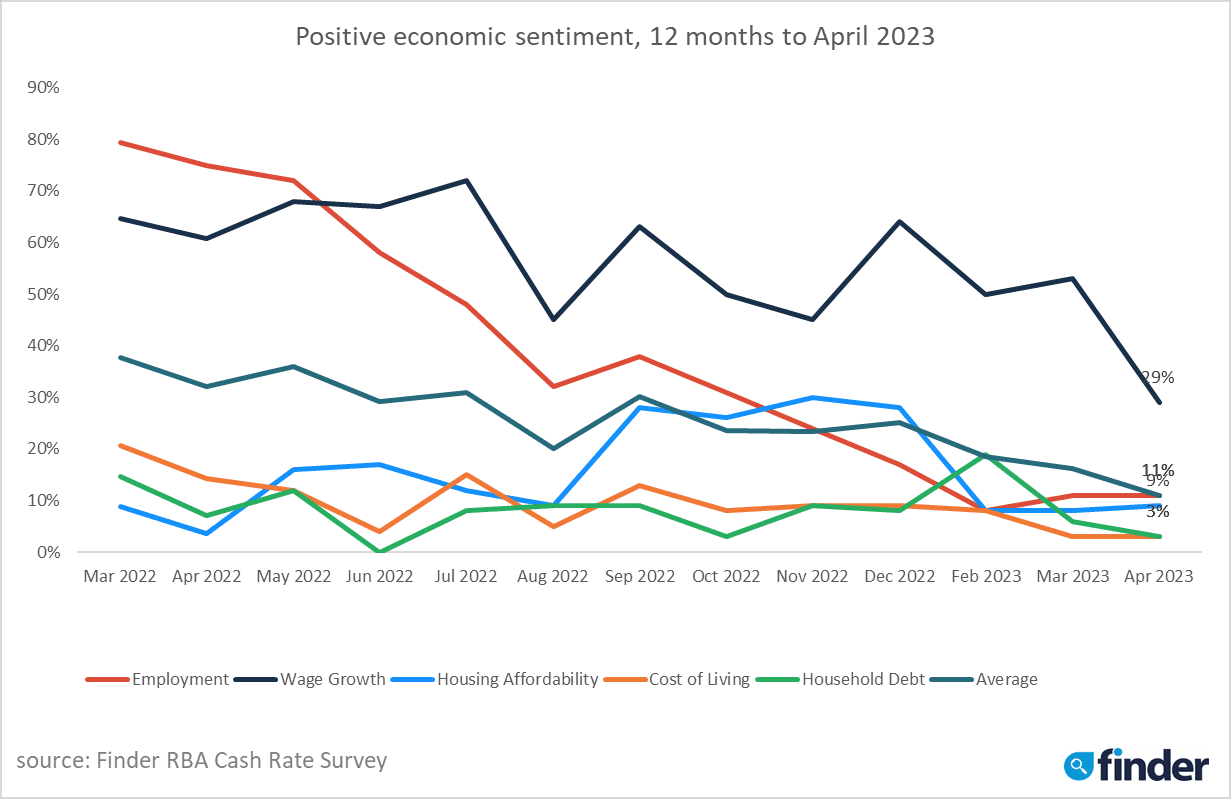

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators: housing affordability, employment, wage growth, cost of living and household debt.

Negativity towards housing affordability jumped from 53% in March to 66% in April.

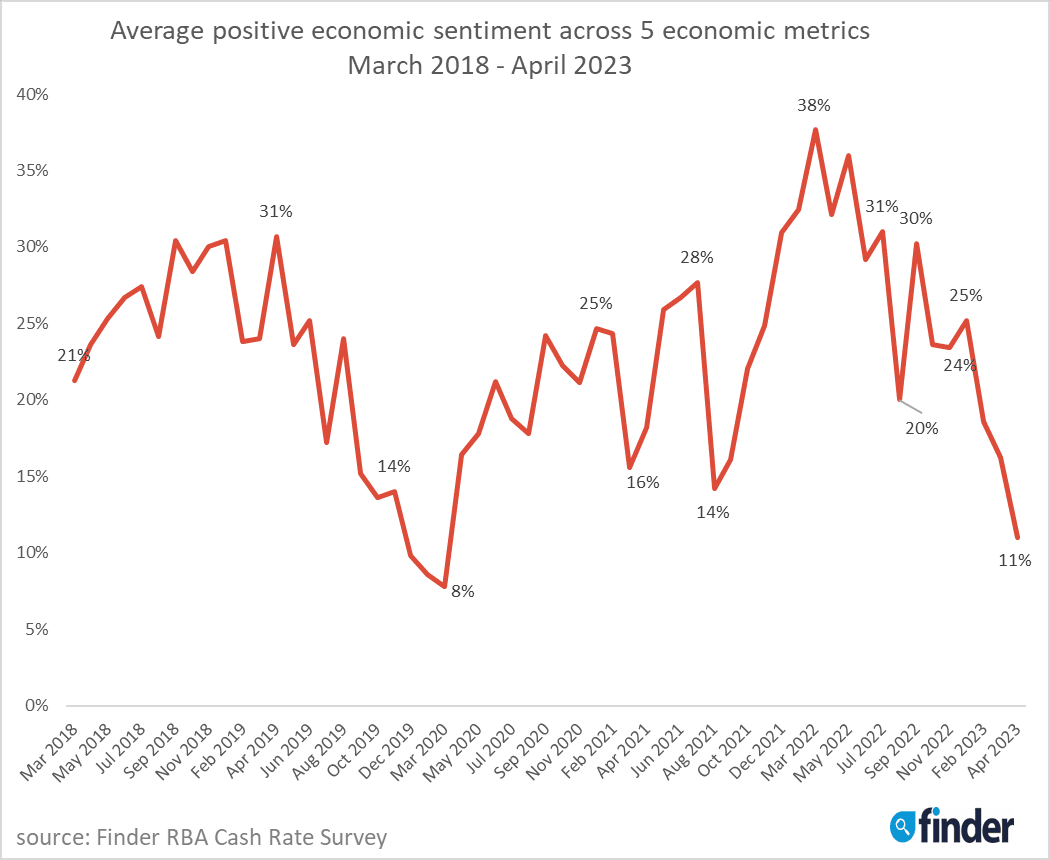

Positive economic sentiment has dropped to 11% – the lowest level since March 2020.

Finder's Consumer Sentiment Tracker revealed 44% of Australians feel somewhat or extremely negative about the prospect of affording a home – the highest it's been since November 2022.

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Anthony Waldron, Mortgage Choice (Increase): "I expect the Reserve Bank will raise the cash rate in April, joining the US Fed and other central banks around the world."

Tomasz Wozniak, University of Melbourne (Increase): "The weighted pooled forecasts from my monthly and weekly bond yield models indicate that April is likely to be the last month with increases in interest rates. The likely values for the forecasted cash rate target in April range from 3.53–3.76%. After this month, the predictions indicate a probable flattening of the cash rate level. The arrival of the new inflation data will be decisive regarding RBA's decisions in the longer horizon. My forecasts are available at https://donotdespair.github.io/cash-rate-survey-forecasts/."

Sean Langcake, BIS Oxford Economics (Increase): "At the March meeting, the RBA indicated further tightening was to come. Much has happened since then – especially in financial markets. But contagion fears have eased, and the RBA's view is that the Australian financial system is well insulated from developments overseas. Major domestic data releases have been sparse, but crucially the unemployment rate is back to 3.5%. Inflation remains too high and is still the main game when it comes to setting the cash rate."

Nalini Prasad, UNSW Sydney (Increase): "While previous increases in the cash rate are already having an effect on the economy, inflation is still high and the labour market is tight. Inflation is still a concern globally. This suggests that the RBA will tighten at its meeting on Tuesday."

Sveta Angelopoulos, RMIT (Increase): "The inflation figures are still too high, and although there is some suggestion of the economy slowing, it is still insufficient to halt the upward movement of the cash rate."

Alex Joiner, IFM Investors (Increase): "The data flow has not as yet deteriorated enough for the RBA to pause its policy tightening phase."

Andrew Wilson, My Housing Market (Increase): "10 consecutive rate rises have clearly failed to quell economic activity as forecast by the RBA with a booming economy and record low jobless, strong retail sales still rising and now capital city house prices rising again. Significantly more work for the RBA in prospect to bring inflation back to target range."

Matthew Greenwood-Nimmo, University of Melbourne (Increase): "Inflation is still too high and the RBA's priority is to bring it down and keep inflation expectations in check."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Increase): "At its last Board meeting the RBA foreshadowed that "further tightening of monetary policy would likely be required to ensure that inflation returns to target" – a softening of previous statements that "further increases'' (plural) in interest rates would be required to that end. The minutes of the last meeting included an observation that "it would be appropriate at some point to hold the cash rate steady", and that the case for doing so would be "reconsidered" at the April meeting. So it is possible that the Board may leave rates unchanged for the first time since the current tightening process began. But on balance, and noting the increases in rates by the Fed, the ECB and BoE over the past month, I suspect that the RBA Board will come to the view that the case for a "pause" at this meeting isn't sufficiently persuasive."

Brodie Haupt, WLTH (Increase): "It is almost certain the Reserve Bank will continue to increase the cash rate until the inflation begins to abate."

Angela Jackson, Impact Economics and Policy (Increase): "The RBA has a lot to weigh up this month, and the case for pausing is strong – however given actions from overseas banks, it would appear unlikely that the RBA will pause this month. Good chance however this will be the final increase for a while."

Harry Murphy Cruise, Moody's Analytics (Increase): "Inflation, though off its peak, remains bitingly high. Like a roll of twine wrapped in honey, price pressures are sticky and will take time to unwind. That will likely see the RBA push one last rate hike through the Aussie economy in April."

Stephen Miller, GSFM (Increase): "Inflation is still too high. The RBA haven't done enough to contain it."

Tim Reardon, Housing Industry Association (Increase): "Their previous statements suggest further increases. The economy remains robust, and demand for labour exceeds full employment. The lagged impact of the cash rate is obscuring the adverse impact on the wider economy."

Stella Huangfu, University of Sydney (Increase): "I expect the RBA will increase the cash rate by 25 basis points in April and then in June. The increase in June should be the last round of increasing cash rate. There is a clear sign that the economy has slowed down. The RBA does not want to take the risk of bringing the economy into a severe recession."

Mark Crosby, Monash University (Increase): "The rate decision this month is line ball, but one further rate rise before a pause is consistent with still elevated levels of inflation."

Cameron Kusher, REA Group (Increase): "Despite the banking issues in US and Europe we have seen both Central Banks and others press on with rate hikes aimed at taming inflationary pressure, I can't see why RBA would do anything other than hike again this month."

Mala Raghavan, University of Tasmania (Increase): "Though the monthly CPI indicator shows signs of slower growth in goods prices, the costs of essential items such as housing, food and non-alcoholic beverages are still way above the target rate. The ABS Living Cost Index (LCI) measures out-of-pocket living expenses incurred by Australian households. The LCI appears to be higher than the CPI and also highlights that households in the lowest wealth and income quintiles face significantly more financial stress than those in higher quintiles. Therefore, given the rising cost of living, the RBA is expected to tighten the monetary policy in April in its effort to tame inflation."

Peter Boehm, Pathfinder Consulting (Increase): "Despite what the RBA is indicating, I believe there will be one more rate rise before the bank considers a pause."

Jeffrey Sheen, Macquarie University (Increase): "After 10 cash rate increases in a row and the potential for financial system instability, the RBA needs to pause after a 25 bp rise in April. With expected lower than actual inflation, the real expected interest rate is now sufficiently positive for households and firms to assist the required disinflation. This final April increase will signal the RBA's confidence in the financial system at current rates."

Nicholas Frappell, ABC Refinery (Increase): "I think that the sudden shift in expectations around easing are overdone and that the RBA has unfinished work ahead of it."

Geoffrey Kingston, Macquarie Business School (Increase): "The Fed hiked this month, and this will probably force the RBA's hand. As the line in the David Bowie song says, it's too late to be late again."

Tim Nelson, Griffith University (Increase): "RBA will continue its tightening phase due to overarching concerns about inflation."

Stephen Halmarick, Commonwealth Bank (Increase): "One final rate hike before a pause."

Rich Harvey, Propertybuyer (Increase): "The inflation rate is still persistently high and the RBA has said it will use all means necessary to curtail aggregate demand to bring it down to imaginable levels. While the RBA cash rate is lower than other central banks around the world, the 10 successive rate rises are still yet to have full impact as many borrowers are on fixed rate loans till mid-year."

James Morley, The University of Sydney (Increase): "Despite the banking troubles internationally, the RBA is unlikely to pause just yet as they will want to do so in the context of more progress on bringing down inflation. However, the Q1 CPI release in late April may well provide some room for the RBA to pause in May, especially if international financial turmoil continues. Then I think there is some chance the RBA will start cutting in Q4, especially if there are indications of a recession through rising unemployment, weak global conditions, rising mortgage stress, and generally weak demand. It would, of course, help if the Q3 inflation data suggests many measures, including underlying, are coming down. Hence, I am suggesting the first cut would be at the November meeting when the Q3 data will be available."

A/Prof Mark Melatos, School of Economics, University of Sydney (Hold): "RBA might use recent bank instability as an excuse to pause rate hikes to get more clarity on the direction of the economy over the next couple of months. Inflation, especially the trimmed mean of the CPI, remains significantly above the RBA's target band. The RBA is still in catch-up mode with respect to matching their cash rate settings to the inflation reality. So RBA bias is still towards tightening over the rest of 2023 – unless a significant banking crisis develops."

Jakob Madsen, University of Western Australia (Hold): "RBA will be cautious to avoid any serious repercussions of higher rates."

Jason Azzopardi, Resimac (Hold): "I think we will see one more increase prior to pens down."

David Robertson, Bendigo Bank (Hold): "The RBA are well positioned to pause rate hikes in April, ahead of key inflation data to be released later next month. Recent offshore market volatility adds weight to the likelihood of a pause, but they will still need to maintain a tightening bias until inflation normalises."

Cameron Murray, University of Sydney (Hold): "Given that there are delays with the effect of interest rates, it makes sense for the RBA to wait in this new risky financial environment."

Noel Whittaker, QUT (Hold): "It's tough but I think it will hold. The minutes from their last meeting gave hints that increases might be paused this month, but added that it would depend on the prevailing circumstances at the time. I think they will pause now and increase rates next month."

Garry Barrett, University of Sydney (Hold): "I anticipate a pause to the sequence of increases to the cash rate due to uncertainty in international financial markets."

Malcolm Wood, Ord Minnett (Hold): "The RBA has tightened too aggressively, driving a domestic downturn. Inflation should turn much lower, allowing 2H23 rate cuts."

Craig Emerson, Emerson Economics (Hold): "The RBA would be wise to pause in the face of a possible financial crisis and ensuing recession in the United States and some other advanced economies."

Michael Yardney, Metropole Property Strategists (Hold): "We're clearly living in uncertain times and the Reserve Bank of Australia should pause its record-breaking run of interest rate hikes in April as it assesses the effect of the 10 rises it has already delivered. Consumer confidence has plunged to its lowest point in decades, homeowners and investors are being battered by the huge rise in their mortgage payments and business confidence is understandably low. But then the February unemployment figures indicated a robust Australian economy with the unemployment rate falling to 3.5%. On the other hand global markets have become unstable with news of UBS having to merge with international bank Credit Suisse to help it keep the doors open, along with the collapse of the Silicon Valley Bank and Signature Bank and this should tip the RBA in favour of a pause in rate hikes next month."

Evgenia Dechter, UNSW (Hold): "The RBA will consider recent developments and current data. Unemployment is still low but retail trade shows signs of slowdown. The January monthly CPI declined, if this trend is also observed in February, the RBA is likely to pause and observe."

Leanne Pilkington, Laing+Simmons (Hold): "The minutes from the March meeting indicate the RBA is considering pausing the rate rise cycle and we believe this would be the right move. People need a reprieve and in the housing market, buyers and vendors need to know where they stand with a degree of certainty."

Shane Oliver, AMP (Hold): "After 10 rate hikes in a row it's time for a pause, the RBA has said it will consider a pause at its next meeting, economic data is showing increasing signs of cooling activity and peaking inflation and banking turmoil has increased the risk of a global recession. So while it's a close call on balance we think the RBA will pause in April."

Mathew Tiller, LJ Hooker Group (Hold): "The lag between when the RBA increases rates and their full effect on the economy, signs that inflation has started to soften, uncertainty around the outlook for the global economy (including US banking issues) should all be enough reasons for the RBA to pause, take stock and evaluate the impact of the past 10 consecutive rate hikes on the economy."

Nicholas Gruen, Lateral Economics (Hold): "They have suggested they may want to pause in light of financial market instability."

Peter Munckton, Bank of Queensland (Hold): "The RBA will keep rates unchanged in April reflecting the increased uncertainty in financial markets. It will also allow them to assess the impact of the rate hikes to date."

Ask a question