- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Cash you later: Aussies ditching physical currency

- 23% of Australians don't carry cash

- Those who do hold $59.40 on average

- How to ditch your wallet

30 October, 2019, Sydney, Australia – Cash might be headed the same way as the Tasmanian tiger, according to Finder, Australia's most visited comparison site.

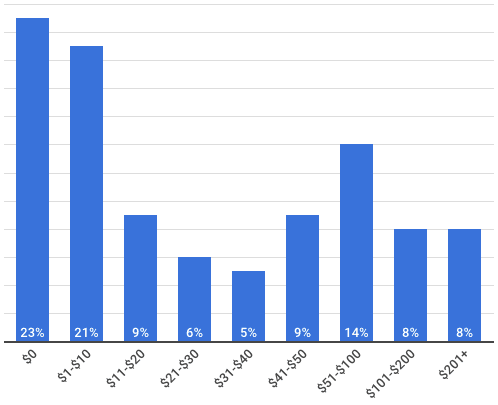

A recent survey of 1,000 respondents revealed that 23% of Aussies, equivalent to 4.4 million people, no longer carry cash.

Kate Browne, personal finance expert at Finder, said as we increasingly become a cashless society, the need for wallets may soon be non-existent.

"Cards are the new cash. With tap and pay accepted almost everywhere these days, physical currency is no longer necessary.

"Between digital wallets on smartphones and loyalty card apps, there's increasingly no need for a wallet. Eventually we'll be able to pay for everything with a smart device," she said.

However the research shows that some Aussies remain committed to carrying cash, with the average person holding $59.40 in their wallet.

Around 21% have between $1 and $10, while a further 9% carry between $11 and $20.

Millennials are twice as likely (24%) to have no cash on them as baby boomers (11%), while men generally carry twice as much as women. Males carry $74 on average compared to $44.90 for females.

RBA data1 shows ATM withdrawals are also declining nationwide, falling from 51.5 million in July 2017, to just 45.7 million in July 2019.

Browne said that although the amount of cash Aussies are carrying has dropped, many people still like to have a few coins or notes handy.

"At this stage, there are still situations where spare change doesn't go astray. We might want to grab sausage sizzle on the weekend or buy something from a cash-only business.

"But it will be interesting to see whether this is still the case in 10 years' time," she said.

1https://www.rba.gov.au/payments-and-infrastructure/resources/payments-data.html

How much cash do you have in your wallet right now?

| Generation | Average amount of money in wallet |

|---|---|

| Gen Z (under 24) | $37 |

| Gen Y (24–38) | $68 |

| Gen X (39–58) | $56 |

| Baby boomers | $70 |

Source: Finder September 2019 survey

Population breakdown

Source: Source: Finder September 2019 Survey

How to ditch your wallet

- Make sure your card and device are compatible. Most banks now offer debit and credit cards that are compatible with digital wallets. If your card isn't compatible, switch to a lender that offers the technology. Make sure your smartphone is compatible too.

- Install a digital wallet app. Once you have the right card and phone, download the relevant app (Apple Pay, Samsung Pay or Google Pay), follow the prompts and connect your card.

- Ditch your cards. If you carry a stack of loyalty cards in your wallet, you can now store them digitally rather than carrying around. Apps like Stocard and Key Ring allow users to add their loyalty cards and keep them all in one place.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel