- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA Survey: Apartment prices to drop by up to 8% by end of 2019 – November, 2018

- Experts and economists predict property values will continue to fall until end of 2019

- Positive sentiment for housing affordability remains at year-long high

- Why patient first home buyers are in the best position

5 November, 2018, Sydney, Australia – Apartment values across Australia are expected to plummet by the end of 2019, according to finder.com.au, the site that compares virtually everything.

In this month’s finder.com.au RBA cash rate survey, experts and economists were asked how much they expect property values to dip by the end of 2019. This follows last month’s prediction of 8% drops to house prices in eastern capitals by 2021.

Sydney apartments are predicted to be the hardest hit, with an 8.44% reduction pegged over the next 13 months, which would result in $59,906 being knocked off the price of the average unit.

Houses in Sydney are predicted to fare a little better, dropping by 5.81% next year, with $53,620 coming off the average value.

Percentages are similar for Melbourne, but lower property prices mean an expected $38,163 will be slashed off the city’s units, and $33,350 off its houses by the end of next year.

Graham Cooke, Insights Manager at finder.com.au, said it was surprising that property values would drop so dramatically in such a short period.

“Those in the market for an apartment face a much greater risk of losing equity compared to those buying a house, due to an oversupply of units in capital cities.

“Property on the outskirts of cities will experience a much more significant drop than those in the CBD, as demand is generally not as strong in these areas."

| City | Houses % | Houses $ | Apartments % | Apartments $ |

|---|---|---|---|---|

| Sydney | -5.81% | $53,620 | -8.44% | $59,906 |

| Melbourne | -4.60% | $33,350 | -7.13% | $38,163 |

| Brisbane | -1.33% | $7,200 | -4.42% | $17,998 |

| Perth | -2.08% | $10,417 | -3.42% | $12,983 |

Cooke said ‘rentvesters’ – people who are renting out a property they have purchased, and are simultaneously paying rent where they live – are particularly at risk, as properties in lower-priced areas have historically been hardest hit.

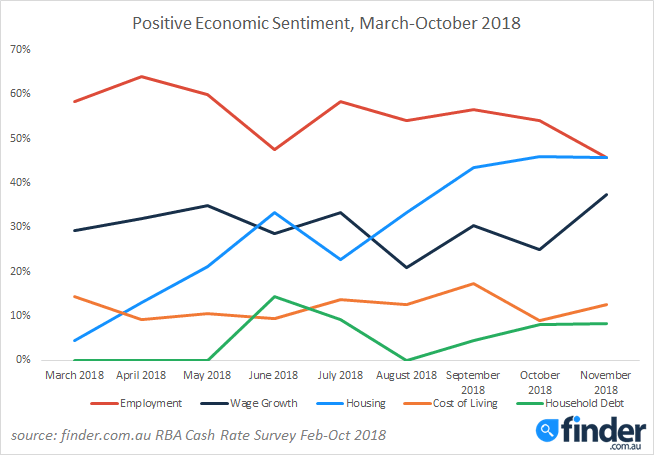

Results from finder’s Economic Sentiment Tracker, show positive economic sentiment for housing affordability this month continues to remain at a year-long high since its low point in July (up to 46% from 23% in July).

Cooke says there’s reason for optimism for first-timers looking to get on the property ladder.

“A positive to take out of all of this is that housing will get more affordable. Those who have been saving a deposit and waiting to get into the market are in the best position to make their move.

“If you’re in the market to buy now, look for value before you sign on the dotted line. It’s overwhelmingly a buyer’s market so use your bargaining power and don’t take the price guide at face value,” he said.

“As well as falling property prices, and therefore a smaller mortgage, first home buyers are spoilt for choice when it comes to home loans on offer, with historically low variable and fixed rates, alike, in market. Today, your rate should have a ‘3’ in front of it.”

Mathew Tiller from LJ Hooker said higher interest rates and tighter lending restrictions by the banks mean that Reserve Bank of Australia won’t be adjusting the cash rate soon.

“There is little chance of a change in the official cash rate in the short term, especially given the ongoing soft inflation numbers and the slowdown in the housing market," he said.

This mirrors the feelings from the entire panel where all 32 experts and economists forecasted the cash rate to be held for the 25th consecutive time on Tuesday (06/11/2018).

Seventy-eight percent of those surveyed expect the next rate change, whenever it does happen, to be an increase. This belief is consistent with the 85% who held this prediction last month.

Here’s what our experts had to say:

Alan Oster, NAB: "Still waiting to see what happens to wages and the consumer."

Alex Joiner, IFM Investors: "Inflation data for the third quarter came in slightly weaker than the market expected and decelerated again away from the bottom of the RBA’s target band. This is broadly in line with the Bank’s expectation however underscores that despite good economic growth the inflationary pulse in the economy is weak. In the absence of either a material pick up in wage growth and inflation the RBA simply has no reason to alter its currently policy path."

Alison Booth, ANU: "The fundamentals have not yet altered enough to warrant any change."

Brian Parker, Sunsuper: "Enough downside risks to the economic outlook and to inflation to keep RBA on hold."

Christine Williams, Smarter Property Investing: "Employment has reduced slightly. Housing pricing has slowed and or reduced slightly from an investor perspective. My opinion due to the impact of stamp duty payable for investor purchases."

Clement Tisdell, UQ-School of Economics: "No major changes in the economy that would warrant a change. These days, this rate is more a signalling device than anything else."

Dr Andrew Wilson, My Housing Market: "Drums are beating louder for a cut but RBA have somewhat painted themselves into a corner with recent consistent statements that next move likely to be up. Ordinary inflation data, unions marching in the streets demanding higher wages, stock market crumbling and housing markets tanking. If the next wages index remains benign then a louder cut chorus will be heard - clock ticking.”

Geordan Murray, HIA: "Inflationary pressures are still below the target band and there is still excess capacity in the labour market, so rates are likely to be left on hold. It will be interesting to see what the RBA make the latest update to the labour force figures which showed the national unemployment rate dropped to 5.0 per cent, with rates in NSW and Victoria are 4.4 and 4.5 per cent, respectively. Housing credit growth is continuing to slow and home prices in Sydney and Melbourne are easing, it will be interesting to see what the RBA makes of these developments in the context of their earlier concerns about the risks posed by these two markets."

Janu Chan, St.George Bank: "Low inflation and slow wage growth continue to point to scope for the RBA to leave the cash rate on hold."

John Caelli, ME: "The RBA are still looking for further falls in unemployment and higher inflation. Current settings are considered appropriate to support this."

John Hewson, ANU: "Uncertain data - economy slowing."

Jonathan Chancellor, Property Observer: "We are only starting to see serious shocks in the property market. And if it escalates the accompanying uncertainly will trigger a drag on the wider economy too. The RBA will be watching closely. Its prior modelling found increases in uncertainty can trigger a downturn characterised by lower employment growth, weaker retail sales growth, and a fall in consumer confidence."

Jordan Eliseo, ABC Bullion: "When assessing the economy as a whole, its a mixed scorecard for the RBA. They will be pleased with recent developments in the labour market, though persistently low inflation, and continued falls in the housing market are obvious areas of concern. On balance, there is no immediate case to move rates in either direction, hence the likelihood that they'll remain stuck at 1.5%."

Leanne Pilkington, Laing+Simmons: "We can’t see any reason for a Cup Day surprise this year. The subdued housing market, particularly the major markets of Sydney and Melbourne, combined with a weak inflation rate beneath the target range should continue to keep rates low in the short to medium term."

Malcolm Wood, Baillieu: "While the RBA is bullish on growth, the housing downturn and inflation below target will lead them to leave rates on hold."

Marcel Thieliant, Capital Economics: "While the unemployment rate is now close to the RBA's estimate of the natural unemployment, the RBA will want to see more evidence that wage growth is picking up. What's more, the RBA will want to see how the housing downturn is affecting consumer spending, to what extent the Royal Commission is restraining credit growth, and whether the trade war is restraining export growth."

Mark Brimble, Griffith Uni: "The economy remains delicately poised. With increasing fuel prices and lending rates, credit availability declining and asset prices easing, both sentiment and activity are vulnerable."

Mark Crosby, Monash University: "The RBA has signalled it will be holding rates steady this year and into early 2019."

Mathew Tiller, LJ Hooker: "There was no discernible change in domestic economic indicators over the past month, ensuring that the RBA will hold the cash rate steady in November. A number of global economic developments may yet have an impact on the outlook for the Australian economy. That’s said, there is little chance of a change in the official cash rate in the short term, especially given the ongoing soft inflation numbers and the slowdown in the housing market; due to higher interest rates and tighter lending restrictions by the banks."

Matthew Peter, QIC: "Rising risks to the global economy, the domestic housing downturn and modest underlying inflation mean that the RBA is in no hurry to raise rates. However, a robust economy, strong employment growth and a falling unemployment rate mean that the RBA will not want to postpone normalising the cash rate indefinitely and will pull the trigger on a first rate hike in the second half of 2019."

Michael Witts, ING Bank: "The economy is unfolding as the RBA has anticipated therefore no action required by the RBA."

Michael Yardney, Metropole Property Strategists: "The RBA must be a little worried with the current crisis in consumer confidence. If anything it may want to err on the side of caution and lower rates, but it is likely to take a wait and see approach."

Nerida Conisbee, REA Group: "There has been some great economic news lately, particularly that unemployment has hit 5%. While this is the rate at which the RBA believes will kick start wages growth and inflation, this is yet to happen. As such, rates are likely to stay on hold this month."

Nicholas Gruen, Lateral Economics: "They've telegraphed it for ages."

Noel Whittaker, QUT: "No reason to raise or lower. $ is down, property prices are falling and the economy is OK."

Peter Boehm, KVB Kunlun: "There are no economic or financial reasons to move rates at this stage."

Peter Gilmore, Gateway Bank: "Although unemployment has fallen, consumer confidence will be shaken by the house price and stock market falls."

Peter Haller, Heritage Bank Limited: "There is no economic case for changing the cash rate at this point in time."

Saul Eslake, Corinna Economic Advisory: "Although most recently reported economic growth figures were 'above trend', and the unemployment rate is 5% - the level traditionally regarded as signifying 'full employment' - the above trend growth is unlikely to be sustained in the near-term, the unemployment figure was probably 'rogue', there is still a lot of spare capacity in the labour market by other measures, the RBA itself has started to 'wonder out loud' that unemployment probably needs to be lower for longer than history suggests before wages growth starts to pick up - and, most importantly of all, the latest CPI data show 'underlying' inflation still running below the RBA's target range."

Shane Oliver, AMP Capital: "The fall in the official unemployment rate to 5% helped by above trend economic growth is good news. But the slide in home prices in Sydney and Melbourne risks accelerating as banks tighten lending standards which in turn threatens consumer spending and wider economic growth and inflation and wages growth remain low. Against this backdrop, it remains appropriate for the RBA to leave rates on hold."

Stephen Koukoulas, Market Economics: "RBA is continuing to ignore its inflation target otherwise it would be cutting."

Tim Nelson, Griffith University: "RBA believes current state of monetary policy is acting to gradually reduce unemployment with inflation in check. "

Other participants: Bill Evans, Westpac.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel