As promised: we've got answers to your First Home Buyer questions

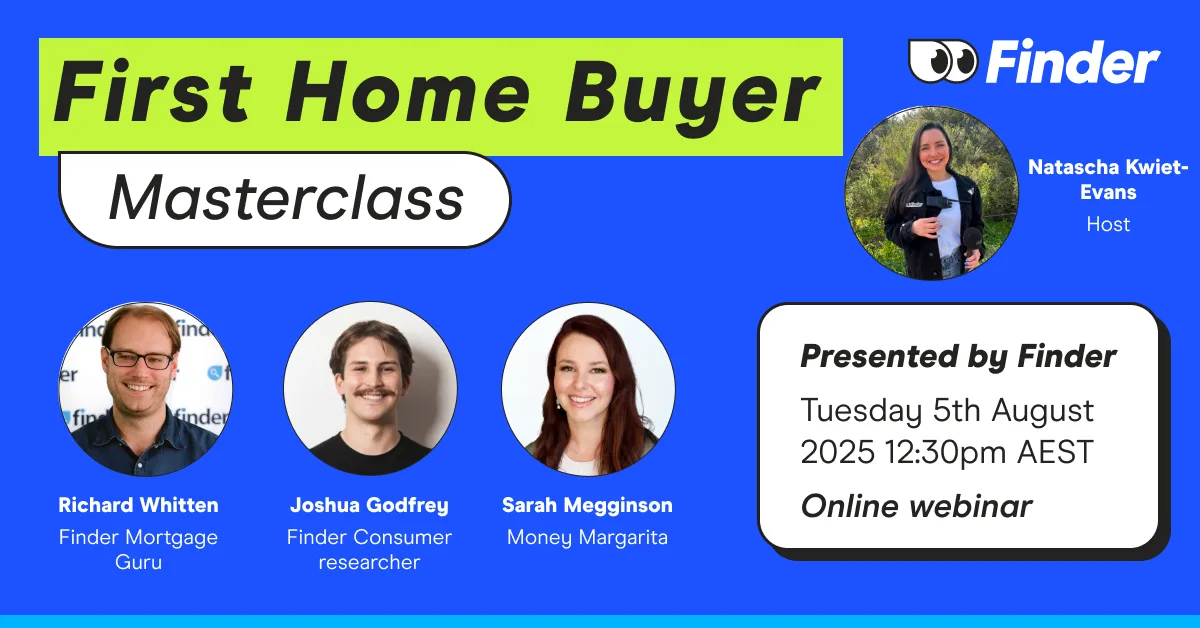

The Finder First Home Buyer Masterclass took place on Tuesday, 5 August, 2025 at 12.30pm AEST.

Our experts have pored through all of your submitted questions from Finder's First Home Buyer Masterclass this week.

Many asked similar questions, but in all, we 201 submissions. Our experts have done their best to give you a steer with general advice and resources to get you on your way.

Your free copy of the Finder First Home Buyer Report

The Finder First Home Buyer Report is packed full of juicy stats on all the habits and tactics of Australia's first time buyers.

Missed the masterclass?

No dramas. Watch the replay here.

Your questions answered

Here are all the questions attendees submitted, with detailed answers from our expert panellists.

Question: Where to begin?

- submitted by Emma, Aba, Kristy

Buying a home can seem overwhelming, especially if you're starting later in life or as a single parent. However, by breaking down the process into manageable steps, you can confidently navigate the journey to homeownership.

- Financial Health Check: The first and most crucial step is to get a clear picture of your finances. This involves:

- Budgeting and Saving: Understand your income and expenses to determine how much you can realistically save. A solid savings history is essential for loan approval. Consider using budgeting apps or tools to track your spending.

- Debt Management: Pay down or consolidate any outstanding debts like credit cards or personal loans. High debt levels can significantly impact your borrowing capacity.

- Credit Score: Check your credit score and take steps to improve it if needed. Lenders use this to assess your creditworthiness. Paying bills on time and limiting new credit applications are key.

- Saving for a Deposit: A deposit is your own money that you contribute towards the purchase of a property. While a 20% deposit is ideal to avoid Lenders Mortgage Insurance (LMI), there are government schemes that can help you buy with as little as a 2% or 5% deposit.

- Government Assistance: Research the various state and federal government initiatives available to first home buyers. These can include:

- First Home Owner Grants (FHOG): A one-off grant for eligible first home buyers purchasing a new home. The amount and eligibility criteria vary by state and territory.

- Home Guarantee Scheme: An Australian Government initiative that helps eligible buyers purchase a home with a small deposit by guaranteeing a portion of the loan. This includes the First Home Guarantee (FHG), Regional First Home Buyer Guarantee (RFHBG), and Family Home Guarantee (FHEG) for single parents.

- First Home Super Saver (FHSS) Scheme: This allows you to make voluntary contributions to your superannuation fund to save for a deposit. These contributions and their earnings can be withdrawn to help you buy your first home.

- Seek Professional Advice: Engage a mortgage broker or a financial advisor. They can assess your individual situation, help you understand the available grants and schemes, and find a suitable home loan product from a range of lenders. They are an invaluable resource throughout the process.

- Get Pre-Approval: Once your finances are in order, a lender can provide you with pre-approval. This gives you a clear idea of your borrowing limit, allowing you to search for properties within a realistic price range.

- Property Search: With pre-approval in hand, you can confidently start looking for a home that meets your needs and budget. Consider factors like location, proximity to amenities, and the property's condition.

Question: What's the minimum range for the deposit?

- submitted by Ceita, Nancy, Elle, Bhavni, Ed

The minimum deposit required for a home loan in Australia is typically 5% of the property's value. However, there are some important considerations:

- 20% Deposit (No LMI): A 20% deposit is generally considered the "gold standard." With a 20% deposit, you avoid paying Lender's Mortgage Insurance (LMI). LMI is a one-off insurance premium that protects the lender, not you, in case you default on your loan. It can be a significant cost, often thousands or even tens of thousands of dollars, and is usually added to your loan amount.

- Under 20% Deposit (With LMI): If your deposit is less than 20%, you will almost always be required to pay LMI. The amount of LMI is calculated based on the size of your deposit and the total loan amount. The smaller your deposit, the higher the LMI premium will be.

- Government Schemes (Low Deposit): The Australian Government's Home Guarantee Scheme offers a way to buy with a deposit of as little as 5% for the First Home Guarantee and Regional First Home Buyer Guarantee, or 2% for the Family Home Guarantee. Under these schemes, Housing Australia provides a guarantee to the lender, allowing you to avoid LMI. These schemes are subject to strict eligibility criteria, including income caps and property price caps.

Therefore, while the technical minimum can be as low as 2% with certain government support, a more realistic starting point for most first home buyers is 5-10%. However, aiming for a 20% deposit is the best way to reduce costs and secure more favourable loan terms.

Question: What government initiatives and assistance are available?

- submitted by Allen, Vanessa, Paul, Mitch, Amy

There is a range of government assistance available to help first home buyers in Australia. These initiatives are offered at both the federal and state/territory levels.

Federal Government Initiatives:

- Home Guarantee Scheme (HGS): This umbrella scheme includes several guarantees administered by Housing Australia:

- First Home Guarantee (FHG): Allows eligible first home buyers to purchase a home with a 5% deposit and avoid LMI.

- Regional First Home Buyer Guarantee (RFHBG): Provides the same benefits as the FHG but is specifically for buyers in eligible regional areas.

- Family Home Guarantee (FHG): Supports single parents with at least one dependent to buy a home with a deposit of as little as 2% and without paying LMI.

- First Home Super Saver (FHSS) Scheme: This scheme allows you to make voluntary contributions to your superannuation fund to save for a home deposit. It provides a tax advantage, as contributions are taxed at a lower rate than your marginal income tax. You can withdraw these savings, along with associated earnings, to use as part of your deposit.

State and Territory Government Initiatives:

- First Home Owner Grant (FHOG): A one-off payment to eligible first home buyers. The grant amount and eligibility criteria, including property value caps, vary significantly between states and territories. In most cases, the grant is for new or substantially renovated homes, not existing properties.

- Stamp Duty Concessions and Exemptions: Most states and territories offer stamp duty exemptions or concessions for first home buyers, up to a certain property value. The specific thresholds and savings differ greatly depending on where you are buying.

It's crucial to research the specific rules and eligibility criteria for the state or territory in which you plan to buy, as they can be complex and change over time.

Question: What are some reasonable steps that young adults (18-24) who are studying at uni take to ensure that they can one day buy a house whilst still ensuring they have money to maintain a healthy social life?

- submitted by Bailey, Eniola

It is possible for young adults to start their journey toward homeownership while still enjoying their social life. The key is to establish a strong financial foundation early on.

- Create a Budget: Start with a realistic budget. Understand your income and expenses, and identify areas where you can save. Allocate a specific amount for savings each month, but also set aside a reasonable amount for social activities.

- Start Saving Early: Even small, consistent contributions can grow significantly over time. Open a high-interest savings account specifically for your home deposit and automate your transfers. The First Home Super Saver (FHSS) scheme is also a powerful tool for young savers, offering a tax-effective way to boost your deposit.

- Reduce Debt: Avoid unnecessary debt. Be mindful of credit card use and student loans (HECS/HELP debt). While HECS debt is considered when assessing borrowing capacity, having a significant amount can impact the amount a lender is willing to lend.

- Explore Side Hustles or Casual Work: While studying, consider taking on a part-time job or a side hustle. The extra income can be directed straight to your savings, accelerating your deposit goal without severely impacting your social budget.

- Utilise Student Discounts and Be Savvy: Look for student discounts and deals on social activities, travel, and everyday purchases. Cook at home, pre-drink before going out, and find free activities to do with friends. Small changes can add up to big savings.

- Understand the Market: Start learning about the property market now. Follow property news, research different suburbs, and understand the factors that drive prices. This knowledge will be invaluable when you are ready to buy.

Question: Can I pay my mortgage? How is borrowing capacity determined?

- submitted by Huong, Jae, Sharon, Clarissa, Bridget, Steve

The ability to pay your mortgage is at the core of a lender's assessment. Your borrowing capacity, which determines the maximum loan amount you can get, is based on a number of factors:

- Income: Lenders will scrutinise your income, including your salary, wages, and any other regular earnings. They will want to see proof of stable employment. For self-employed individuals, you will need to provide a history of consistent income, typically through tax returns and financial statements, to demonstrate your business's viability.

- Expenses: Lenders will also assess your living expenses. They'll ask for a breakdown of your spending, including rent, utilities, food, entertainment, and other regular outgoings. It is a common mistake for first home buyers to underestimate these costs.

- Debts: All your existing debts, such as credit card limits (even if you don't use them), personal loans, and car loans, are factored into your borrowing capacity. Lenders will also consider HECS debt.

- Savings History: Lenders want to see a history of genuine savings, usually for at least three to six months. This demonstrates your ability to manage your money and make regular repayments.

- Dependents: The number of dependents you have will affect your borrowing capacity, as each dependent adds to your living expenses.

Question: Which is worth buying: owner-occupied property OR investment properties? What are the implications for first home buyer grants?

- submitted by Santhosh, Santos, Donggeon, Kenny

The choice between buying an owner-occupied property and an investment property depends entirely on your personal goals and financial situation.

- Owner-Occupied Property: This is a home you intend to live in. The primary benefit is that you are building equity in your own home, not paying rent to a landlord. Many government grants and stamp duty concessions for first home buyers are tied to the condition that the property will be your principal place of residence for a certain period of time.

- Investment Property: This is a property you buy to rent out to tenants. The goal is to generate rental income and capital growth over time.

First Home Buyer Grants and Schemes:

The vast majority of first home buyer grants, stamp duty exemptions, and the Home Guarantee Scheme are only available for owner-occupied properties. If your first home purchase is for investment purposes, you will generally not be eligible for these grants or concessions.

- Donggeon: If you buy an investment property first, you will not remain eligible for first home buyer grants or schemes later when you buy a home to live in. The definition of a "first home buyer" is someone who has never owned property in Australia. By purchasing an investment property, you lose this status.

- Kenny: Similarly, if you bought an investment property first and are now planning to buy your first home to live in, you are no longer considered a "first home buyer" in the eyes of the government and are not eligible for first home buyer discounts or assistance.

Question: What are common mistakes first home buyers make and how can I avoid them?

- submitted by Sarina, Nina, Steve, Drew, Ford, Jackson, Shree

Buying your first home is a huge decision, and mistakes can be costly. Here are some of the most common pitfalls and how to avoid them:

- The Biggest Financial Mistake: Not understanding all the costs. Many first home buyers focus solely on the deposit and loan amount, completely overlooking the "hidden costs."

- How to avoid it: Get a full breakdown of all potential costs upfront. This includes stamp duty, LMI, conveyancing fees, building and pest inspection costs, and ongoing expenses like council rates and strata fees. Create a realistic budget that includes all of these.

- Not doing due diligence on the property itself. Buyers can get caught up in the emotional side of the purchase and fail to look for potential problems.

- How to avoid it: Always get a professional building and pest inspection. These reports will highlight any structural issues, pests, or other problems that could lead to expensive repairs down the line, whether the home is new or old.

- Making an emotional offer and paying too much. In a competitive market, it's easy to get caught up in an auction or negotiation and overpay.

- How to avoid it: Do your research on recent comparable sales in the area to understand the property's true value. Determine your maximum offer before you start negotiations and stick to it. Consider working with a good buyer's agent or conveyancer to guide you through the process.

- Misunderstanding borrowing capacity. Buyers may think their borrowing capacity is what they can afford to pay back, but the bank's assessment is different.

- How to avoid it: Get pre-approval from a lender. This gives you a clear and realistic figure of what you can borrow. It's a conditional approval, so you can make offers with confidence, and it also demonstrates to sellers that you are a serious buyer.

- Not having a good offer strategy.

- How to avoid it: For private sales, work with your mortgage broker and conveyancer to structure an offer with a "subject to finance" clause and building/pest inspection. At an auction, you are bidding unconditionally, so all your due diligence must be done beforehand.

The hidden costs of a mortgage are a common pitfall for first home buyers. Beyond the principal and interest repayments, you also need to budget for:

- LMI: As discussed, this is a significant upfront cost if you have less than a 20% deposit.

- Stamp Duty: This is a state-based tax on the purchase of a property. Concessions or exemptions may be available for first home buyers.

- Legal/Conveyancing Fees: The cost of a solicitor or conveyancer to handle the legal aspects of the sale.

- Building and Pest Inspections: It is highly recommended to get these before you sign a contract.

- Ongoing Costs: Council rates, water rates, strata fees (for apartments/townhouses), building insurance, and maintenance costs.

Question: How do I realistically make sure I don't pay as much interest as house value?

- submitted by Max, Austin

This is a common concern for many borrowers, and the good news is that you can actively reduce the amount of interest you pay over the life of your home loan.

- Make Extra Repayments: The simplest and most effective way to reduce interest is to pay more than the minimum required repayment. Even small, regular extra payments can significantly shorten your loan term and save you thousands in interest.

- Use an Offset Account or Redraw Facility:

- Offset Account: This is a transaction account linked to your home loan. The balance in this account is "offset" against your loan balance, and you only pay interest on the difference. For example, if you have a $500,000 loan and $50,000 in your offset account, you only pay interest on $450,000.

- Redraw Facility: This allows you to make extra repayments into your loan and then "redraw" those funds if you need them later. This also helps reduce the interest you pay.

- Choose a Shorter Loan Term: While a longer loan term (e.g., 30 years) means lower minimum repayments, it also means you pay more interest overall. If your budget allows, consider a 25-year or even 20-year loan term. You'll pay more each month but repay the loan faster.

- Refinance to a Lower Rate: Regularly review your home loan interest rate. If you see a better deal from another lender, consider refinancing. The savings from a lower interest rate can be substantial over time.

Question: Is now a good time to buy? Do I wait and hope prices drop? Is it out of reach to buy?

- submitted by Kylie, Hon, Cory, Dave

This is a question on the mind of many potential home buyers, and there is no single right answer.

- The "Good Time to Buy" is Personal: The best time to buy is when your personal financial situation is strong enough to support a mortgage. This means having a stable income, a solid savings history, and a realistic budget. Trying to time the market is incredibly difficult.

- Waiting for Prices to Drop is a Gamble: While property prices can fluctuate, they have a long history of increasing over time. Waiting for a "crash" could mean missing out on a purchase and finding that prices have continued to rise, pushing your goal further out of reach. If you are financially ready, buying sooner allows you to start building equity and stop paying rent.

- "Out of Reach" is a Matter of Perspective and Strategy: It's true that property prices, particularly in major cities, are very high. However, there are strategies to make homeownership more accessible:

- Consider Regional Areas: Prices are often significantly lower in regional centres, and the lifestyle can be appealing.

- Look at Different Property Types: Apartments or townhouses can be a more affordable entry point than a detached house.

- Use Government Schemes: The various government grants and guarantees are specifically designed to make homeownership more accessible in this climate.

Ultimately, instead of trying to time the market, focus on getting your own finances in order and making a purchase that you can comfortably afford in the long term.

Question: Fixed rate or variable home loan, which is the best option for a first home buyer?

- submitted by Adrian

The choice between a fixed and variable rate loan depends on your financial risk tolerance and personal circumstances.

- Fixed Rate Loan: A fixed rate means your interest rate and repayments are locked in for a set period, typically 1 to 5 years.

- Pros: Certainty and predictability. Your repayments will not change, making budgeting easy and providing peace of mind against rising interest rates.

- Cons: Less flexibility. You may be limited in how many extra repayments you can make, and there are often significant break fees if you want to pay off the loan early or refinance. If interest rates fall, you won't benefit.

- Variable Rate Loan: A variable rate can change at any time, usually in response to the Reserve Bank of Australia's cash rate.

- Pros: Flexibility. You can make unlimited extra repayments and often have access to features like an offset account and redraw facility. If interest rates fall, your repayments will decrease.

- Cons: Uncertainty. Your repayments can increase, making budgeting more difficult.

A popular option for first home buyers is a split loan. This involves fixing a portion of your loan to protect against rising rates while leaving the rest on a variable rate to allow for extra repayments and an offset account. This provides a balance of security and flexibility.

Question: How to strengthen my credit score and get approved for a home loan?

- submitted by Mike, Marak

Your credit score is a crucial factor in a lender's decision to approve your home loan application. Here are the key steps to improving your credit score and increasing your chances of approval:

- Get a Copy of Your Credit Report: You are entitled to a free copy of your credit report every 12 months from credit reporting agencies like Equifax, Experian, or Illion. This allows you to check for any errors and understand your current standing.

- Pay Bills on Time: This is the most important factor. Late payments are recorded on your credit report and can negatively impact your score. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce and Consolidate Debt: High debt levels, especially credit card debt, can signal financial stress to a lender. Pay down your credit cards and consider consolidating other debts into a single loan to simplify payments and potentially lower interest costs.

- Limit Credit Applications: Each time you apply for credit (e.g., a new credit card, personal loan, or phone contract), a "hard inquiry" is recorded on your credit file. Multiple inquiries in a short period can lower your score.

- Build a Savings History: Lenders want to see a history of "genuine savings." This means consistently saving money over a period of at least three to six months. This demonstrates financial discipline and your ability to manage a mortgage.

Question: What are some of the things I need to be aware of or ask when looking into the right funding options?

- submitted by Jae, Yogesh, Daniel, Emma

First of all, decide whether you're going through a bank or mortgage broker. Brokers are free (they get paid by the bank), but they can give you information and advice about structuring your loans.

- Mortgage Broker vs. Bank:

- Mortgage Broker: A broker works for you, comparing loans from multiple lenders to find the best fit for your needs. They can be particularly helpful for first home buyers who need guidance on the complex application process and available grants.

- Bank: Going directly to a bank means you are only considering their products. If you already have a relationship with a bank and they offer a competitive rate, this can be a straightforward option.

- Questions to Ask:

- Interest Rate and Fees: What is the interest rate? Is it fixed, variable, or a split loan? What are the ongoing fees, application fees, and any other charges?

- Features: What features does the loan have? Does it offer an offset account, a redraw facility, or the ability to make extra repayments?

- Government Schemes: Which government grants and schemes are you eligible for, and does this lender participate in them?

- Loan Term: What is the standard loan term, and are there options for a shorter term?

- Nature of Job and Salary: Lenders will assess the stability of your employment. Having a permanent, full-time job with a consistent salary is ideal. For those with casual, part-time, or self-employed work, you will need to provide a longer history of consistent income and may face more scrutiny. For those on a disability support pension with part-time work, your income and stability will be assessed on a case-by-case basis.

Question: What should I be doing before applying for a home loan?

- submitted by Cassie, Aba

Preparing for a home loan application is something you want to start doing around six months before applying. Here's a checklist of what to do:

- Build a Solid Savings History: Lenders want to see "genuine savings". This means you need to demonstrate a history of saving a consistent amount of money over several months.

- Review Your Spending: Lenders will scrutinise your bank statements to understand your spending habits. Reduce unnecessary spending, avoid gambling, and minimise expensive "discretionary" purchases. This demonstrates financial discipline.

- Get Your Paperwork in Order: Prepare all the required documents. This includes:

- Proof of identity (passport, driver's license).

- Proof of income (payslips, tax returns for self-employed).

- Proof of expenses (utility bills, bank statements).

- Details of any outstanding debts (credit card statements, loan contracts).

- Strengthen Your Credit Score: As mentioned, check your credit report and take steps to improve it, such as paying all bills on time and not applying for new credit.

- Understand Your Borrowing Capacity: Use online calculators and talk to a mortgage broker to get a realistic idea of how much you can afford to borrow.

Question: I'm a permanent resident applicant, should I wait for PR or apply now?

- submitted by Esther

This is a key question, as a person's residency status directly impacts their eligibility for home loans and government assistance.

- Eligibility for Home Loans: Most Australian banks will lend to non-residents or temporary visa holders, but they often require a larger deposit (e.g., 20-30%) and may charge higher interest rates. The lending criteria for these applicants are generally much stricter.

- Eligibility for Government Schemes: Almost all federal and state government first home buyer grants and schemes, including the Home Guarantee Scheme and First Home Owner Grants, require you to be an Australian citizen or a permanent resident.

It is generally advisable to wait until you have been granted permanent residency. This will give you access to a wider range of lenders and, crucially, make you eligible for the valuable government grants and concessions that are designed to help first home buyers enter the market. The financial benefits of these schemes will almost certainly outweigh the risk of waiting a little longer to secure a home loan.

Question: As a non-resident buying residential property in Sydney, what are the best investment options available today, and how could upcoming changes to taxes, grants, or foreign buyer rules in the next 2-3 years impact my purchase – especially if I become a resident?

- submitted by Luna

The landscape for non-resident property buyers in Australia is complex and subject to change.

- Investment Options:

- New Property: Non-residents are generally restricted to buying new dwellings or vacant land to build a new dwelling. Buying established residential property is usually prohibited unless you are a temporary resident.

- Apartments vs. Houses: Given the restrictions, new apartments are a common investment choice for non-residents in Sydney.

- Taxes and Fees: Non-residents typically face additional costs.

- Foreign Buyer Surcharge Stamp Duty: Most states, including NSW, levy an additional stamp duty charge for foreign buyers.

- Foreign Investment Review Board (FIRB) Fees: You will need to apply for approval from the FIRB and pay a significant application fee.

- Land Tax Surcharge: Some states also have a land tax surcharge for foreign owners.

- Impact of Future Changes:

- Taxes and Rules: The Australian government can, and does, change foreign investment rules and taxes. Any future changes could affect the profitability of your investment.

- Becoming a Resident: If you become an Australian permanent resident, you will no longer be subject to the foreign buyer surcharges and taxes from that point forward. You may also be able to claim a refund for some of the surcharges if you meet certain criteria and apply within a specified timeframe. It's crucial to get legal and financial advice to understand the specific rules and processes for your situation.

Question: I have a self-employed job. Can I still buy my first home and get a loan?

- submitted by Bartoz

Yes, it's possible for a self-employed person to get a home loan. However, the application process is often more stringent than for a salaried employee.

- Documentation: Lenders require a solid history of business performance and consistent income to assess your ability to repay the loan. You will typically need to provide:

- A minimum of two years of personal and business tax returns.

- Business Activity Statements (BAS).

- Profit and Loss statements.

- Income Stability: Lenders want to see stability in your income. If your income fluctuates, they may take a conservative approach and assess your borrowing capacity based on the lower end of your earnings.

- Mortgage Broker: Working with an experienced mortgage broker can be particularly beneficial. They specialise in "low doc" or "alt doc" loans, which are designed for self-employed individuals, and can help you present your financial situation in the best possible light to a range of lenders.

Question: If your deposit is from an inheritance or a gift, how will banks view this when assessing your loan application?

- submitted by Kay

Banks are generally open to a deposit that comes from an inheritance. However, they will still want to see that at least some of your deposit is "genuine savings". This means lenders may still require you to demonstrate a history of saving your own money, even if the inheritance covers the entire deposit. This is to prove your financial discipline and ability to make regular repayments.

Question: Is a $660,000 home loan the minimum borrowing amount now & is there still a cheaper option?

- submitted by Clarissa

No, there is absolutely no minimum home loan amount. The average home loan size in Australia right now is around $650,000, so perhaps this is where you got this figure from. The amount you borrow is determined by your borrowing capacity, which is based on your income, expenses, and a range of other factors. The amount you borrow is also determined by the price of the property you choose to purchase.

- Affordable Options: You can find properties at a lower price point, especially in regional areas, or by considering different property types like apartments or studios.

- Government Schemes: The Home Guarantee Scheme and state-based grants are designed to help people buy at a lower price point and with a smaller deposit.

- Borrowing Capacity: Your borrowing capacity is a personal figure. It is based on your own financial situation and not on a market average. A mortgage broker can help you determine what you can realistically afford to borrow.