April 2020: In this supplementary submission to the Select Committee on Fintech, we propose an amendment to the current JobKeeper Payment program that will enable high-growth Australian businesses like Finder to continue to help Australian consumers through this difficult period. Visit our government submissions hub for more Finder submissions to government consultations and inquiries.

Finder's view on the JobKeeper Payment program:

We believe jobs not only provide people with an income but that they also maintain structure and purpose in people's lives. All of these things are critical for people's physical and emotional wellbeing so we are supportive of the ambition and scale of the JobKeeper Payment program recently proposed by the Government.

However, the current design of the JobKeeper Payment program excludes a number of successful businesses that have grown rapidly through to February 2020, but have also experienced significant drops in revenue from March onwards. These businesses provide goods and services that will be crucial for supporting Australians through the difficult months ahead.

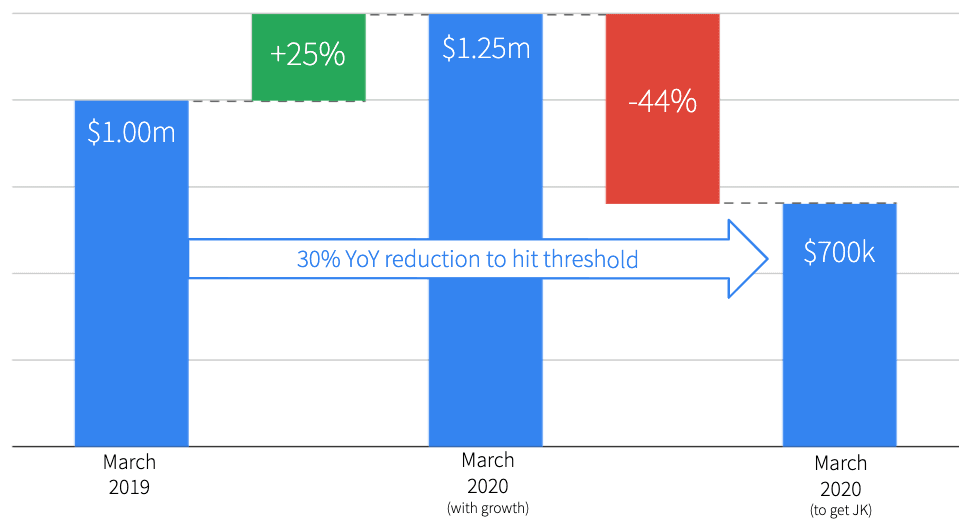

The current eligibility criteria for JobKeeper Payments states that a business' turnover needs to have fallen in recent months by 30% relative to their turnover for that period a year earlier. To

reach this threshold, turnover in a high-growth business will need to have dropped significantly more than 30%. At the same time, many high growth businesses will have made significant investments based on current monthly turnover figures and not on prior year turnover figures. As an example:

- If a business' turnover was growing by 25% year-on-year to 28 Feb 2020, that business

is likely to have invested significantly to continue this growth - If the same business is impacted by a drop in revenue related to the COVID-19, to hit the

30% reduction threshold to be eligible for JobKeepers Payments the business would

actually be looking at a 44% drop in turnover for the period (see chart below).

Current program: Current JobKeeper requirements mean that a business growing 25% year-on-year would effectively need to a 44% drop in turnover to hit the 30% threshold

Proposal: High-growth exception for the JobKeeper payment

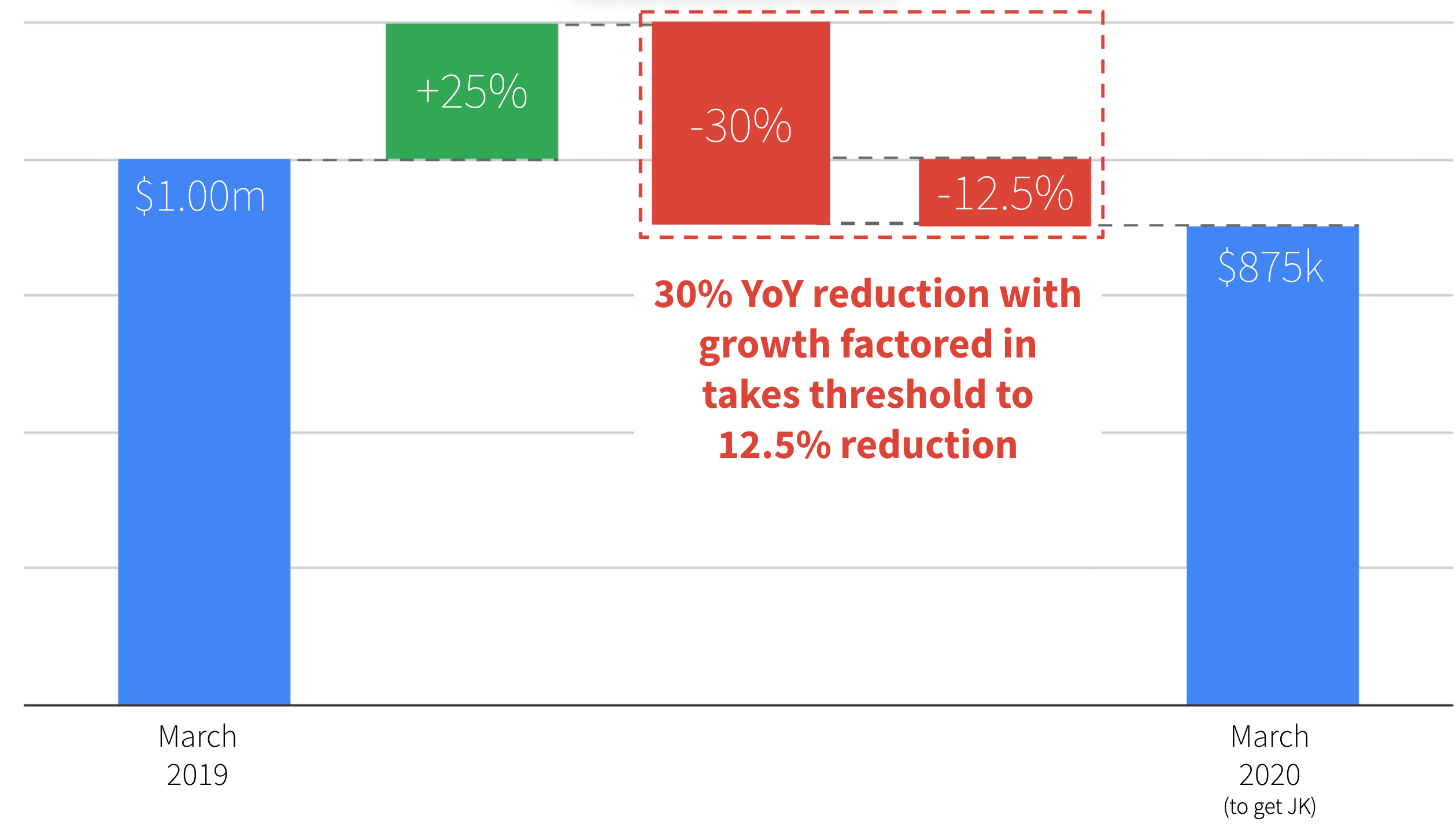

High-growth businesses are feeling the impact of the coronavirus crisis in the same way as all businesses. To enable these businesses to continue to support Australian consumers, we propose the introduction of a "high-growth exception" into the JobKeeper payment program. There are a number of ways this could be executed but we'd suggest:

- Creating a rule that defines a "high-growth business" as any Australian business that has

grown annual turnover by 25% or more in the 12 months to 28-Feb-20 compared to

turnover for 12 months to 28-Feb-19. - Using this 25% growth figure to adjust the 30% year-on-year turnover reduction

threshold for accessing JobKeeper Payments to 12.5%. - Applying this new 12.5% threshold to all businesses that meet the "high-growth

business" definition that applies for JobKeeper Payments (see chart below).

We believe an amendment like this enables the Australian Government to support our nation's high growth businesses during this difficult period. These businesses are providing hugely valuable services to Australian consumers and we believe that it is especially important to support these businesses as it will be the same high-growth businesses that will play a key role in helping the Australian economy to recover once this crisis is over.

Finder proposal: Adding a "high-growth exception" would mean businesses that have grown by >25% have an adjusted threshold of 12.5% reduction to access JobKeeper Payments

Ask a question