6 travel insurance features you might not know about (and are actually pretty cool)

Travel insurance may have more perks than you realise. Take a look at some of our favourites.

Sponsored by Freely. Customisable travel insurance from $4 a day. Download the app, tailor cover to suit you, and add extras if you need them. Peace of mind, from the palm of your hand.

Sponsored by Freely. Customisable travel insurance from $4 a day. Download the app, tailor cover to suit you, and add extras if you need them. Peace of mind, from the palm of your hand.

As someone who recently saved around $1,500 thanks to a $50 travel insurance policy, I'm still in the rosy afterglow of a good deal.

Quite honestly, I think travel insurance is one of the best things anyone can buy. It might not be the sexiest, but it's worth its weight in gold if you ever have to claim.

Despite this, many Aussies still risk it without cover. But why?

My theory is that most people aren't fully aware of the benefits included in travel insurance. They don't teach it in schools, parents don't really chat about insurance to their kids, and very few adults get enjoyment from reading insurance documents.

Well, I do. Yep, slightly embarrassing for me but great for you because I'm going to break down 6 travel insurance features which I think are actually pretty cool.

We've partnered with Freely to bring you this article, so I'll be using some specific examples from their policy, but always compare options before you commit. Okay, let's get into it.

Pre-holiday benefits

The sooner you buy travel insurance, the more value it has. Why? Because most policies actually have benefits that kick in before your holiday even starts.

Maybe you fracture your leg 3 weeks before your trip and a doctor rules you out of flying. Or maybe a natural disaster hits your holiday destination just days before you're due to fly, turning it into a no-go zone for tourists.

If you already had travel insurance, you'd be able to claim back lost expenses such as flights and accommodation. But if you'd waited until the last minute, you'd be out of luck.

Airport nightmares

Delays, cancellations, missed connections – travel insurance can help cover the unexpected costs of a waylaid trip, including accommodation and flights.

This also extends to baggage mishaps. Travel insurance will typically cover the cost to replace your luggage if it's lost in transit but it may also cover some costs if it's just delayed.

So with Freely, luggage delay benefits kick in once your bag has been delayed for just 12 hours. You could get up to $500 for underwear, socks, shoes, clothing, toiletries, non-prescription medication and even a new bag.

Plus, you can get up to $100 to pay for transport to go and pick your original bag up again, once it's been located.

Special event cover

This one's good to know if you're heading overseas for a specific and particularly important reason, such as a wedding, music festival or major sporting event.

Some travel insurance policies will come with special event cover, which essentially promises to cover the cost of alternative travel if your original plans are delayed or cancelled and you're at risk of not reaching the event on time.

Of course, this is all within reason (don't expect an insurer to charter a private jet for you), but they may pay for an entirely new flight on a different airline, if it means getting you there on time.

Rental car excess cover

If you're renting a car on holiday, you'll have to pay for insurance. But if you end up having to claim on that insurance, you'll still have to pay the excess first.

Unfortunately, that excess is usually pretty high. Some (me) might say exorbitant. For this reason, many rental car companies also offer add-on features which remove or significantly reduce the excess.

But that comes at a cost. On top of your insurance. And on top of the daily rental charge.

But here's a trick. Often, travel insurance policies will come with rental car excess cover included. If you already have it in your policy, you can sidestep the rental agency's prices.

I've even bought a travel insurance policy purely for this benefit before, when I was travelling interstate. I ended up dinging the rental car and my travel insurance stepped in, which is how I managed to save almost $1,500 from a $50 policy.

Always be absolutely certain it's covered, though. Some policies might not cover rental car excess and others may include it but ask you to opt in. For example, Freely lets users select which days they need rental vehicle insurance. It covers a raft of vehicles from motorbikes and mopeds through to mini buses and SUVs. You can also switch cover on and off while you're actually on your trip, so no stress if your plans change.

The very modest damage that landed this author with a bill of almost $1,500. Image: Nicola Middlemiss

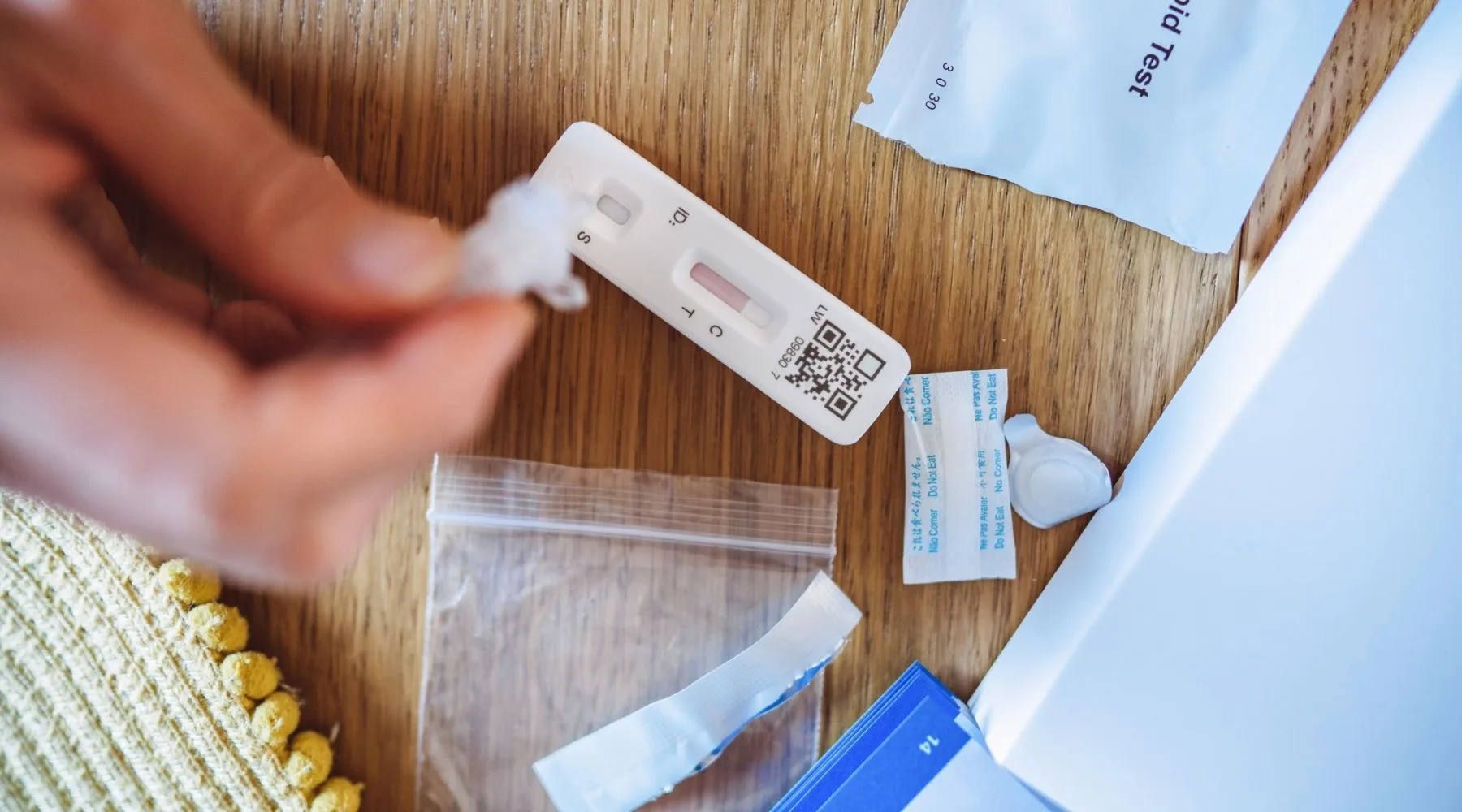

COVID-19 cover

Finally, let's talk about COVID cover. For a while there, some insurers were ruling out almost all claims related to COVID-19. Now, we're seeing some providers loosen the rules a bit.

So, for example, Freely will cover some lost costs if you're diagnosed with COVID-19 while on holiday and either have to quarantine, return home, or stay in hospital. Book more than 21 days before your trip and you'll get even more COVID-19 benefits, including reimbursements if you're a close contact and can't go on your trip.

COVID benefits do vary significantly from insurer to insurer, so always compare the product disclosure statements (PDS) carefully.

Emergency support

Obviously we all keep our fingers crossed that nothing goes seriously wrong on holiday but, if it does, your travel insurer might be able to offer valuable support or guidance.

For example, Freely's app features an SOS function which connects you to an emergency assistance team, as long as you have an internet connection and can make calls. The app also issues safety alerts during your trip which are relevant to where you are or where you're planning on going.

Take a closer look at Freely

Sponsored by Freely. Customisable travel insurance from $4 a day. Download the app, tailor cover to suit you, and add extras if you need them. Peace of mind, from the palm of your hand.

Sponsored by Freely. Customisable travel insurance from $4 a day. Download the app, tailor cover to suit you, and add extras if you need them. Peace of mind, from the palm of your hand.