Why BSV prices jumped 20% today, and the Lightning Network vulnerability explained

How the Lightning Network vulnerability works and whether it's playing into today's BSV, BCH and LTC price rises.

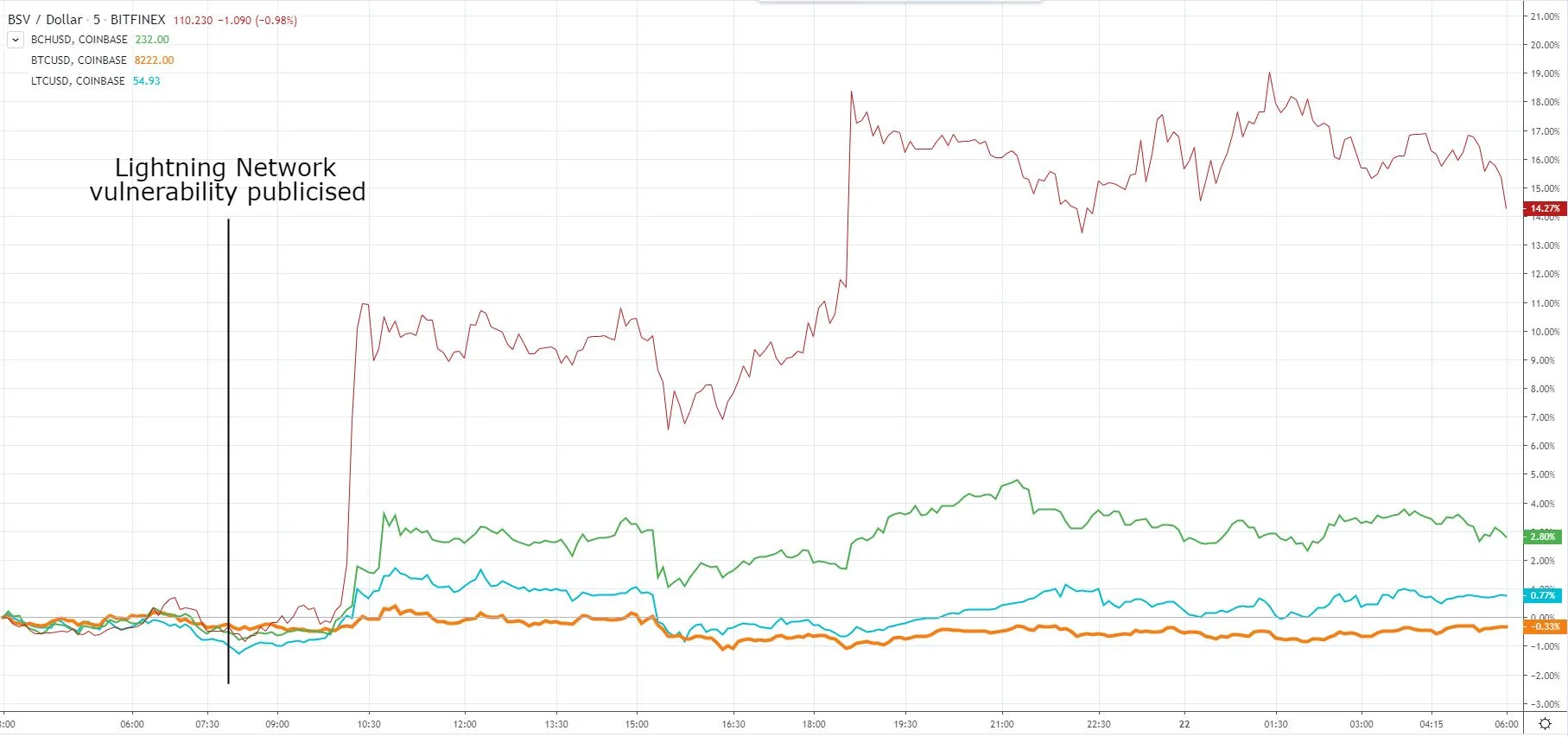

Bitcoin SV and Bitcoin Cash prices experienced a concerted jump in price today, even as Bitcoin remained steady. It happened right as CoinDesk published a story on a Bitcoin Lightning Network vulnerability.

Here's what that looks like. Bitcoin SV is the red line, Bitcoin Cash is the green line, Litecoin is blue and Bitcoin is orange.

What, why and how

Intuitively, one would expect both Bitcoin Cash and Bitcoin SV to benefit from bad Lightning Network news. The Lightning Network is being held up as the answer to Bitcoin's scaling problems, so if that fails, Bitcoin's main rivals – which use different scaling solutions – should benefit.

And with the timing matching so perfectly, it's safe to say that the vulnerability is indeed the "what" behind these price movements.

As for the why and how, intuition says the answer is market manipulation and market manipulation respectively.

But before jumping to conclusions, we should probably explore the nature of the Lightning Network vulnerability to find out whether this is a proportionate price response.

The Lightning Network vulnerability

The vulnerability is pretty cool. It's focused on the way the network routes payments.

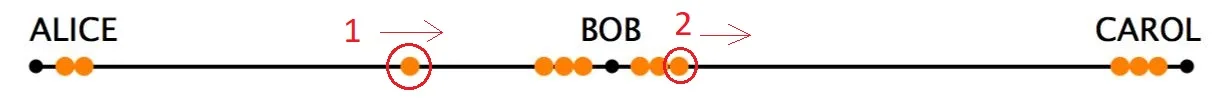

Basically, the Lightning Network (LN) uses a series of payment channels to route payments. It looks a little something like this:

Those lines between the dots are payment channels between LN nodes. When you send an LN payment, it gets passed through those lines until it reaches its destination. Sometimes it can go direct, but other times – such as if you're the node in Hawaii trying to send a payment to Australia – it will have to get passed through multiple channels to reach its destination.

But not all of those channels are made equal. The vast majority have very little capacity. Capacity, in this case, refers to how much Bitcoin is in them.

You can only send Lightning Network payments through channels with at least as much Bitcoin as you're trying to send. The way payments are passed can be visualised like so:

Source: Visualising HTLCs and the Lightning Network's Dirty Little Secret

In this example, Alice wants to send money to Carol, but doesn't have a direct payment channel with her. Bob does though, so the payment gets routed through him. Alice's money goes to Bob through the Alice-Bob channel, and then the equivalent amount gets sent from Bob to Carol on the Bob-Carol channel.

This is why payments can only be routed through channels with sufficient capacity. The system will automatically work out how to get a payment from A to B through the constraints of this system.

The way LN payments work in theory is very simple and easily understood. But the way payment routing works in real life is crazy complicated and very poorly understood for three reasons:

- Every time someone makes a payment, money moves around in the network. Channel capacity is dynamic and constantly shifting.

- Channel capacity is determined by human behaviour, and the amount of money in any channel at any given time is subject to game theory, unpredictable individual circumstances and so on.

- There are several different implementations of the Lightning Network, each of which uses its own system for choosing payment channels. Different people use different implementations, and so have their payments routed in different ways.

As a general rule though, most Lightning Network implementations will look for the cheapest routes.

This recently-publicised vulnerability is the result of someone wondering whether they could set up zero-fee payment channels to attract a lot of LN traffic and then do bad things to that traffic. The answer is yes, yes they can, and doing it is really cheap and easy.

Bad things

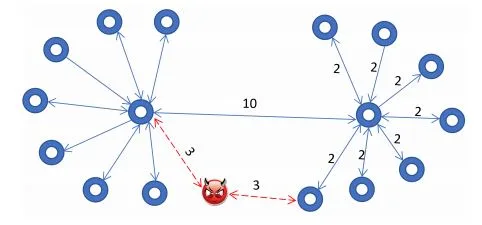

In its current form, the vast majority of channels have little to no capacity. Consequently, about 60% of all payment routes pass through just 5 nodes, while 80% pass through 10 nodes. As such, an attacker with 5 nodes may be able to draw about 65% to 75% of LN traffic through their channel.

It looks exactly like this:

Source: Hijacking Routes in Payment Channel Networks: A Predictability Tradeoff

The good news is that the attacker can't steal funds passing through their channel.

The bad news is that they can still hold it up, while attracting enough payments to functionally cripple the network. All they have to do is not send payments onwards. Doing this is quite cheap too, clocking in at just a couple thousand dollars in the network's current form.

Can it be fixed?

Bitcoin developers have floated a few ideas for a potential fix. One is to route payments in a way that prioritises older channels, to prevent attackers from simply crippling the network on demand. This could be used in tandem with a system that "bans" channels with a history of blocking payments. There are also ways for Lightning Network implementations to make the attack more expensive, the researchers note.

Opinion: Does the LN vulnerability warrant the BCH and BSV price spikes?

So, does this vulnerability warrant the BCH and BSV price spikes?

Yes and no, respectively.

This is a live vulnerability that anyone could easily start exploiting right now, to essentially paralyse the system. But it's not exactly a deathblow for the Lightning Network (although the need to pre-fund payment channels is).

BCH would be a likely beneficiary, just in the form of people looking for the next best thing for cheap transactions. This theory is supported by the similarly sensible ~2% rise experienced by Litecoin.

BSV, on the other hand, is trying way too hard here. 20%? What a drama queen.

This kind of obvious manipulation is par for course for BSV though. In the past, we've seen its prices dramatically swan around following developments like the BSV founder lodging a meaningless copyright claim and the deliberate circulation of fake news on Chinese social media.

It's not clear who's behind this pump though, and it may have nothing to do with BSV's managers. A quick visit to the official BSV trough of self-appreciation (one of its websites) finds no mention of the Lightning Network vulnerability. It doesn't appear to be pushing any kind of official narrative here.

And to be fair, the whole cryptocurrency market is riddled with manipulation, so it's kind of rude to single BSV out just because it's so illiquid about the whole thing. And no matter how you slice it, the BSV gains are real for anyone holding the stuff when it pumps.

Just make sure you wear gloves if you do, and politely say no if anyone offers you Kool-Aid.

Also watch

Disclosure: The author holds BNB and BTC at the time of writing.

Latest cryptocurrency news

Picture: Shutterstock