What you need to know about Westpac’s share capital raise

Westpac shareholders can now stock up at a discount, but is it a good bargain?

Westpac's disappointing profit report last week came as it entered a two day trading halt, announcing a $2.5 billion capital raise to cover royal commission-related costs and economic windfalls.

If you're a shareholder, this means you can now buy up extra Westpac shares for a bargain rate. Here's how it works.

The first $2 billion was allocated to institutional investors (this is complete) while $500 million is now available to regular Westpac shareholders at a discounted price, up to a maximum value of $30,000 each. The offered shares come in parcels of $1,000, $2,500, $5,000, $10,000, $15,000, $20,000, $25,000 or $30,000.

The share purchase plan (SPP) opened on Tuesday, but to be eligible you need to have been a registered Westpac shareholder by 1 November, with the offer closing at 5pm, 2 December.

Also read: How to buy Westpac shares

The discount? Eligible investors can buy additional WBC shares at $25.32 (the price offered to institutional investors) or the average price of shares in the week leading up to the SPP end date, with a 2% discount – whichever is the lower price.

But there are a couple of other factors already weighing Westpac's price. In the latest profit report, Westpac slashed its dividend for the first time since the GFC, from 94 cents to 80 cents fully franked.

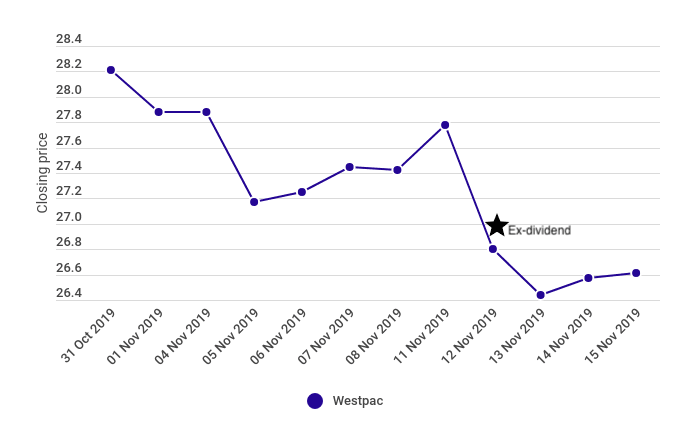

It also comes in the same week Westpac went ex-dividend, which means that shares are already running low. When a company goes ex-dividend, new shareholders will not be eligible for the next round of dividend payments, so share prices typically drop in response.

- Final dividend: 83 cents per share

- Ex-dividend date: 12 November 2019

- Final dividend payment: 12 December 2019

If you're interesting in applying for the SPP deal, you can do so directly through Westpac's Investor Center via a BPay payment or over the phone. There are no brokerage fees for the service.

Analyst's view

The share purchase plan might be a good opportunity for shareholders intending to build up their blue chips for the long haul, but there are undoubtedly headwinds – as flagged by the major banks themselves – that could weigh on profits and dividends over the next 12 to 24 months.

I spoke to a couple of analysts for their views on Westpac following the capital raising announcement. Neither was bullish on the major bank in the immediate future, though of course, it all depends on your strategy.

Sydney portfolio manager Michael Gable of Fairmont Equities said he was surprised by the capital raise, but he'd predicted the poor profit results and sold off WBC for clients before its release.

Also read: Best online share trading platforms

"My experience is that many investors are too overweight the banks and they would have been better off on a total returns basis by having some reliable growth stocks in their portfolio such as the major health care names," said Gable.

"Not only will banks find it hard to see their share prices head higher, but the dividends are under threat as well...I think any short term rally in the shares would be an opportunity to sell."

Managing Director Michael Wayne of Medallion Financial also pointed to long-term challenges facing the banking sector in FY20 due to declining margins and pressure on their wealth management arms (or lack thereof) following the royal commission.

"To compound the issues for WBC, cost pressures appear to be rising which isn’t ideal in an environment of declining revenues," said Wayne.

"One positive to come out of the result was an improved capital position. The cut to the dividend, and institutional placement and SPP has left the bank with an unquestionably strong capital position as well as a buffer for any regulatory changes and litigation that may emanate from the royal commission."

Among the major brokers, UBS has maintained a Sell rating with a target price of $24.50 while Macquarie is sitting at neutral with a price target of $26.50.

Disclaimer: This information should not be interpreted as an endorsement of futures, stocks, ETFs, options or any specific provider, service or offering. It should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks, ETFs and options trading involves substantial risk of loss and therefore are not appropriate for all investors. Past performance is not an indication of future results. Consider your own circumstances, and obtain your own advice, before making any trades.