Key takeaways

- There are 4 main ways to cover your watch, so you can look like a boss and feel at peace.

- You can get contents insurance, or standalone cover for your (awesome) timepiece.

- Portable item cover can also cover your watch outside your home, so you can look like a boss everywhere.

What is watch insurance?

Watch insurance is a type of insurance designed to protect the value of your watch by replacing it or repairing any damage. Insurance for your watch can be found in many ways, such as through home insurance, contents insurance, single item insurance or specialist watch insurance.

![]()

Contents insurance

A contents insurance policy is a type of home insurance that protects your belongings (contents within your home), including jewellery and watches. It automatically covers watches up to a certain limit. If the value of your watch exceeds this amount, you can always add more cover for specified personal effects. You might also want to add on portable contents cover so that your watch is covered outside of your home.

![]()

Home and contents insurance

Home and contents insurance is for those who own their own home and want to insure that as well as their watch. It covers your watch in the same way as above with just the contents policy, but will also include insurance for your home building too.

![]()

Single item insurance

If you don't own anything else of huge value and you want cover for your watch only, single item insurance could be the right option for you. It says it all in the name, you insure specific items only. Make sure you compare it to the cost of other insurances though since you might get better value out of a home insurance policy.

![]()

Specialised jewellery and watch insurance

There are a few insurers out there, like Q Report and JewelCover, that specialise in insuring jewellery and watches. You'll probably have to pay a little more for this specialised insurance since it also offers things like valuations of your watch and the ability to choose your own jeweller if your watch needs replacing or fixing.

Compare specialised jewellery insurance

Compare contents insurance policies for watch cover

Compare other products

We currently don't have that product, but here are others to consider:

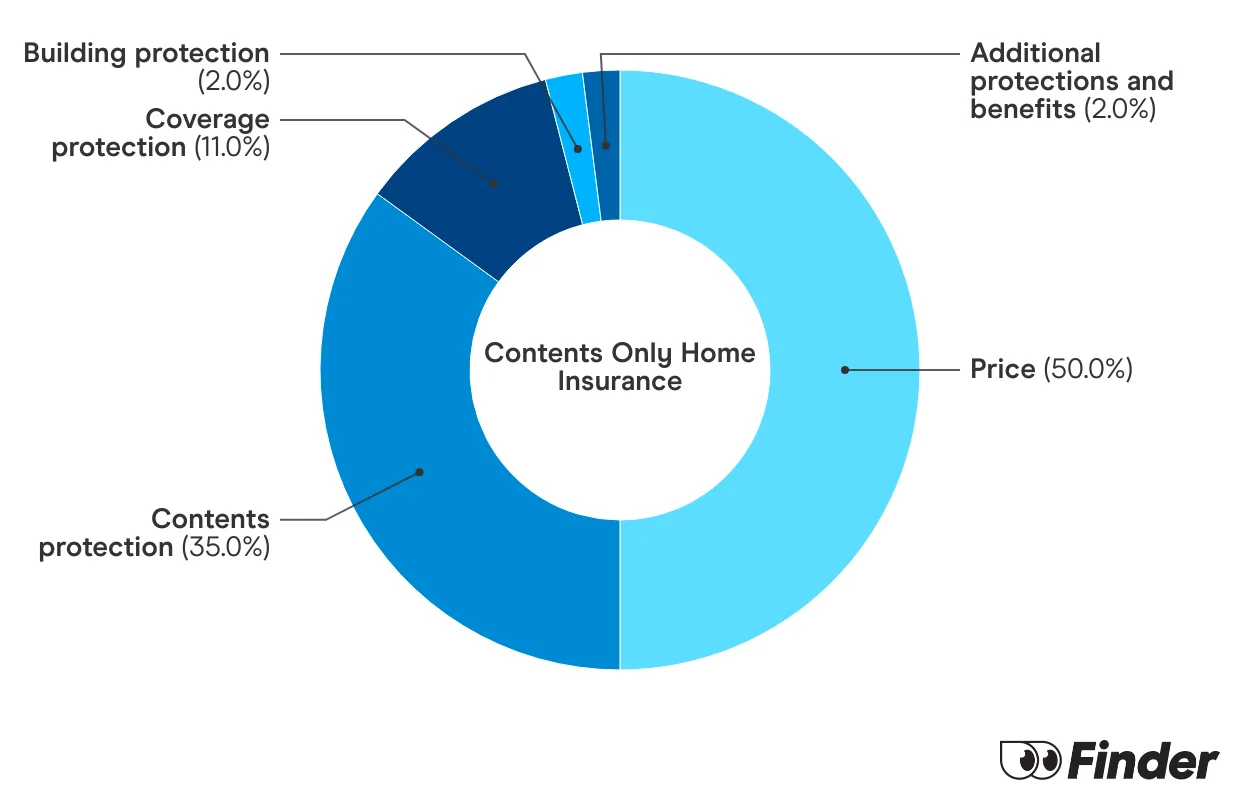

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

How much does watch insurance cost?

| Provider | Premium cost without watch | Premium cost with watch |

|---|---|---|

| $652.78 | $664.92 | |

| $598.46 | $601.46 | |

| $833.75 | $910.37 | |

| $706.44 | $710.28 |

This information is accurate as of February 2026.

How to find the right watch insurance for you

There are a lot of watch insurance options and the right fit for you will depend on how you use your watch, how expensive it is and how thoroughly you want to protect it. Here's some questions you can ask yourself to help know what level of cover might be right for you.

- Do you wear your watch outside of the home? If so, you might like to ensure you're covered for times outside of the home.

- How much is it worth? If your watch costs $30,000 for example, then a contents policy with a maximum payout of $7,000 is going to be useless to you. In this instance, you'd be better off looking at specialised insurance.

- Do you care who repairs it in the event of damage? If your watch becomes damaged to the extent that you decide to make a claim, do you mind who is assigned to repair it? If yes, you'll likely need to look into specialised insurance.

- Do you already have a home and contents policy? If yes, it's worth checking how your existing policy covers watches and seeing if you're happy with the level of cover here. There's no use taking out an additional policy if you're already covered to an appropriate extent with your existing insurer.

FAQs

Sources

Ask a question

More guides on Finder

-

Handbag insurance

Love your handbag? Handbag insurance is a good way to show it.

-

Are kitchen appliances covered by contents insurance?

Get protection for your high-value electronics and whitegoods with home and kitchen appliance insurance.

-

Art insurance

Find out the ins and outs of art insurance and what type of cover is right for you.