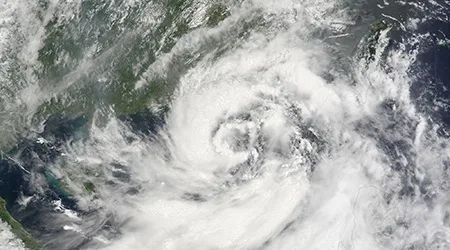

Be prepared for Typhoon Kammuri with your travel insurance

Travelling to the Philippines? The category 4 typhoon could impact your cover.

Typhoon Kammuri has killed four people and prompted authorities to close the country's largest airport in Manila due to dangerous winds and heavy rains. More than 100 flights have been cancelled and half a million people have been evacuated.

The typhoon, locally named Tisoy, made landfall on 2 December at 22:00 (UTC) in Gubat, in Sorsogon province, with wind strengths of up to 175kph. It has since hit Luzon, the country's largest and most populous island.

If you've taken out a travel insurance policy for a trip to the Philippines after 5am (AEST) 29 November 2019, you might not be covered for claims related to the typhoon. Depending on what features are in your policy, this will likely mean that any claims related to natural disasters and flight cancellations will not be covered. Some brands treat medical expenses differently and you might still be covered if you need emergency medical care because of the typhoon.

However, if you took out travel insurance before the typhoon became a "known event", you should still be covered for all of the above.

In insurance terms, a "known event" is something that any reasonable person should have knowledge of due to the media attention it receives.

Natural disasters and travel insurance

If you do purchase travel insurance after this time, it doesn't mean that your cover is worthless. You can still claim for unrelated issues like medical care as well as lost, stolen or damaged items.

At the time of publication, the following partners have released alerts regarding the typhoon. If you're not sure about your specific travel insurance policy, always contact your insurer directly for more information.

Picture: GettyImages