The one area where CommBank is shrinking

While annual profits soar to $9.9 billion, branch sizes are plunging.

Commonwealth Bank shareholders will be happy with the bank's record $9.9 billion annual profit, even if they're nervous about the long-term implications of the current money laundering scandal that's hit CommBank.

But what jumped out at me leafing through the annual results announcement was how rapidly we're leaving behind the era of branch banking and shifting to a largely digital future.

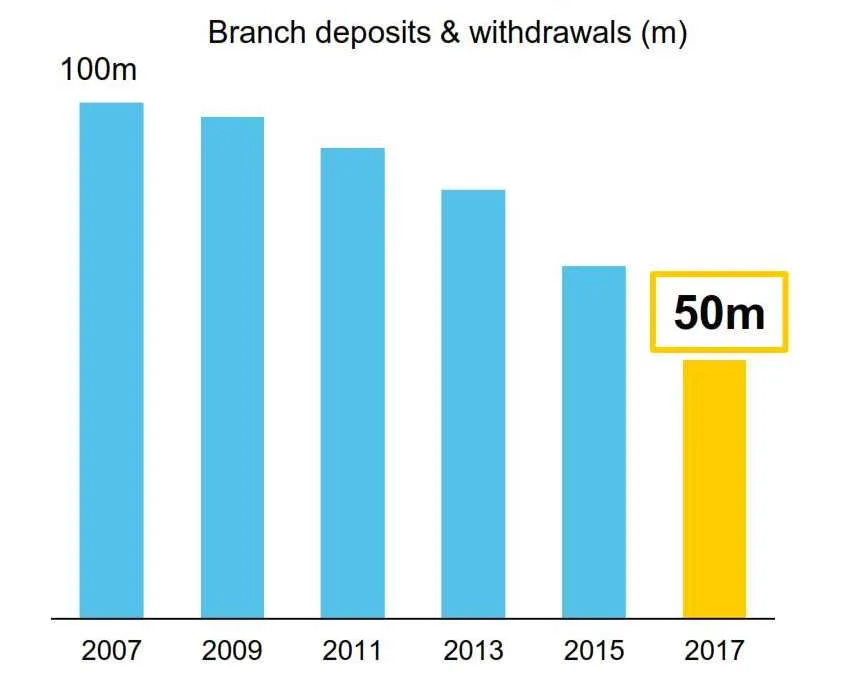

Over the last year, CommBank has achieved an overall reduction of 50% in branch space. It has rolled out 226 "new format locations", which are much smaller branches which can easily be deployed in shopping centres. Those branches don't need to be so large because the number of people going into them to make deposits has dropped markedly in recent years, as the following chart shows:

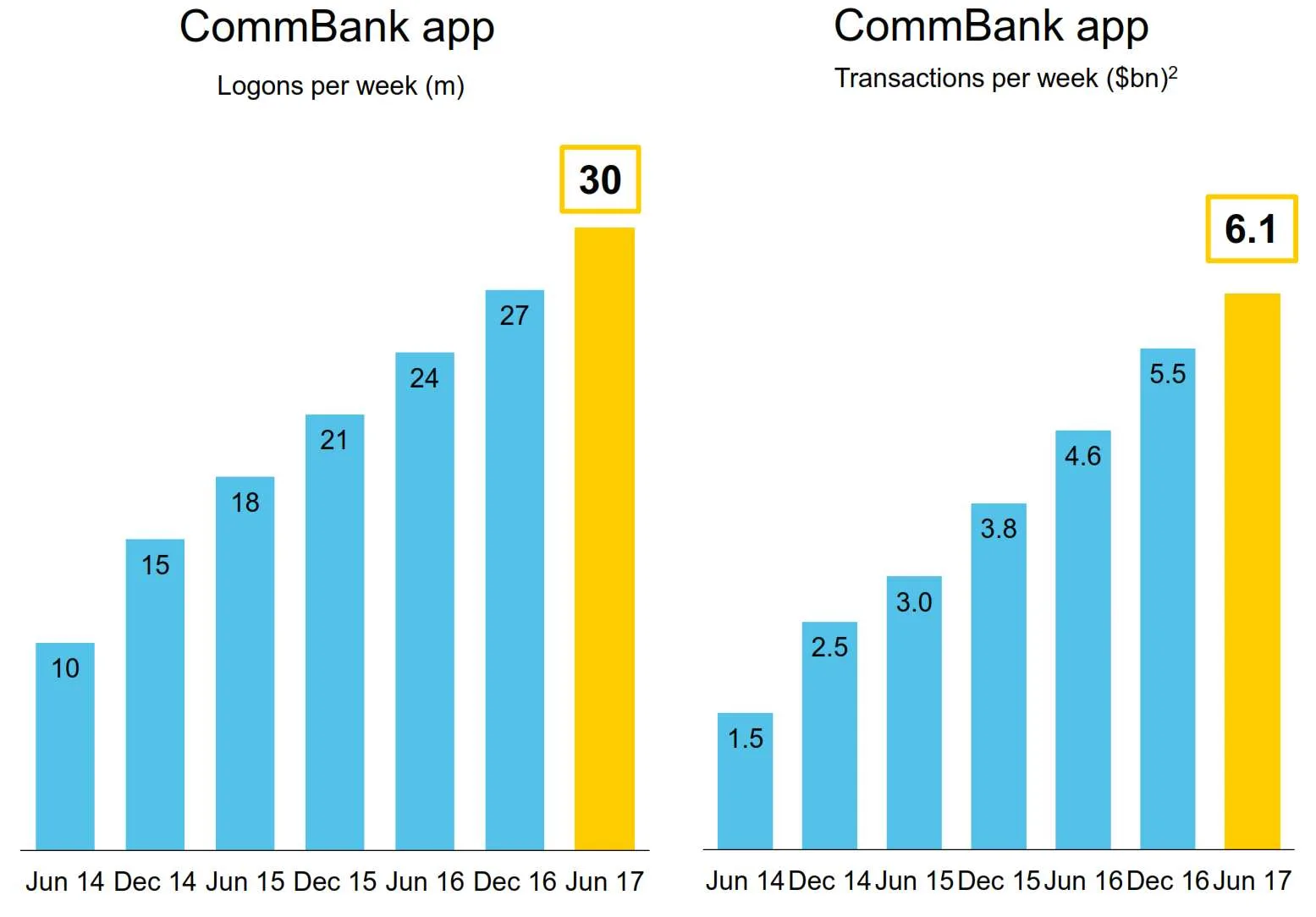

That switch has become possible because we do so much of our banking online these days. Digital transactions now account for 54% of total transaction value at CommBank, which won finder's award last year for best online banking (this year's awards are now open, by the way. There are 30 million logons to the bank's apps every week, and $6.1 billion in transactions through them.

CommBank isn't unique on this front, of course. Every one of the Big Four is scrambling to enhance its range of digital tools. ANZ boasts about its agile approach to development, while NAB worries that it's tough to measure returns on digital.

Let's have more of it, I say. I'd be happy if I never had to set foot in a branch again. We're not quite there yet, but I live in hope.

Angus Kidman's Findings column looks at new developments and research that help you save money, make wise decisions and enjoy your life more. It appears regularly on finder.com.au.

Latest news headlines

- HECS-HELP hell: Your uni debt could jump by $900+ by July

- Ordinals and runes – the new crypto craze?

- Earn up to $1,297 by investing some of your savings | Dollar Saver tip #79

- Why are there millions of dodgy cars on Australian roads?

- Shady shoppers: Petty crime escalates as Australians hit hard by cost of living crisis

Picture: Nils Versemann/Shutterstock