SHEIN

SHEIN

Extra 15% off orders over $30

Shop now and apply the code at checkout to enjoy 15% off when you spend over $30 at SHEIN. Limited time only. T&Cs apply.

Ends

Technology today has moved from a niche purchase for the wealthy and into our everyday lives. While everybody gets excited about the hottest new mobile phones or gaming consoles, the reality is that the technology that help make our lives easier is in practically everything these days, from the smartwatches we wear that help us keep fit to the laptops we use for work, and all the way through to the appliances that cook our food and wash our clothes. Here at Technology finder, we'll bring you regular news, deals and reviews for all kinds of technology, from the latest wearables, to laptops, ebook readers and digital cameras.

SHEIN

SHEIN

Extra 15% off orders over $30

Shop now and apply the code at checkout to enjoy 15% off when you spend over $30 at SHEIN. Limited time only. T&Cs apply.

Ends

The Good Guys

The Good Guys

Up to 50% off: Massive Clearance Sale

Enjoy huge discounts on home appliances, mobiles, laptops and more at The Good Guys. Hurry before they're gone. T&Cs apply.

HP

HP

Up to 40% off: Easter Sale

Save up to 40% on selected laptops, desktops, gaming & monitor at HP by using the code at checkout. Limited time offer. T&Cs, exclusions apply.

Ends

Phonebot

Phonebot

Up to 50% off mobile phones, laptops and wearables

Valid for a limited time only at Phonebot. Hurry, while stocks last. T&Cs apply.

Ends

Global Shop Direct

Global Shop Direct

5% off sitewide with code FINDER5

Use the code at checkout to get a 5% discount when you order at Global Shop Direct. T&Cs apply.

Myer

Myer

Mid Season Sale: Up to 50% fashion, beauty, home and more

Score huge discount on women's, men's & kids' clothing, homewares, toys, beauty brands, tech and more at Myer. Hurry, limited time only. T&Cs apply.

eBay Australia

eBay Australia

Up to 60% off tech

Enjoy up to 60% off mobile phones, smart cameras, accessories and more at eBay. Hurry, while stocks last. T&Cs apply.

Squarespace

Squarespace

10% off Squarespace subscription with code FINDERAU10

Apply the promo code at checkout and score 10% off Squarespace subscription. Limited time only. T&Cs apply.

Ends

Amazon

Amazon

Up to 80% off: Today's Deals

Save up to 80% on selected toys, books, appliances, beauty, health, laptops and more at Amazon. Hurry, while stocks last. T&Cs apply.

Squarespace

Squarespace

Up to 28% off annual plans

Enjoy up to 28% savings with Squarespace's annual plans. All plans come with 24/7 customer support. T&Cs apply.

Temu

Temu

30% off orders over $39 with code FINDERAU30

Apply the promo code at checkout and score 30% discount on orders over $39, capped at $25. New Users Only! Other T&Cs apply.

MyDeal

MyDeal

Up to 60% off: Price Drop Sale

Save big daily with up to 60% off selected homeware, furniture, appliances and more at MyDeal. Hurry, while stocks last. T&Cs apply.

Otterbox

Otterbox

Up to 50% off selected products

Get up to 50% off selected phone cases at Otterbox. Valid while stocks last. T&Cs apply.

Amazon

Amazon

Up to 80% off PlayStation 5 games

Get up to 80% off NBA 2K23, Dead Space, The Last Of Us, Hogwarts Legacy, Call of Duty: Modern Warfare 2 and more at Amazon. Hurry, while stocks last. T&Cs apply.

BlazeVideo

BlazeVideo

Up to 46% off Trail Camera

Enjoy huge savings on trail cameras at BlazeVideo. Valid for a limited time only. Exclusions, T&Cs apply.

Stan.

Stan.

Try Stan with a 30-day free trial

Stream Australian originals plus some of the biggest shows from around the world like Yellowstone and Breaking Bad.

Lenovo

Lenovo

Up to 55% off selected Lenovo PCs

Discounts applied at checkout. Valid for a limited time only. Exclusions, T&Cs apply.

Espresso

Espresso

$50 off espresso Display Premium Bundle

The espresso Display is the world's thinnest portable monitor, making it ideal for workers and creators on the go. Order the Premium Bundle now and get $50 off + FREE shipping on your order.

Mwave

Mwave

Up to 70% off computers, laptops and more

Score huge savings when you shop now at Mwave. Hurry, valid for a limited time only. T&Cs apply.

HP

HP

Up to 50% off refurbished laptops and desktops

Shop for refurbished laptops and desktops and enjoy up to 50% discount at Hewlett-Packard. T&Cs apply.

HostPapa

HostPapa

Up to 75% off web hosting plans

Get 75% off Start, 65% off Plus, 70% off Pro or 63% off Ultra. Hurry, valid for a limited time only. T&Cs apply.

Kogan

Kogan

$50 off + free shipping on all iPhone 15 models, for Kogan First Members

Don't miss out on this limited-time offer at Kogan. T&Cs apply.

Disney+

Disney+

Sign up to Disney+ to stream thousands of movies and shows

Watch new and classic TV and movies from Disney, Pixar, Lucasfilm, Marvel, National Geographic, 21st Century Fox, Hulu, ESPN and more from 1 streaming service.

iiNet Deals

iiNet Deals

8GB for $10 for your first 6 recharges

8GB for $10/month for the first 6 months, then $19.99/month after.

Dell

Dell

Save on clearance computers

Grab these clearance laptops, desktops, monitors and headsets at Dell while stocks last. T&Cs apply.

HP

HP

Up to 50% off selected printers

Buy any PC and enjoy 50% off selected printers. Valid for a limited time only. Exclusions, T&Cs apply.

Planet VPN

Planet VPN

Save up to 80% 3 years + 1 year promotion

Discounts applied at checkout. Valid for a limited time only. Exclusions, T&Cs apply.

Apple Store

Apple Store

Get up to $950 in credit towards your next iPhone

Out with the old and in with the new iPhone 14! Upgrade and get up to $950 in credit when you trade in your old iPhone. Exclusions, T&Cs apply.

Green Man Gaming

Green Man Gaming

Up to 90% off selected games

Enjoy 90% off selected games on Green Man Gaming. While stocks last. T&Cs apply.

PTC Shop

PTC Shop

Up to 40% off sale

Enjoy up to 40% off selected tech items from Airthings, Roccat, Satechi and more at PTC Shop. While stocks last. T&Cs apply.

Kinguin

Kinguin

3% off bestseller games and softwares

Get 3% off Mortal Kombat 11, Tom Clancy's The Division 2, Windows 10 Professional and more using this exclusive code for Kinguin. T&Cs apply.

eBay Australia

eBay Australia

20% off storewide at HP

Upgrade your home office or gaming setup with the latest tech. Apply the promo code at checkout to get your discount at eBay. Limited time only. T&Cs apply.

Ends

The Good Guys

The Good Guys

Up to 60% off electronics and home appliances

Save up to 60% on select electronics and home appliances on sale at The Good Guys. Limited time offer and while stocks last. T&Cs, exclusions apply.

Phonebot

Phonebot

$130 off + FREE shipping on Apple AirPods Pro 2nd Generation with MagSafe Charging Case

Save $130 and get FREE shipping when you order Apple AirPods Pro 2nd Generation with MagSafe Charging Case (refurbished, Grade B) at Phonebot. Limited time offer and while stocks last. T&Cs apply.

Amazon

Amazon

PlayStation 5 consoles from $769.95

Get the PlayStation 5 Digital Edition Consoles starting from $769.95 at Amazon. Hurry, while stocks last. T&Cs apply.

eBay Australia

eBay Australia

20% off Apple AirPods (2nd Gen) with Charging Case

Save $50 on Apple AirPods (2nd Gen) with Charging Case at eBay. Limited time offer and while stocks last. T&Cs apply.

eBay Australia

eBay Australia

15% off Apple AirPods (2nd Gen) with Charging Case

Save $38.22 on Apple AirPods (2nd Gen) with Charging Case at eBay. Limited time offer and while stocks last. T&Cs apply.

Amazon

Amazon

$135 off Apple AirPods Max (Sky Blue)

Save 15% on the Apple AirPods Max - Sky Blue at Amazon. Limited time offer and while stocks last. T&Cs apply.

Amazon

Amazon

$141 off Apple AirPods Max (Green)

Save 16% on the Apple AirPods Max - Green at Amazon. Limited time offer and while stocks last. T&Cs apply.

Samsung’s updated Galaxy Watch 5 matches style with improved battery life, but it’s predictably best suited for Samsung phone users.

Read more…

There's a lot to like in the Apple Watch Ultra if you’re into ultramarathons or diving into the ocean's depths.

Read more…

The Huawei Watch GT 3 SE is a lower-cost variant of the company's GT 3 smartwatch.

Read more…

Does Dreamworld still deliver a good theme park experience if you're looking for things to do on family holidays to the Gold Coast?

Read more…

These are the 8 best dash cams available online, from the best 4K option to the top model for motorcycles.

Read more…

Finding the perfect mobile phone for your needs is an important decision, but we can help make the choice easier with our mobile phone reviews.

Read more…

Our shopping experts check the price of Apple Airpods daily to find the best deals.

Read more…

We’ve rounded up the 9 best smartwatches you can get right now in Australia.

Read more…

Find out where you can pre-order the Samsung Galaxy S24 phone range in Australia right now.

Read more…![Is the Humane AI pin your next phone, or a “jumped-up brooch”? [VIDEO]](https://www.findershopping.com.au/finder-au/wp-uploads/2023/11/AngusKidmanProject_Supplied_450x250.jpg)

Will an app-free laser projecting wearable curb our smartphone addiction?

Read more…

We've found the 9 best cases to keep your brand-new iPhone 15 in pristine condition.

Read more…With its fingerprint-free chassis and USB-C (finally!), the iPhone 15 range might just be Apple's best phone yet.

Read more…

Find out all the details and an initial review on the SONOS Move 2, a newly announced portable bluetooth speaker releasing in 2023.

Read more…

Find out where you can buy the iPhone 14 outright and at lower prices.

Read more…

Find out where you can buy the Samsung Galaxy S23 phone range in Australia right now.

Read more…

As expected, Samsung's got a trio of fancy new smartphones to kickstart its 2023 smartphone strategy.

Read more…

We went hands on with Samsung's new Galaxy S23 range to determine which one is best.

Read more…

Samsung’s updated Galaxy Watch 5 matches style with improved battery life, but it’s predictably best suited for Samsung phone users.

Read more…

There's a lot to like in the Apple Watch Ultra if you’re into ultramarathons or diving into the ocean's depths.

Read more…

The Huawei Watch GT 3 SE is a lower-cost variant of the company's GT 3 smartwatch.

Read more…

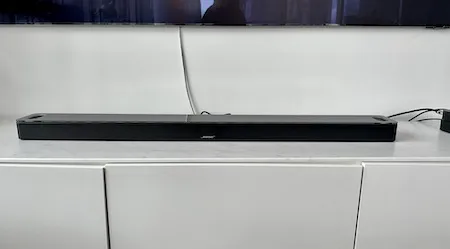

Enough bass that Nicki Minaj would be proud

Read more…

Orbic aims to deliver tech with a difference, but will it be able to make an impact in the Australian market?

Read more…

With their highest resolution crop sensor ever the Fujifilm X-H2 unlocks a world of detail once thought unobtainable by APS-C photographers and videographers.

Read more…

Bose has not-so-subtly refined its already excellent QuietComfort Earbuds with a better shape, simpler case and improved audio quality.

Read more…

Android fans will be well served by the Pixel 7, especially given its premium performance in the sub-$1,000 space.

Read more…

Here's where you can buy Google's latest flagship phone in Australia.

Read more…

Get a premium device at an affordable price tag with this eBay Samsung phone sale.

Read more…

Google's got new Pixel 7 smartphones, the new Pixel Watch (finally!) and we even got a glimpse at Google's upcoming Pixel Tablet.

Read more…Icons made by Freepik from www.flaticon.com

These are the 8 best dash cams available online, from the best 4K option to the top model for motorcycles.

These are the 9 best turntables online, from the best cheap option to the top model for beginners.

These are the best tablets for kids you can buy right now in Australia.

We compared product features and read real customer reviews to find the best alarm clocks you can buy right now.

We did the research, now here are the 6 best tripods available in Australia.

These are the 7 best cordless phones you can buy in Australia right now.

This is the best antivirus software available in Australia right now, no matter what device you need to protect.

These are the 10 best laptop stands you can get right now in Australia.

LG's gadgets this year will all feature LG's ThinQ AI for everything from driving controls to TV selections.

Optometrists are seeing rising levels of device-related damage.