What details do I need for an international money transfer?

Here’s our guide to the information you need to provide when sending or receiving an international money transfer.

Thanks to modern technology and the rise of online banking, it’s quicker and easier than ever before to send money overseas. From banks to specialist online transfer providers, there are plenty of options to choose from when you need to transfer funds across international borders.

But do you know what information you need to provide to ensure that your funds arrive in the right account straight away? This guide explains all the bank account details you need to supply to safely send or receive an international money transfer.

Sending an international money transfer online

Regardless of whether you choose to send a transfer through your Internet banking account or using a specialist online transfer company such as OFX, the details you need to provide remain the same.

You must supply:

- The recipient’s name

- The account name

- The recipient’s home address (supplying this information is optional with some providers)

- The recipient’s account number

Based on the country you are transferring funds to, you will also need to supply one of the following:

- IBAN (International bank account number)

- ABA (American Bankers Association) routing number

- Bank and branch

- IFSC (Indian Financial System Code)

- SWIFT (Society for Worldwide Interbank Financial Telecommunication) or BIC (Bank Identifier Code)

For example, the ABA routing number is used to identify banks in the United States and you will need to provide it or a SWIFT for transfers to that country, while if you’re sending a transfer to Europe you will need the IBAN and the SWIFT of the recipient’s bank. Your bank or money transfer provider will be able to provide specific information about the bank details you need to supply during the transfer process.

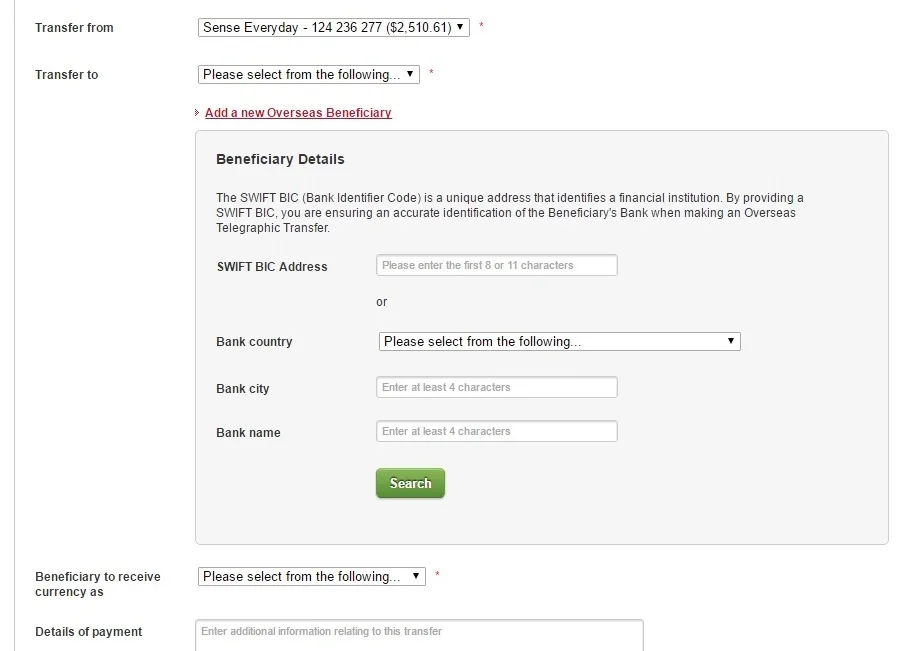

How to send money overseas with St.George

Apart from your recipient’s bank account details, you will also need to provide some specific details about the transfer, including:

- The currency you wish to send

- The amount you are sending

- The purpose of the transfer

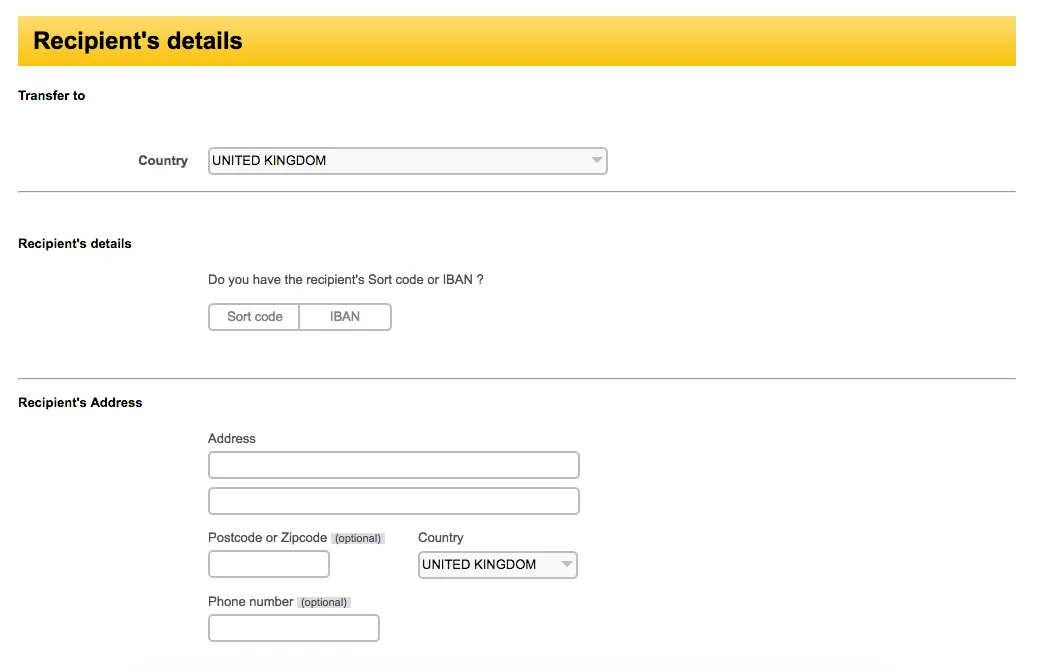

You can see what details you need from your recipient in the UK below.

How to send money with CommBank

Search and compare international money transfers

Finder survey: How many Australians have sent money abroad?

| Response | |

|---|---|

| No | 67.03% |

| Yes | 32.97% |

Sending an international cash transfer in person

This service is offered by providers such as Western Union and MoneyGram, allowing you to send fast cash transfers to hundreds of thousands of pickup locations around the world. The details you need to provide when sending a cash transfer are a little different, as you will typically need to supply:

- Photo identification for yourself (a passport or driver’s licence will do)

- Your recipient’s full name (this must match the recipient’s name as it appears on their ID)

- Your recipient’s address

- Money to complete the transaction

It’s also worth remembering that you will need to be at least 18 years of age to send a transfer overseas.

Receiving an online international money transfer

If someone wants to transfer money to you from an overseas bank account, you’ll need to make sure they have all the relevant details needed to complete the transaction. These include:

- Your name

- The name of your bank

- Your bank’s BIC/SWIFT code

- Your bank’s BSB (Bank State Branch) number

- Your account number

- Your address

IBANs are not used in Australia, but banks and transfer providers in some countries will require an IBAN to be provided before the transfer can be processed. If this is the case, you can combine your BSB and account number.

It’s also worth pointing out that you may be charged a fee by your bank for receiving an international transfer. For example, Commonwealth Bank charges customers up to $11 for transfers received into AUD accounts.

Receiving an international cash transfer

If you’re visiting a transfer provider’s branch to collect a cash transfer, you will need to provide:

- Photo ID, for example your driver’s licence or passport

- The reference number quoted to you by the person who sent the transfer

Depending on the size of the transfer, you may need to phone ahead to confirm that the agent has sufficient cash to complete the transaction. This is also useful if you need to check a branch’s location or opening hours.

Top tips for sending or receiving an international money transfer

- Check details carefully. It’s your responsibility to ensure that the bank account details you provide for your recipient are correct. If you make a mistake and the funds are sent to the wrong account, there’s no guarantee that you’ll be able to recover those funds.

- Check the exchange rate. Exchange rates vary across providers, and even a small variation in rates can make a big difference to the cost. Search for a provider that consistently offers competitive exchange rates. For example, Wise offers the mid-market exchange rate while other providers add a margin to the rate.

- Be aware of transfer fees. Make sure you’re aware of the fee the bank or money transfer provider charges for handling the transfer, and check whether the receiving bank will take a cut by imposing its own fees.

- Use a reputable brand. Make sure that any transfer provider you choose is reputable before handing over any bank details or money. The last thing you want to do is disclose your own or your recipient’s account information to a dodgy company.

Follow up questions about your documentation

What information do I need to provide when I send or receive an international money transfer via PayPal?

When sending money via PayPal, you’ll need to provide the email address or mobile phone number of your recipient, as well as the details of the bank account or credit card used to fund the transaction. As for receiving payments, you will need to provide your name, address, phone number and email address to open a free PayPal account.

Can I pay for an international money transfer using my credit card?

Yes, this option is available with some transfer providers, but typically only with companies that offer cash pickup transfers.

Will I need to sign up for an account before I send a transfer?

Yes, if using an online transfer company you will need to register for an account before you can send any money. Signing up is usually free.

Should I send a transfer via my bank or a specialist transfer company?

That’s entirely up to you. The advantage of using your bank is that it’s convenient, as you will most likely already have an account established from which you can transfer funds. However, in most cases, the better exchange rates and lower fees charged by online transfer companies mean that they are often a more affordable option.

What recipient bank account details will I need to provide when sending funds to India?

You will need to supply a SWIFT and an IFSC number for your recipient’s bank, as well as a reason for your transfer.

What recipient bank account details will I need to provide when sending funds to China?

You will need to provide a SWIFT for your recipient’s bank.

More guides on Finder

-

Best multi-currency business accounts

Your guide to the best foreign currency accounts for business, including how to open an account.

-

Opening a bank account in New Zealand

Your detailed guide to opening a bank account in NZ, including eligibility criteria and how to apply.

-

Buying a property in Japan

All the info you need to know about buying a property in Japan from Australia.

-

Buying a property in the UK

The detailed guide to buying a property in the UK as a foreigner.

-

Australian bank fees for international money transfers

Wire transfers can sometimes incur fees, but comparing your options could help you avoid these.

-

Revolut vs Wise (TransferWise)

Compare Revolut with Wise on speed and cost to see which is best for your next money transfer.

-

TorFX money transfer review

Check out our review of TorFX's fee-free money transfers.

-

Best way to transfer large amounts of money internationally

What are the best options for sending or receiving a large amount of money overseas? Read this $50,000 case study with exchange rates and fees comparison.

-

Best places to exchange currency in Sydney

Your guide to currency exchange services in Sydney, including where to find the best exchange rates and lowest fees.

-

International money transfers with cash pickups

Send an international money transfer to someone without a bank account. Get it there instantly and they can pick it up in person, in cash. Get quotes now.

Ask a Question

if sending money internationally using Telegraphic Transfer (TT) via Swift -Outward remittances, do we need to pay for activation for this type of payment? This type of payment instrument require INSURANCE PREMIUM BOND CERTIFICATRE (IBC)?

Hi Heng!

Thanks for your inquiry. The exact details of how a TT payment works are dependent on the banks involved. It would be best to refer to the money transfer service you choose before moving sending funds via wire transfer.

Hope this helps!

Best,

Nikki