Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseHow do business frequent flyer credit cards work?

A business frequent flyer credit card lets you earn points for every dollar you spend on your business. You can choose cards that earn you Qantas Points or Velocity Points.

But there are also business credit cards that let you earn rewards points and convert those to Qantas or Velocity Points. Amex Membership Rewards Points convert to either program at a rate of 2:1.

Business credit cards offer huge amounts of bonus points if you meet the spending and eligibility criteria.

Who can get a business credit card?

Business credit cards are usually designed for small to medium sized businesses, but there are also some corporate cards for larger organisations.

To apply for one of these cards, you usually need:

- To have an Australian Business Number (ABN)

- Meet a minimum annual turnover

- Be the business owner or someone authorised to apply on behalf of the business.

What's the best Qantas business credit card?

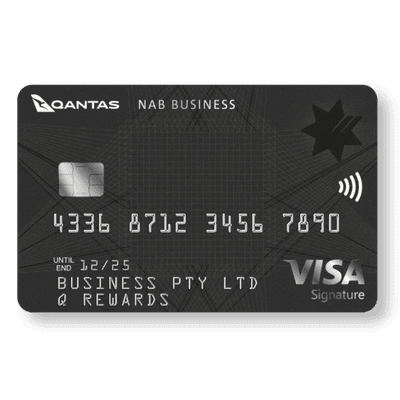

The NAB Qantas Business Signature Card won best business frequent flyer credit card and best small business frequent flyer credit card at the 2025 Finder Credit Card Awards. This was based on a detailed analysis of rates, fees, points offers, earn rates and card features across 12 months.

Best Business Frequent Flyer Credit Card: NAB Qantas Business Signature Card

The NAB Qantas Business Signature Card won the business frequent flyer award at this year's Finder Awards. It comes with a massive 200,000 bonus Qantas Points and complimentary Qantas Business Rewards membership.

Highly commended cards

- The ANZ Qantas Business Rewards credit card was highly commended in the best business frequent flyer credit card category.

- The St.George Amplify Business Credit Card and the BankSA and Bank of Melbourne Amplify Business cards were highly commended in the best business frequent flyer credit card category.

How to compare frequent flyer credit cards for your business

The first step is to figure out what points program you want to earn. That's either Qantas Points, Velocity Points or get a card that's linked to a flexible rewards program such as American Express Membership Rewards or CommBank Awards.

These reward programs usually let you transfer your points to frequent flyer program partners, such as Velocity, Singapore Airlines KrisFlyer and Emirates Skywards (although it does vary between reward programs).

Qantas business credit card options

If you want a business credit card that earns Qantas Points, there are two main options:

- Cards linked to your Qantas Frequent Flyer account. These cards are linked to your individual Qantas Frequent Flyer account, similar to most personal frequent flyer credit cards.

- Cards linked to Qantas Business Rewards. These cards earn Qantas Points through the Qantas Business Rewards program, which you can redeem for flights or transfer to any personal Qantas Frequent Flyer account. This gives you the flexibility to use Qantas Points for your business, yourself or someone else (like an employee).

How many points can I earn on my spending?

When you're comparing cards, keep in mind that an earn rate of at least 1 point per $1 is competitive. The number of points you’ll earn per $1 may also vary based on the transaction. For example, you might be able to earn 1.25 points on everyday eligible purchases and only 0.5 points per $1 spent on your ATO bill or other government transactions.

Is there a bonus points offer?

The best business frequent flyer credit cards also offer hundreds of thousands of introductory bonus points when you meet the offer requirements (you normally need to be a new customer and spend a lot in the first few months of having the card).

Business credit cards have the biggest bonus frequent flyer points offers on the market.

What is the annual fee?

Business credit cards that offer Qantas Points or other frequent flyer rewards usually have an annual fee. This can vary from $150 to $450 (or more) depending on the card.

You should make sure that your business can afford the annual fee and that the monetary value of the points and the extra perks can justify this cost.

Is it a credit card or a charge card?

When you're comparing business cards that earn frequent flyer points, you'll see both credit cards and charge cards. If you get a credit card, you'll be able to carry a balance from month to month (with interest charges) as long as you meet the minimum repayment requirements.

If you get a charge card, you have to pay it off in full each month. But you do get a set number of "cash flow days" in each statement period and won't have to pay interest on the account.

What are the extra perks?

Frequent flyer business credit cards often include other benefits, such as complimentary lounge passes or complimentary international travel insurance. You might also be able to use a complimentary concierge service for everything from booking a restaurant for a business meeting to organising a corporate trip.

Some business cards also come linked with reporting software (such as MYOB, QuickBooks and Microsoft Excel), which you can use to monitor and download your balance sheets and transaction details.

How many additional cards does the account offer?

If several of your employees require a credit card for work spending, you can request additional credit cards that are linked to the one account. This can help keep track of business spending and save time on expense-reporting. It also gives you a way to earn more points – or offer points as a perk to your employees.

Pros and cons of a business credit card with frequent flyer points

Pros

- Rewards for business spending. Unlike other business credit cards, these cards reward you for every $1 you spend on eligible purchases. You can use these rewards to cut costs on regular business expenses (such as business travel) or to reward yourself and your employees.

- Extra perks. These cards also come with extra features like lounge invitations, complimentary travel insurance and concierge services which could help justify the cost of the card.

- Access credit. These cards usually offer higher credit limits than personal cards and can help your business manage its expenses with a line of credit.

- Business reporting. You can monitor your business spending under one account and link it with business reporting systems to help simplify the way you manage your finances.

Cons

- Higher annual fees. While some business cards come with low or $0 annual fees, these cards usually come with higher annual fees.

- Liability. If you link additional cards to the account, the primary cardholder or the business will be liable for any expenses made on the supplementary cards.

- Interest charges. If you opt for a business credit card and carry a balance from month to month, you’ll likely collect high interest rates on your purchases.

How to apply for a business frequent flyer credit card

Once you’ve compared your options and decided on a card, you can apply for a frequent flyer credit card for your business online, over the phone or in a branch.

Before you begin the application, make sure that your business meets the eligibility requirements and has the necessary information:

Eligibility criteria

- Business requirements. You'll usually need to have an ABN (Australian Business Number) for your business and may need to be registered for GST. You may also need to meet an annual revenue requirement (such as $75,000 per year).

- Australian residency status. Depending on the card, you may need to be an Australian citizen or a permanent resident to apply.

- Credit history. You’ll usually need to have a good credit history with no evidence of bad debts or payment defaults.

- Age. You must be at least 18 years old to apply for a credit card in Australia.

Required documents and information

- Personal details. You’ll need to provide personal information including your full name, contact number and email address. You must also provide the details of your personal pre-tax income.

- Business details. This will include your business name, contact details, ABN and other business financial information.

- Frequent flyer account. This could be your personal frequent flyer account, or details of a business account if you're a member of Qantas Business Rewards.

Once you have completed the application, the bank or card provider will be in touch with details about the assessment process and outcome. If you're approved, you should get your card within 5-10 business days.

Want to look at other money management options for your business? Check out a wider range of business credit cards and other business banking options to find accounts that work for you.

Sources

Ask a question

28 Responses

More guides on Finder

-

Business line of credit vs a credit card

Compare line of credit loans and business credit cards to find the best fit for your business needs. Understand the pros, cons, and key differences.

-

ANNA Money Business Credit Card

Check out Finder's review of ANNA Money Business Credit Card and see if it's right for you.

-

Airwallex Corporate Credit Cards

If you’re a business owner that travels or spends overseas, Airwallex Corporate Cards give you a way to save on fees and manage employee spending. Weigh up the features and costs here.

-

Business statistics Australia

Insights and analysis on Australian businesses, from those with the biggest profits to small business owners.

-

ANNA Money business credit cards

ANNA Money’s all-in-one expense platform gives you a way to track and manage business spending, with virtual and physical cards and no foreign transaction fees.

-

Weel

Designed for businesses that want to manage all their spending from one place, Weel offers virtual cards, expense management tools and transaction insights.

-

Archa

This Australian fintech offers an alternative to traditional business credit cards, with an all-in-one spend management platform.

-

Commonwealth Bank Corporate Interest-Free Days card

If you run a medium to large business, the features of the CommBank Corporate Interest-Free Days Card could help with expense management – here's how.

-

How to accept credit card payments online

Learn how you can accept credit card payments online, compare a range of online payment solutions, including merchant accounts, payment gateways and extras such as Apple Pay acceptance.

I am disappointed with the Qantas frequent flyer programme.

I wish to utilise Kris Flyer points. Can you inform me of current best deals with credit cards AUD spent to Kris Flyer points?

Currently, I use NAB credit cards linked to Qantas frequent flyer automatically.

Presumably, I can notify NAB to cancel this agreement and use this card for conversion to Kris Flyer points?

I believe Citi Bank used to have the best conversion to Kris Flyer. Is this still the case?

Business expenditure such as tax etc and other gov. depts; can you advise best card utilisation for points accumulation using which card to pay these bills? I note that some cards have exclusion clauses for payment to gov. institutions.

Many thanks in anticipation of your reply.

David

Hi David,

Thanks for getting in touch with Finder. I’m sorry to hear about how you are disappointed with the Qantas Frequent Flyer programme.

As of this time, there aren’t any credit cards in Australia that currently directly earn Singapore Airlines KrisFlyer Miles and that includes NAB. However, many reward credit cards such as NAB allows you to earn points for your everyday spending, which you can then transfer to your KrisFlyer account (or to another partnered frequent flyer program). With this option, you usually need to earn a minimum number of credit card reward points before you can redeem them for KrisFlyer Miles.

With this in mind, what you can do is notify NAB that you want to earn reward points instead. When you have enough reward points, then you can convert them into KrisFlyer Miles points.

Citibank allows you to get 1 KrisFlyer mile for every 1.5 Citi Reward points. However, you would first need to check with your provider to confirm since this may change from time to time.

As of now, American Express gives you a 1:1 transfer ratio from American Express reward points to KrisFlyer miles. You may also refer to our list of Singapore Airlines credit cards to know the other banks and how much points they give for 1 Krisflyer miles point. Please read details under the subheading, “Which banks can transfer rewards points to Singapore KrisFlyer Miles?”

It is worth noting though that many rewards programs exclude utility payments and government charges from earning points, or offer a reduced rate of points for these types of payments. To help you, see our guide about paying bills with a credit card to know each provider with reward programs that let you earn reward points for most everyday purchases as well as the types of transactions that are not eligible for earning points.

I hope this helps. Should you have further questions, please don’t hesitate to reach out again.

Have a wonderful day!

Cheers,

Joshua

I am looking for an uncapped card that gives me the best redemption rate for qantas points, where I can spend $60,000 plus per month and I don’t want American Express. Can you advise which is the best at the moment, also with sign on points?

Hi Mark!

Thanks for the comment.

You can read more about how to earn uncapped rewards points and get a detailed comparison review of the cards that may meet your preferences. Select the “Go to Site” button to proceed with your application of your chosen card issuer.

Take note that if you need information beyond this page or the status of your application, you need to contact the bank for further advise.

Hope this helps.

Cheers,

Jonathan

Can you advise the best business credit card, i want to just pay my quarterly BAs with this card. I have been told you can accuse Qantas points from these payments?

Hi Sam,

Thanks for your question.

You can check our article about earning points when paying taxes. You’ll be able to compare business credit cards that let you earn rewards and Qantas points when you pay to the ATO.

Cheers,

Anndy

Is Amex the only business card to offer points on Govt dept purchase (i.e. RTA), currently 0.5 per dollar sent but going to 0.25 per $ from July 1.

Thanks

Hi Mark,

Thanks for your inquiry.

That is correct. You may also refer to our guide to compare credit cards that have rewards points earnings and allow payments to the ATO and see points per $1 for government charges.

Cheers,

Jonathan

which frequent flyer cards are not capped at present (2015)

Thanks

Hi Simon,

Thanks for your question.

You can compare and apply by reading through uncapped frequent flyer credit cards.

I hope this will help.

Thanks,

Elizabeth