Compare hospital insurance

Prices are based on a $750 excess for a single person earning less than $101,000 and living in Sydney. Your own cost will differ.Key takeaways

- The cheapest hospital cover can be found from around $18 a week.

- There are cheap policies that let you avoid the Medicare Levy Surcharge.

- There are 4 tiers of hospital coverage: basic, bronze, silver and gold.

Main benefits of hospital cover

Tax benefits

There can be tax benefits if you earn over $101k as a single person or $202k as a couple. You can avoid paying the Medicare levy surcharge with a basic hospital policy.

It's cheaper to buy by age 31

The Lifetime Health Cover loading is a penalty that applies to anyone who takes out private health insurance after their 31st birthday. The loading increases by 2% for every year you don't have hospital insurance.

Shorter waiting times

Elective surgery waiting times are typically much shorter than public hospitals. Keep in mind though that you'll have to wait 12 months if your condition is pre-existing.

You get your choice of doctor

You often get to choose your own doctor, when you're treated and your own room in a private hospital, where possible.

Ambulance cover

Medicare doesn't cover ambulance transport, except in Tasmania and Queensland. A basic hospital policy can cover you though. There are also ambulance-only policies from $1.50 a week.

How does hospital cover work?

If you receive an in-hospital service as a private patient, Medicare typically covers 75% of the Medicare Benefits Schedule (MBS) fee. Your private health cover will pay the remaining 25%.

However, a doctor or specialist won't always stick to the MBS fee set by the government as a fair fee for a service or treatment. In this case, you'd have to pay an out-of-pocket fee known as "the gap".

Some insurers have deals with healthcare providers that mean all or some of the gap is covered by your health fund.

Hospital cover only helps with items that are on the MBS. If the treatment you want isn't on the MBS, you won't get help from private hospital cover.

- Extras only: $44

- Basic: $105

- Bronze: $152

- Silver: $179

- Gold: $260

What are the hospital health insurance tiers?

Each of the different health insurance tiers has to cover a standardised set of treatments. Here's a quick summary of each tier.Gold hospital cover

Gold-tier hospital insurance covers all 38 treatments outlined by the Australian government. This includes treatments like joint replacements, pregnancy and insulin pumps, as well as all services covered by Silver-tier policies.

Silver hospital cover

Silver-tier hospital insurance covers at least 26 treatments outlined by the Australian government. This includes treatments like dental surgery, lung and chest, and podiatric surgery, as well as all services covered by Bronze-tier policies.

Bronze hospital cover

Bronze-tier hospital insurance covers at least 18 treatments outlined by the Australian government. This includes treatments like joint reconstructions, gynaecology, and ear, nose and throat, as well as all services covered by Basic-tier policies.Basic hospital cover

Basic-tier hospital insurance isn't required to fully cover any treatments outlined by the Australian government, but it does need to have restricted cover for rehabilitation, hospital psychiatric services and palliative care. Generally, Basic cover is primarily used to avoid the Medicare Levy Surcharge and Lifetime Health Cover loading.

*Average prices updated February 2026, in line with Finder's database of health insurance policies. Prices are based on a single individual with less than $101,000 income and living in Sydney with a $750 excess.

Hospital health insurance and tax (the MLS and LHC)

There are 2 different government schemes that may cost you money if you don't have hospital cover.

Medicare Levy Surcharge

If you earn over $101,000 (from 1 July 2025) and don't have hospital cover, you'll be taxed 1%, 1.25% or 1.5% of your wage due to the MLS. Get a cheap policy and you can avoid the tax.

For a lot of people, the cost of a hospital policy can be less than what they'd be taxed if they didn't have it. For example, a single person who earns $101,000 per year would pay an additional $1,010 in tax if they don't have insurance. But there are health insurance providers with basic policies starting from around $915 per year.

So even if you don't plan on using private health insurance, it can make financial sense to get a policy anyway.

Lifetime Health Cover loading

LHC loading kicks in on 1 July immediately after your 31st birthday. For every year you don't have health insurance from that date, you'll be charged an extra 2% when you eventually do decide to get a policy.

For example, if you wait until you're 41 to get hospital cover, your premiums will be 20% higher than they would have been if you took out a policy before the deadline. That's assuming you don't have an exemption. Get hospital cover before the deadline and you won't be hit with the penalty.

"My wife and I earn over the MLS threshold and we live in NSW, so it made sense for us to take out hospital insurance. Now we're saving money by having a policy in place, plus we don't need to worry about an expensive ambulance bill anymore."

Hospital waiting periods

With hospital cover, the Private Health Insurance Ombudsman sets the maximum possible waiting periods for every circumstance and insurers have to stick to them. This means the same waiting periods will apply no matter what hospital policy you get.

| Hospital benefit | Waiting period |

|---|---|

| Most pre-existing conditions | 12 months |

| Pregnancy and childbirth | 12 months |

| All psychiatric care, rehabilitation and palliative care | 2 months |

| Other in-hospital treatment | 2 months |

| Accidents and ambulance services | No waiting period |

What isn't covered by private hospital insurance?

No matter what level of health insurance you get, there are certain things that won't be covered. They include the following:

- Pre-existing medical conditions within the first 12 months

- Out-of-pocket costs (that's when your doctor charges more than the MBS item fee)

- Fees for any specialists you see outside of hospital

- Any services you receive outside of hospital

- Any medical treatment that does not have an MBS item number

- Hospital stays that are longer than 35 days

- Cosmetic surgery for non-medical reasons

FAQs

Learn more about Finder score

Groups

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. They're very different machines for very different jobs. So we've separated all the hospital policies on the market into groups.

Price Score

We calculate the net price for each product, which is compared against other products within its assigned product pool. Each product is assigned a score between 1 - 10, with the lower the price, the higher the score. The net price comprises the premium charges and excess.

Features Score

We calculate the number of hospital treatment categories covered by each product and position the number between the products that offer the most and minimum amount of treatments, within the same category, to generate a feature score between 1 - 10.

We also assign 30% of the feature score for the Gap Score and Benefits Score, which is calculated at a provider level and assigned to each product.

The hospital treatment categories that are included are based on the standard list used by the Australian government.

Final Score

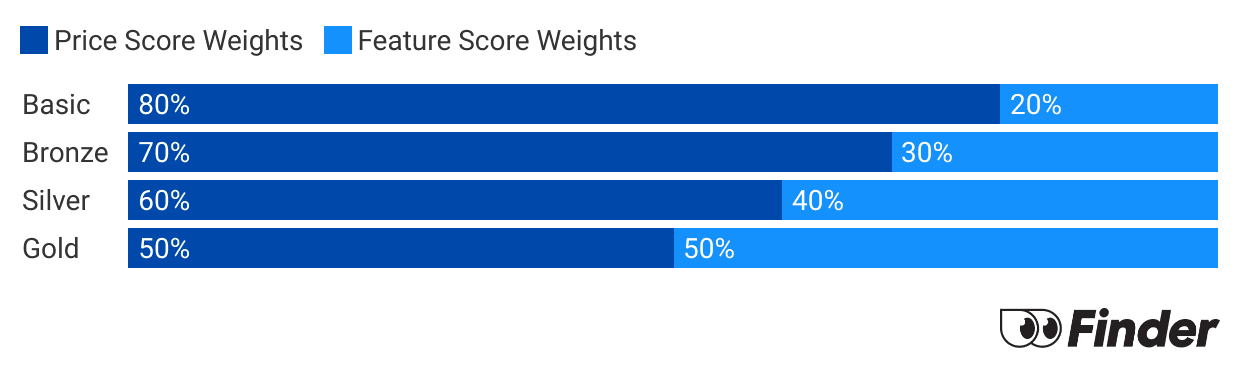

The Price score and Feature score are combined to determine each product's Finder Score. We assign weights between price and features based on the category level.

Finder Score - Hospital Cover Score Weightings

| Category Level | Price Score Weights | Feature Score Weights |

|---|---|---|

| Basic | 80% | 20% |

| Bronze | 70% | 30% |

| Silver | 60% | 40% |

| Gold | 50% | 50% |

Sources

Read more on Health Insurance

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.