- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Income to debt ratio nears 200% danger zone and is due to rise, say experts – March, 2018

- Cash rate holds for March 2018, with next move largely expected in 2019

- Experts (55%) expect Australia’s income to debt ratio to rise; 25% think it will hit 205%

- 77% of panellists think debit card spending may surpass credit card spending

6 March, 2018, Sydney, Australia – Consistent with expectations, the central bank held the cash rate this afternoon (06/03/2018) but with the country’s debt to income ratio nearing 200%, experts and economists think it will rise even further, according to finder.com.au, the site that compares virtually everything.

As tipped by all 33 members of the finder.com.au RBA survey, the Reserve Bank of Australia (RBA) maintained the cash rate at 1.5% at the board meeting today.

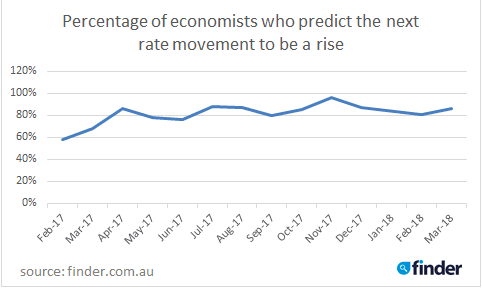

Eighty-six percent of experts and economists think when the rate eventually budges, it will be in an upward direction. This prediction of a rate rise has remained steady for nearly a year with 80 to 90% of panellists maintaining this belief over the past 11 months straight.

However, a future rate change is still a fair way off with half (50%) of experts and economists forecasting no rate movement until 2019, while a third (31%) are anticipating a raise in November this year.

According to a recent UBS report, Australia's household debt to income ratio has nearly hit 200 percent, so finder.com.au asked the experts if they believe this figure will grow further.

The majority of the 20 economists surveyed on this topic (55%) expect the income ratio to rise, with a quarter (25%) expecting it to hit as high as 205%, with nearly another quarter (20%) of the panellists forecasting it to rise even further.

Graham Cooke, Insights Manager at finder.com.au, says this forecast is worrying.

“Our household debt to income ratio is one of the highest in the world and if it exceeds the 200% mark, this could be a real hurdle for many Australians.

“If the RBA does raise the cash rate later this year, some Australians may lose grip of their repayments, particularly those who are already struggling to make the minimum repayment,” he says.

A separate UBS report found nearly a third of granted home loan applications in Australia are not "completely factual and accurate", with some applicants submitting incorrect income and expenditure details.

In light of this, panellists were asked if this could make banks susceptible to a housing market downturn. Just under half of the 15 who responded to this question (7, 55%) said it would, with a third (5, 33%) saying it wouldn’t.

Mr Cooke says some applicants may simply not know the value of their assets or debt.

“It may not necessarily be a case of people ‘fudging’ their details to get their application over the line, but people may not know the true value of their assets and liabilities, while their spending may differ dramatically from month to month”, he says.

Shane Oliver of AMP Capital pointed out that despite greater risk, the low level of non-performing loans suggests this isn’t a major problem: “This is not to say that there has not been an increase in risk - its inevitable after the booms in Sydney and Melbourne property prices that risk has increased to some degree. So the RBA will have to tread carefully when it does start to raise rates.”

A recently released finder.com.au forecast predicts debit card spending may overtake credit card spending for the first time in Australia later this year, with debit card spending due to hit $27.6 billion in August 2018, and credit card spending trailing behind at $27.5 billion.

Seventy-seven percent of the 13 respondents to this question (10) agreed this trend was likely to occur.

Mr Cooke says new payment infrastructure and innovations like Afterpay could be driving this trend.

“Industry developments such as the interchange fee regulations that were enforced in July 2017 may be fuelling this trend. The regulations devalued reward programs which meant cardholders had to jump through more hoops to earn points compared to what they did in the past.

“Afterpay is another new payment method that could be moving the needle as far as debit consumption goes where no interest is payable.

“And with an average purchase rate of 17.06% as of March 2018, consumers are seeking ways to avoid paying high interest charges,” he says.

Here’s what our experts had to say:

Jordan Eliseo, ABC Bullion (Hold): "There remains no compelling reason for the RBA to move the dial when it comes to interest rates. Employment data, business conditions and overall growth figures are solid, though there seems no obvious catalyst to turn around record low wage growth, whilst a slowing property market will inevitably weigh on confidence. We remain of the view that the next move in rates will be a reduction."

Tim Nelson, AGL Energy (Hold): "RBA has stated that the process of inflation returning to target will be gradual."

Shane Oliver, AMP Capital (Hold): "High levels of business confidence, strong jobs growth and the RBA’s forecasts for stronger growth and inflation point to eventual rate hikes. But against this, continuing very weak wages growth, sub-target inflation, the $A remaining too high and uncertainty around the outlook for consumer spending all argue for rates to remain on hold or even fall. So on balance it makes sense to continue to leave interest rates on hold."

Alison L Booth, ANU (Hold): "The fundamentals have remained fairly steady."

Malcolm Wood, Baillieu Holst (Hold): "Inflation below target band; mixed indicators."

Richard Robinson, BIS Oxford Economics (Hold): "Price and wages inflation still low, so no pressures yet. RBA has a large buffer between rising US rates and local rates, so there is no hurry to raise rates. Although A$ is still a bit high for RBA's comfort, the Bank is still reluctant to cut rates, because it fears it would re-ignite property prices."

Paul Dales, Capital Economics (Hold): "The RBA has said that there is not a strong case for a near-term adjustment in interest rates (i.e. a hike) as inflation is going to rise to the 2-3% target only slowly."

Michael Blythe, CBA (Hold): "RBA is emphasising patience and gradualism with respect to rates."

Saul Eslake, Corinna Economic Advisory (Hold): "Nothing has happened since the February meeting (and the publication of the February SoMP) to prompt the RBA to change its evaluation of the appropriateness of current monetary policy settings."

Peter Gilmore, Gateway Bank (Hold): "Still insufficient wages and price growth to force the RBA's hand."

Scott Morgan, Greater Bank (Hold): "Economic data does not yet support a shift"

Shane Garrett, Housing Industry Association (Hold): "Inflation and economic growth do not require intervention."

Alex Joiner, IFM Investors (Hold): "There is no economic reason to shift rates and the outlook has not been altered by any deviation in the recent solid data flow."

Andrew Wilson, Independent economist (Hold): "We are experiencing a benign environment for interest rate movements either up or down. After APRA regulations restricting the availability of loans to investors, we actually saw rates for owner occupier loans fall – the difference between owner occupier and investor loans is now smaller than ever. APRA are starting to make noises that they are satisfied that the market has stabilised. We’re likely to see a flat year for interest rates."

Michael Witts, ING (Hold): "The RBA is happy for the current momentum in the economy to continue to run. Inflation remains under control and wages inflation is yet to emerge."

Leanne Pilkington, Laing+Simmons (Hold): "The current interest rate remains appropriate and the fact that the banks themselves are applying tighter lending criteria to their customers demonstrates the potential impact a rate rise too soon may have. It’s a precarious position requiring a steady low environment in the near term."

Nicholas Gruen, Lateral Economics (Hold): "It has flagged that it's not in a hurry to raise rates."

Mathew Tiller, LJ Hooker (Hold): "No discernible change from last month. Employment continue to remain strong, however, wage growth and inflation remain soft. Property markets have seen prices begin to soften, thanks to an increase in listings and a moderation in investor demand."

John Caelli, ME (Hold): "The RBA has already indicated it will hold the cash rate until key economic indicators improve."

Michael Yardney, Metropole Property Strategists (Hold): "While overseas interest rates are likely to rise in the next few months, the RBA Governor has made it clear that Australian rates don't need to be in lock step with overseas rates. There is currently no reason to change rates to either stimulate or slow down our economy."

Mark Crosby, Monash University (Hold): "At this point the RBA would be close to raising rates, but probably still waiting for overseas rises to occur and monitoring of financial markets after this happens."

Christopher Schade, MyState Bank (Hold): "While the economic outlook has if anything improved in recent times, the economy is far from over-heating, inflation remains well contained, and the Australian dollar arguably remains a tad high. The Reserve Bank will leave rates at their current highly accommodative level for at least the next few months to allow the economy to continue to gather momentum. A rate hike will likely become a more serious consideration later in the year."

Alan Oster, NAB (Hold): "Wages data is too weak."

Jonathan Chancellor, Property Observer (Hold): "The central bank will be cautiously content with how things are faring, with no need to change the cash rate."

Noel Whittaker, QUT (Hold): "Property prices falling – our dollar weakening – no reason to move."

Nathan McMullen, RAMS (Hold): "Inflation is within tolerance."

Nerida Conisbee, REA Group (Hold): "Economy still not strong enough to start increasing."

Janu Chan, St.George Bank (Hold): "The next move is more than likely to be higher, and the RBA sees progress towards employment and inflation goals. However, spare capacity still exists within the domestic economy and will therefore hold off from raising interest rates for some time.”

Clement Tisdell, UQ-School of Economics (Hold): "Wage growth slow. Exchange rate needs to be lowered somewhat."

Other participants: Bill Evans - Westpac (Hold), Stephen Koukoulas - Market Economics (Hold), Paul Bloxham - HSBC Bank Australia Limited (Hold), John Hewson -ANU (Hold).

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel