Property pounce: A record 67% of Aussies say now is a good time to buy

Optimistic home buying sentiment has reached a pre-pandemic high in Australia according to new research by Finder.

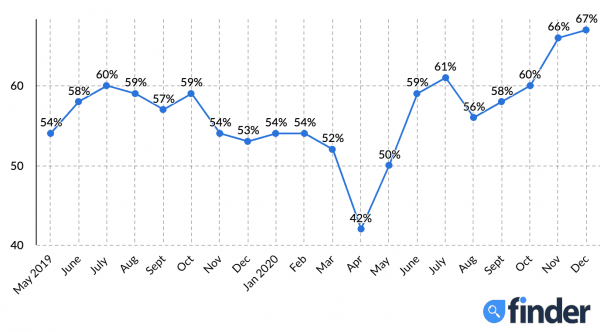

Finder's Consumer Sentiment Tracker, a nationally representative Finder survey of 20,353 respondents, revealed that 67% of Australians think that now is a good time to buy property – up from 42% in April 2020.

This figure is an all-time high since Finder began tracking the stat in May 2019.

Source: Finder Consumer Sentiment Tracker, 20,353 Respondents, May 2019 - December 2020

The survey also found that those expecting house prices in their area to significantly increase in value is also at an all-time high of 19% – up from just 5% in September 2020.

Those who expect property values to "somewhat increase" has jumped to 44% from a low of 18% back in April.

Graham Cooke, insights manager at Finder, said that the recent uptick in buyer confidence is a good sign for the economy.

"This rebound in buyer confidence is indicative of increased economic activity over the past few months, along with an optimistic outlook for 2021.

"Not only did the Australian government do a better job than most at restricting the spread of COVID-19, but federal and state economic support measures helped prop up the property market.

"Now we're seeing that house values in every capital city bar Melbourne are higher than they were compared the same time last year.

"This trajectory looks set to continue, with 86% of economists telling Finder* that they expect prices to fully recover nationally this year," Cooke said.

According to CoreLogic data from December 2020, house values in Sydney are up 3.95% year on year, with Brisbane values also up by 4.57% during the same time period.

Changes to home values in Australian capital cities

| Capital city | % change month on month | % change year on | % of residents who believe now is a good time to buy property (by state)* |

|---|---|---|---|

| year | |||

| Sydney | 1.05% | 3.96% | 59% |

| Melbourne | 1.15% | -1.98% | 70% |

| Brisbane | 1.20% | 4.57% | 69% |

| Adelaide | 1.19% | 5.93% | 77% |

| Perth | 1.05% | 1.98% | 67% |

| Darwin | 2.35% | 11.91% | N/A** |

| Canberra | 0.67% | 8.52% | N/A** |

| Hobart | 0.93% | 7.65% | N/A** |

Source: Finder, CoreLogic

*Finder December 2020 survey of 1,004 respondents

**Some state data omitted due to small sample size

Cooke said that prospective buyers should consider the pros and cons before taking the plunge in the current market.

"Low interest rates and government assistance packages like the first home loan deposit scheme put buyers in a strong position. The potential removal of stamp duty in NSW will be another boon for buyers and may spread to other states.

"If you're thinking about dipping your toe in the market this year, make sure you have a strong credit history, and shop around before signing up for a home loan," Cooke said.

*Finder RBA Cash Rate Survey, December 2020.

Methodology

- This study was designed by Finder and conducted by Qualtrics, a SAP company.

- The online Finder survey was conducted using a nationally representative survey sample of 20,353 Australians aged 18 and above, between May 2019 -December 2020.

- Time to buy sentiment (by state) was based on a separate Finder survey of 1,004 respondents from December 2020.

How to prepare as a first time buyer:

- Seek pre-approval. This will help you to stay within budget while shopping around. You'll also be able to act quickly when you find the right home. You can compare home loans at Finder.

- Know the true cost of buying. Home ownership goes beyond the cost of a house deposit. You'll also need to factor in things like stamp duty, lenders mortgage insurance, solicitor's fees and more.

- Look beyond the property. You should also consider things like suburb trends, the local council, proximity to shops and amenities, public transport, local schools and whether there are any major developments planned in the area.

Why pay more for your mortgage when you don't need to? Check out some of the cheapest home loan rates in history and start saving today

Ask a question