- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA Survey: House prices to keep falling in eastern capitals

- Experts predicting further drops of $50,000-$60,000 in Melbourne and Sydney

- Today represents the 27th consecutive time the RBA has held the cash rate at 1.5%

- Drops would make housing its most affordable since 2015 in Sydney, Melbourne and Perth

5 February, 2019, Sydney, Australia –

The drop in housing prices is not over yet, according to Finder, Australia’s most visited comparison site.

When asked for their housing price predictions in this month’s Finder RBA Cash Rate Survey, experts forecast 6% falls still to come in Australia’s eastern capitals of Sydney and Melbourne by the end of 2019.

According to CoreLogic data, since their peak in July 2017, Sydney values have already fallen 11.1%.

Melbourne prices have dropped 7.2% since their peak in November 2017.

Graham Cooke, insights manager at Finder, said now is a great time to be in the market if you’re lucky enough to have a deposit saved.

“A 6.3 per cent drop in Sydney would see average house prices dip a further $58,000, while a 6.6 per cent drop in Melbourne this time would mean a fall of more than $49,000.

“Remarkably, should these price drops eventuate as forecast, this would make Sydney and Melbourne property the cheapest it has been in four years,” he said.

| City | % | Current median house value Aug-Oct 2018 | Projected value | Change |

|---|---|---|---|---|

| Dec-19 | ||||

| Sydney | -6.30% | $925,000 | $866,725 | ($58,275) |

| Melbourne | -6.60% | $755,750 | $705,871 | ($49,880) |

| Perth | -2.90% | $515,000 | $500,065 | ($14,935) |

| Darwin | -1.30% | $490,000 | $483,630 | ($6,370) |

| Brisbane | -1.00% | $560,000 | $554,400 | ($5,600) |

| Adelaide | 2.00% | $475,000 | $484,500 | $9,500 |

| Hobart | 3.20% | $439,250 | $453,306 | $14,056 |

Source: CoreLogic; Finder. Average of predictions from 7-15 economists, depending on city. Canberra excluded due to small sample size. As October is the most recent data available, price changes from October to December have not been taken into account.

Cooke said prospective buyers should use this speculation to their advantage.

"If you're buying in a falling market, negotiate to the point where you think it will turn.

"In other words, bargain for at least 6 per cent under the asking price in Sydney, or 7 per cent in Melbourne," Cooke said.

Perth and Darwin housing are also predicted to become more affordable. The two cities have already shed their last decade's worth of gains, down 15.6% and 24.5% respectively. Finder's experts expect that trend to continue.

Cooke said property owners in Adelaide and Hobart have reason to celebrate.

"Interestingly, experts predicted property prices in both Adelaide and Hobart to grow, so it could be worthwhile considering investment opportunities in these cities," Cooke said.

Cash rate holds following Royal Commission report

Cooke said yesterday's release of the Royal Commission report may trigger changes from banks that ultimately cause the Reserve Bank of Australia (RBA) to act on the cash rate.

"It remains to be seen what effect the final report from the Royal Commission will have on the banking sector, but it may make credit harder to access.

"The bigger banks may be less inclined to lift rates further out of cycle in a higher-scrutiny environment," he said.

The RBA today announced a hold on the cash rate at 1.5% for the 27th consecutive time, an outcome accurately predicted by all 28 members from the Finder RBA Cash Rate Survey.

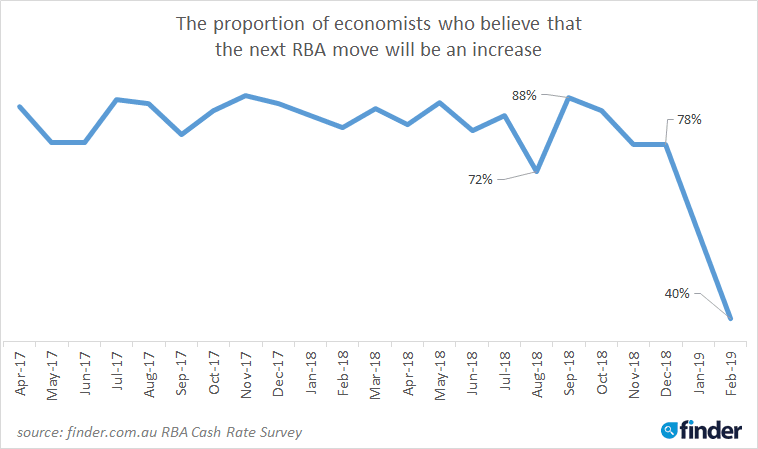

In December, 78% (21/32) of experts predicted the next move would be a hike and the majority of those said it likely wouldn't happen until 2020.

This month, only 40% (11/28) predicted a hike and of the 60% who thought the next move would be cut, they all expect it to happen in 2019.

Chief Economist for My Housing Market, Dr Andrew Wilson, said there are a number of factors as to why he thinks the next rate move will be an easing as early as March or April.

"Although recent data is clearly increasing the chances of a near-term cut in official rates, recent statements by the RBA continue to indicate an ongoing conservative stance on rate settings.

"This however is likely to change if GDP data to be released on March 6 is again disappointing.

"In those circumstances the RBA will be motivated to cut rates, particularly prior to the onset of a likely lengthy federal election campaign," Wilson said.

Here's what our experts had to say:

Shane Oliver, AMP Capital: "While economic data has generally been soft since the last Board meeting in December, it's unlikely to have been weak enough yet to prompt the RBA to cut rates, particularly given that its bias has still been to raise rates."

Alison Booth, ANU: "The fundamentals have not yet altered sufficiently to warrant [the RBA] to change."

John Hewson, ANU: "Data uncertainty and concern economy is slowing."

Malcolm Wood, Baillieu: "Underlying inflation is below the low end of the RBA's target band and underlying economic momentum appears to be deteriorating."

Ben Udy, Capital Economics: "The housing downturn is becoming more severe and will weigh on the economy over 2019. But given the labour market remains in good shape for now, we suspect the RBA will remain on hold for the time being."

Michael Blythe, CBA: "Reasonable economic backdrop says next move is probably up. But low inflation means no hurry to act."

Trent Wiltshire, Domain: "The RBA is very reluctant to cut rates. Despite some weak economic data since the December meeting the RBA will maintain a fairly optimistic outlook for the economy."

Peter Gilmore, Gateway Bank: "Growth is still likely to be above trend."

Mark Brimble, Griffith Uni: "There is little net direction from indicators, with an overall bias to more support being needed given the out of cycle increases of rates by institutions."

Tim Nelson, Griffith University: "There is no strong case for an adjustment of monetary policy."

Peter Haller, Heritage Bank: "Economic conditions have not materially changed since the previous RBA meeting in December and there is no basis for a change at this time."

Tim Reardon, Housing Industry Association: "GDP remains solid. Unemployment low and no evidence of inflationary pressure."

Michael Witts, ING: "Despite the increased market talk about the prospect of an easier stance from the RBA, if this scenario is to emerge it is likely to be around mid year. Underlying economic data remains positive for the time being."

Peter Boehm, KVB Kunlun: "No reason to move rates at this stage."

Leanne Pilkington, Laing+Simmons: "Some economists now believe the next official rate movement will be down instead of up. The Reserve Bank will need firm justification as a move either way will be heavily scrutinised. We don't see any justification to adjust rates at this time."

Stephen Koukoulas, Market Economics: "It will acknowledge the economy is weaker than when it last met and will signal a change in bias towards an easing. It may wait a month or two before acting on that bias."

John Caelli, ME Bank: "Given low unemployment and wages are starting to rise, the Reserve Bank is unlikely to cut rates in the near term. Likewise, with house prices continuing to fall, tightening credit, and CPI below the target band, a rise in the cash rate is also unlikely. It's wait and see for now."

Michael Yardney, Metropole Property Strategists: "The jobs growth figures for December will give the RBA comfort at a time of slower local economic growth and difficult world economic circumstances. With no wages growth and our challenging property markets and the real likelihood of further falls in property values especially in Sydney and Melbourne, the RBA will now have to seriously consider the option of lowering rates this year."

Mark Crosby, Monash University: "While the international situation is deteriorating, there is no reason to move rates at the February meeting."

Jacqueline Dearle, Mortgage Choice: "As wages continue to flat line and spending appears to be fuelled by a mix of credit and savings, consumers may be entering 2019 with a slightly pessimistic view. Continued low inflation, that's sitting below Governor Lowe's target; and the softening property market coupled with the tightened lending environment, only adds to disappointing Australian GDP/economic and global concerns stemming from Trump's trade war with China. The upcoming federal election also adds a feeling of stasis to lacklustre economic data. In February, a myriad of signposts continue to suggest rates remaining on hold but down the track the next move in the cash rate could well be downward. However this could impact on the Aussie dollar, giving the RBA a lot of big issues to consider as the New Year kicks off."

Dr Andrew Wilson, My Housing Market: "Although recent data is clearly increasing the chances of a near-term cut in official rates, recent statements by the RBA continue to indicate an ongoing conservative stance on rate settings. This however is likely to change if GDP data to be released on March 6 is again disappointing. In those circumstances the RBA will be motivated to cut rates – particularly prior to the onset of a likely lengthy federal election campaign."

Matthew Peter, QIC: "The market is now pricing the next move of the RBA to be a 0.25% cut sometime in early 2020 as China slows and the housing market continues to correct. These headwinds are yet to derail the economy, as shown by the strong December labour market data. The RBA will stay on hold until 2020, but failing a crash in China and the housing market, the next move in rates will be up."

Noel Whittaker, QUT: "There is no way they will increase them with the housing market the way it is – and I can't see them reducing them."

Nerida Conisbee, REA Group: "Economic data coming out is still too mixed to make a decision to move rates. While CPI remains low, and GDP growth in September was lower than expected, unemployment is now at just 5%. In Sydney, it is at its lowest rate since 1974."

Christine Williams, Smarter Property Investing P/L: "The economy is not as strong as expected. Also I believe the RBA is waiting for Royal Commission Report to be released."

Janu Chan, St.George Bank: "There continues to be strength in the labour market. However, the downside risks for the global economy has increased. The Australian economy is also not growing as strongly as previously thought. The balance of these risks suggests the RBA could tone down its stance of the next move being up but to remain on hold for some time. However, not likely to the extent that the RBA will be ready to lower rates."

Richard Holden, UNSW: "No chance they raise given housing and inflation."

Other participants: Bill Evans, Westpac

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel