Compare other products

We currently don't have that product, but here are others to consider:

How we picked these3 easy steps to help you find the best personal loan for you

1. Matching your loan with the reason you're borrowing

This is the first broad filter for finding the best personal loan for you. You need to ask yourself why you're taking out the loan.

Different types of personal loans are suited to different loan purposes. For instance, a secured personal loan may be a good way to finance a used car. An unsecured loan may be better suited to general purposes where you can't offer collateral.

Depending on the reason you're looking to borrow, the type of personal loan that is best for you will differ – so your first step is to find a loan that matches your loan purpose.

2. Filter for loan features most useful for you

After you've found a loan that caters to your specific loan purpose, you have to consider the features you want.

Personal loans come with a variety of features. This includes how much you want to borrow, over what term, as well as the type of interest you wish to pay – that is, fixed or variable.

Other features include the ability to make additional repayments, and repaying the loan early without penalty and redraw facilities.

Once you've accounted for your preferences, you can compare your loan options to find a loan with the features you want.

3. Compare loans to find the most affordable loan

Apart from filtering for your specific needs, you also need to find a loan you can afford. Here's where comparison really pays off. Comparing loans can help you find the most affordable loan with all the features you're after.

Keep an eye out for the interest rate, as well as the comparison rate – which will give you an idea of the overall cost of the loan. The range for a competitive comparison rate is anything under 10% p.a.

As well as low interest, you should look for low or no fees, as these will add to the cost of your loan. These will include establishment and monthly fees.

Some loans also come with limited time offers. This could be a discounted interest rate or fee waivers. These offers can help you keep down the cost of the loan in the long run, so consider looking out for them.

What type of personal loan will best suit my needs?

There are a range of personal loans you can apply for. If you're not sure what type of loan you need, we've highlighted the options. We've also included what you should keep in mind and watch out for.

| Type of loan | >What it's best for | >What to watch for |

|---|---|---|

| Unsecured personal loan |

|

|

| Personal line of credit loan |

|

|

| Secured car loans |

|

|

| Secured loan |

|

|

| Short term loans |

|

|

Is the lowest interest rate an indication of the "best personal loan"?

The answer is yes and no.

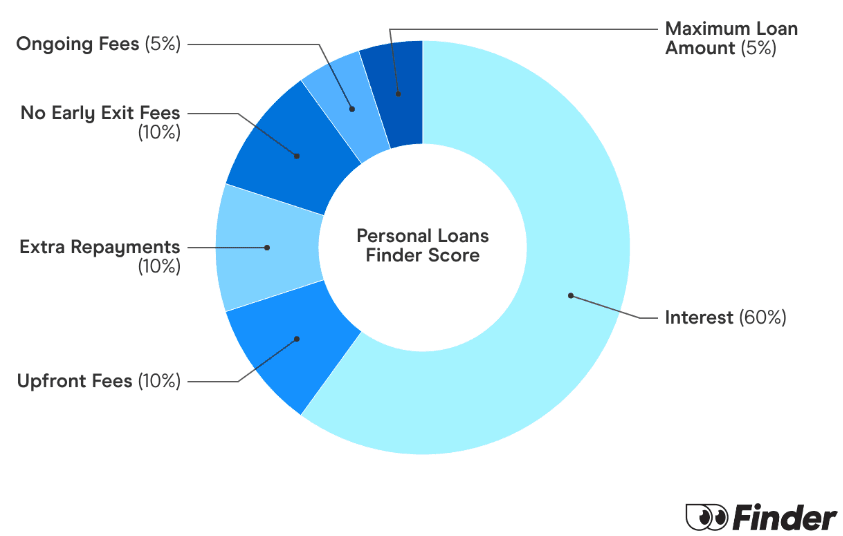

Finding the lowest interest rate is a good indication of a competitive personal loan, but interest rates are not the only feature you should look into. You should also consider other features and fees involved.

Some loans advertise low interest rates but come with high fees. In this case, the loan may cost you more than the benefit you receive from a low rate. This is why you should take note of the comparison rate. It will give you an indication of the overall cost of the loan.

Additionally, if you want features like the ability to repay the loan early, you should consider break costs. Some loans allow you to repay the loan early without penalty. If that's a priority, you should account for this cost too.

What should I keep in mind when looking for the best personal loan?

When you're looking for a personal loan, there are some common misconceptions and mistakes you can make. You should avoid:

🔍 Applying for the first loan you find. The first loan you find may not be the best loan. By searching for other loans and comparing them, you can find what works best for you.

💵 Looking only at the interest rate. As we've mentioned above, you should also consider the comparison rate and loan features.

👀 Not reading loan terms and loan restrictions. You should always be aware of all the fees and restrictions associated with the loan. There could, for instance, be fees associated with extra repayments. Likewise, you may be restricted in terms of how you use the funds. For instance, a car loan can only be used to purchase a car.

💲 Applying for more than you can afford. Lenders are bound by responsible lending laws. According to these laws, they cannot lend you more than you can afford. If you apply for more than you can reasonably repay, your application will likely be rejected. You can work out how much you can afford using a personal loan calculator.

⚠️ Applying to multiple lenders. You may think you're increasing your chances of getting a loan, but this is a no go. This is because every loan application is entered into your credit file. Multiple loan applications in a short period act as a red flag, reducing your chances of getting a loan. Your credit score could also be impacted.

🤔 Not considering all your options before applying. A personal loan may not always be the best option for you, depending on your circumstances. For instance, if you're a low income earner, there are loans designed to address this. You should only apply if you're certain that what you want is a personal loan. It is also important to be sure that using a personal loan is the cheapest option for you.

How do I submit my personal loan application?

💻 After you've compared and found a loan from the table above, you can click "Go to Site".

✍This will take you directly to the lender's website, where you can start the application process.

❗Keep the documents you need on hand. These will include your driver's licence, financial and employment documents, and bank details. If you're applying for a secured loan, you will need details of the asset.

FAQs

Icons made by Flaticon

Ask a question

More guides on Finder

-

Joint Personal Loans

If you're wanting to bolster your application, buy an asset with your partner or apply for a loan you're not eligible for by yourself, you can consider a joint application personal loan.

-

Secured Personal Loans

Are secured personal loans better than unsecured personal loans and how do they work?

-

Joint Personal Loans

If you're wanting to bolster your application, buy an asset with your partner or apply for a loan you're not eligible for by yourself, you can consider a joint application personal loan.

-

Personal loans for temporary residents

Temporary Australian residents may be eligible to apply for personal loans, depending on the visa they hold.

-

Easy personal loans

Not all personal loans come with endless documentation. Some lenders specialise in quick and easy application processes.

-

Unsecured personal loans in Australia

Compare unsecured personal loans from some of Australia's top lenders. Find the best deal on rates, fees and features in seconds.

-

Personal loan calculator

Use a personal loan calculator to work out your repayments or compare loans with a comparison calculator.

-

Compare fixed rate personal loans from 5.76% p.a.

We’ve written about fixed rate personal loans and what their advantages are.

-

Low interest personal loans in Australia

Find a low interest loan by comparing your options with Finder. See interest rates, fees, and features for loans across Australia, plus guides to help you get the best deal.

-

Cheap personal loans

Find out exactly what you need to know when it comes to cheap personal loans, including working out if a loan is really competitive.