Gap between personal loans and home loans wider than ever

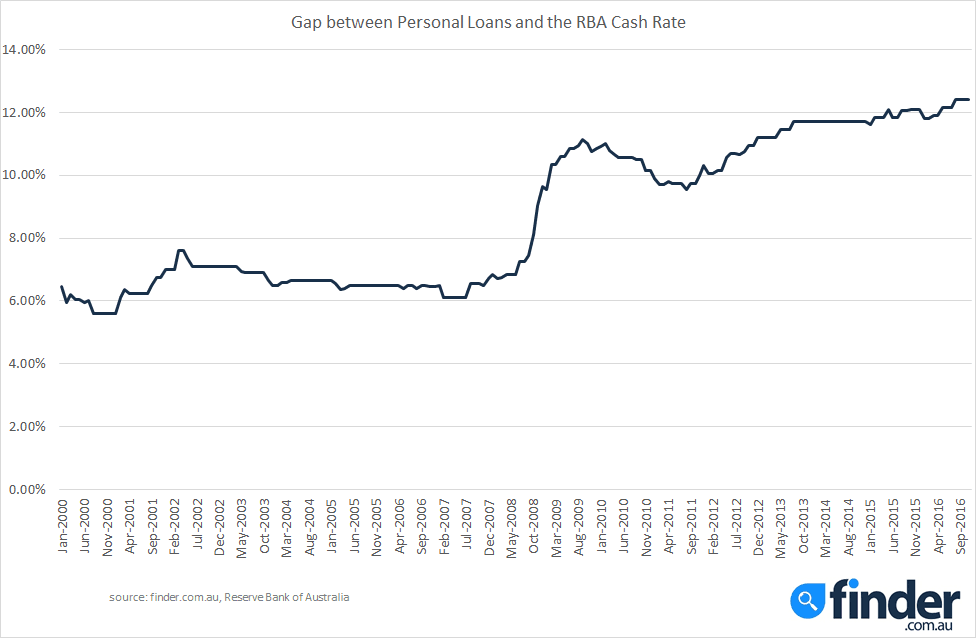

The difference between interest rates for personal loans and the official cash rate is at its highest point on record.

While mortgage holders may wait with bated breath for cash rate changes every month, those with personal loans don't tend to blink an eye. And with good reason. New finder.com.au analysis has found that the disparity between the average unsecured fixed rate personal loan rate and the official cash rate has reached its highest point on record.

The cash rate remained unchanged yesterday at the historical low of 1.50%, but the average unsecured personal loan rate remained significantly higher at 13.90%. This stark difference in rates has been the story since the global financial crisis.

From 2000 to 2007 the gap between unsecured personal loans and the cash rate was between 6-7%, climbing to 10% during the GFC in 2008. The gap now exceeds 12%.

Many take out fixed rate personal loans thinking they will be protected from interest rate fluctuations, but these numbers indicate very little correlation between the cash rate and variable personal loan rates. This is especially true in the past few years with the decrease of the cash rate and the relative increase of variable rate loans.

In light of these numbers, those looking to take out an unsecured personal loan may want to reconsider the necessity of taking out a fixed rate personal loan to be protected from rate changes.

Variable rate loans generally offer more flexibility with repayments, with most loans allowing for additional repayments and letting you repay the loan early without penalty. You will not find the same allowances in fixed rate loans, with many not allowing additional or early repayments or charge you a fee to do so. Setting aside the protection from rate fluctuations, the main benefit offered by fixed rate loans is a slightly lower rate than their variable rate counterparts.

The numbers indicate that banks aren't passing savings onto customers, so it's more important than ever to compare your options before you apply.

Latest news headlines

Picture: Shutterstock