- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Royal Commission silver-lining: Banks will operate to a higher moral standard – June, 2018

- Cash rate forecast for June 2018

- 83% think banks will operate to a higher moral standard following the Banking Royal Commission

- Experts not worried about neobanks; 15% think neobanks will disrupt the banking sector

4 June, 2018, Sydney, Australia – Experts and economists predict the cash rate for June 2018 will be held at the board meeting tomorrow (05/06/2018) and the Banking Royal Commission will result in banks having a higher moral standards, according to finder.com.au.

finder.com.au’s RBA cash rate survey, the largest of its kind in Australia, shows the Reserve Bank of Australia (RBA) is expected to keep the cash rate on ice at 1.5% with all 31 experts and economists predicting this decision.

Consistent with market forecasts, 81% (21/26) of the panel members believe the next move will be in an upward direction.

Following the Banking Royal Commission, experts and economists were asked if banks will hold themselves to a higher moral standard.

The majority (83%, 15/18) of respondents believe banks will operate to a higher moral standard but nearly half of these respondents (39%, 7/18) think this will be short-lived.

Graham Cooke, Insights Manager at finder.com.au, says now is the time for banks to prove they’re customer-centric.

“It’s encouraging that many expect banks to step up and raise the moral bar, but whether or not this will be sustainable is another question.

“In the coming months, we may see a rise in the number of bank customers switching or refinancing if they feel they’ve been wronged or if the trust is broken with their existing provider,” he says.

Seventeen percent of respondents thought banks will not change their tune at all, while 44% (8/18) believe long-term change will come.

Respondents were also asked about the rise of neobanks — new banking institutions that exist independently and 100% online — that are coming to Australian shores.

Currently, brands including Up and Xinja are building platforms and accepting details of prospective customers. However, although most of these platforms have not yet launched in Australia, they could influence the banking sector in the future.

When asked if neobanks have the potential to disrupt banking, economists were doubtful with just two out of 13 (15%) saying they believe they could.

However, Jordan Eliseo of ABC Bullion and Mark Crosby of Monash University both felt strongly that neobanks banks could disrupt the market.

“Banks juicy margins reflect a lack of competition in the payments system and in wealth management. Banks do not have personalised service. Up, Xinja and others will attack the banks in those areas with more personalised and cheaper service offerings,” Mark Crosby said.

Mr Cooke echos this view saying neobanks could threaten traditional lenders.

“As neobanks are relatively new to market, it could be too early to tell if they’ll disrupt.

“However, Australia is witnessing the emergence of neobanks who are breaking the mould of traditional banking as we know it, and this could be a game-changer.

“As more neobanks arise, traditional lenders may be forced to offer more innovative and highly tailored products if they want to remain competitive,” he says.

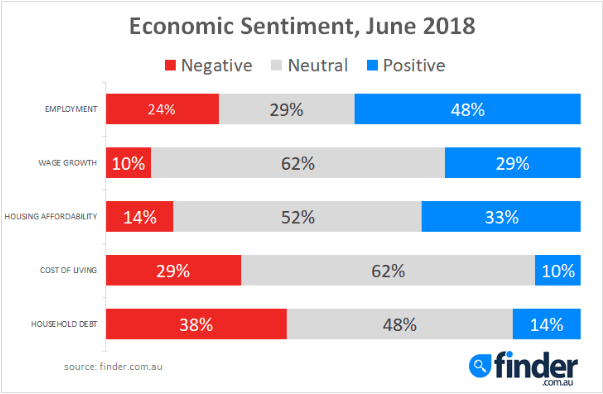

Experts and economists were also asked to weigh in on economic trends with finder’s Economic Sentiment Tracker showing household debt is the leading area of concern, with just 14% of respondents feeling positive about this area.

Perhaps surprisingly, one in three experts and economists (33%) feel positive about housing affordability across the country.

Employment, however, came out with strong positive sentiment with nearly half (48%, 10/21) of respondents expressing optimism about the job market.

Here’s what our experts had to say:

Jordan Eliseo, ABC Bullion: "The RBA will keep rates steady at their upcoming meeting, though we remain convinced the next move will be an interest rate cut. Local economic data remains soft at best, whilst fears over house price declines, and a more subdued environment for private sector credit growth continue to build, fuelled by some of the more troubling revelations from the Banking Royal Commission. The positive narrative around accelerating global growth is also starting to fade, with political uncertainty in Italy (and by extension Europe) unlikely to help."

Tim Nelson, AGL Energy: "Previous meeting indicated that there wasn't a strong case for near-term adjustment."

Shane Oliver, AMP Capital: "Basically nothing has changed. Signs of stronger investment, booming infrastructure spending, strong export volumes and the RBA’s own forecasts argue against a cut but uncertainty around consumer spending, the slowing Sydney and Melbourne property markets, tightening bank lending standards and the slowing Sydney and Melbourne property markets argue against a hike. So no case to move!"

Alison Booth, ANU: "Fundamentals haven’t yet changed sufficiently to warrant altering the interest-rate."

John Hewson, ANU: "No clear evidence to support a tightening especially given household debt."

Jonathan Chancellor, Property Observer: "The RBA won't be wanting to use its lever quite yet, as the economy is in a challenging state of transition. "

Malcolm Wood, Baillieu Holst: "Sluggish domestic economic data and inflation at the low end of the target range."

Paul Dales, Capital Economics: "Economic conditions are not strong enough to warrant higher rates and the RBA is becoming concerned that the Banking Royal Commission will result in some households and businesses finding it harder to get credit. The RBA won't want to raise the price of credit at the same time."

Saul Eslake, Corinna Economic Advisory: "Data releases since the last Board meeting are unlikely to have changed the Board's belief that it will be some time before spare capacity in the labour market has declined sufficiently, and economic growth picked up sufficiently, to warrant taking the first step back towards more 'normal' monetary policy settings."

Peter Gilmore, Gateway Bank Ltd: "Some of the fundamentals are beginning to show signs of lining up, but it's still too soon to move."

Mark Brimble, Griffith Uni: "Nothing has sufficiently changed."

Peter Haller, Heritage Bank: "Market conditions do not warrant a change. The RBA is comfortably on hold for the foreseeable future."

Shane Garrett, Housing Industry Association: "The economy is gathering pace in some areas without generating an increase in inflation - this means that no change in the RBA's cash rate is warranted for the moment."

Alex Joiner, IFM Investors: "There's been no shift in the economic outlook - this is particularly true in the labour market where spare capacity remains and therefore no meaningful acceleration of wages growth should be expected. In this way population growth remaining strong is a double-edged sword for the RBA in so far as it supports economic growth but keeps the unemployment rate from declining. Indeed the RBA does not expect full employment to be achieved over its forecast horizon."

Michael Witts, ING: "The RBA has indicated that rates will remain on hold for an extended period."

Leanne Pilkington, Laing+Simmons: "The housing market, from a number of key indicator perspectives, has peaked. Prices in select pockets are easing, clearance rates have dropped, and residential building approvals for April showed a 5% decline, which is more pronounced than most expected. So we’re seeing the market correct at the moment, but in a sustainable, soft-landing way. Raising interest rates prematurely could jeopardise this soft landing, so we expect the RBA to continue the hold pattern."

Mathew Tiller, LJ Hooker: "There has been no material change in indicators since last month. Property price growth continues to moderate which will be welcome by the RBA. Investor demand has eased with owner occupiers and first home buyers coming back into the market to fill the gap."

Stephen Koukoulas, Market Economics: "It remains the case that the RBA is downplaying the news of falling house prices, rising unemployment rate, weak wages and inflation. It should cut rates but it won't."

John Caelli, ME: "The RBA will want to see inflation and wages improve and lower unemployment before making any changes."

Michael Yardney, Metropole: "There's no reason to change rates. Jobs growth rebounded strongly last month but not enough to stop the jobless rate rising to a 9 month high of 5.6% keeping wages pressure low and rates won't rise until wages start growing."

Mark Crosby, Monash University: "The RBA is likely to remain on hold for the next few months unless wages growth and inflation strengthen. Moderation in asset price growth also lessens the probability of a rate rise."

Jacqueline Dearle, Mortgage Choice: "The RBA's decision to hold would be consistent with sustainable growth in the economy, home loan demand remaining stable, and achieving the inflation target over time."

Dr Andrew Wilson, My Housing Market: "Most recent relevant economic data continues to support steady rates and the Banks conservative stance on monetary policy. Rising spectre of a tariff enhanced-trade war however may require action to lower the AUD which would mean lower official rates.”

Alan Oster, NAB: "Watching for signs of better wages and labour market outcomes. Inflation still low."

Matthew Peter, QIC: "The rosy global economic backdrop is coming under pressure. Slowing growth momentum, Italian political chaos, uncertainty over Korea, and emerging-market instability in the face of rising interest rates and USD are eroding confidence in the global economy. Domestically, we have the Banking Royal Commission casting a shadow over credit growth. In the face of rising uncertainties, RBA will have not have to think twice before remaining on hold."

Noel Whittaker, QUT: "There is no compelling reason to increase them – and they certainly won't be reducing them."

Nerida Conisbee, REA Group: "The economy still isn't growing fast enough for the RBA to start moving rates upwards to slow it down."

Christine Williams, Smarter Property Investing: "Employment has stabilized. APRA's recommendations have been accepted and rolled out to all major funders."

Janu Chan, St.George Bank: "Low inflation, ongoing spare capacity, downside risks to housing and the household sector suggests RBA will remain on hold for some time.”

Clement Tisdell, UQ-School of Economics: "The statements of the bank."

Other participants: Bill Evans, Westpac.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel