HECS-HELP hell: Your uni debt could jump by $900+ by July

With inflation still high and the annual indexation looming, should you make some extra repayments to your debt?

A personal loan could help you tidy up your finances.

- Rebecca Pike, money expert

With inflation still high and the annual indexation looming, should you make some extra repayments to your debt?

Earn more from your money while rates are high.

Our experts analysed 4,370+ data points to pick the winners.

We looked at 200+ loans to find our top picks.

We reviewed 250+ cards to pick the best by category.

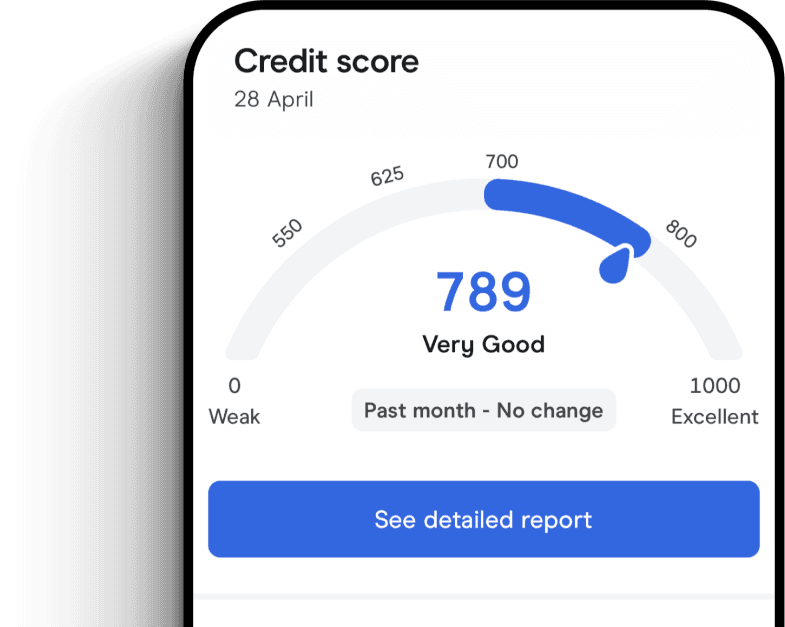

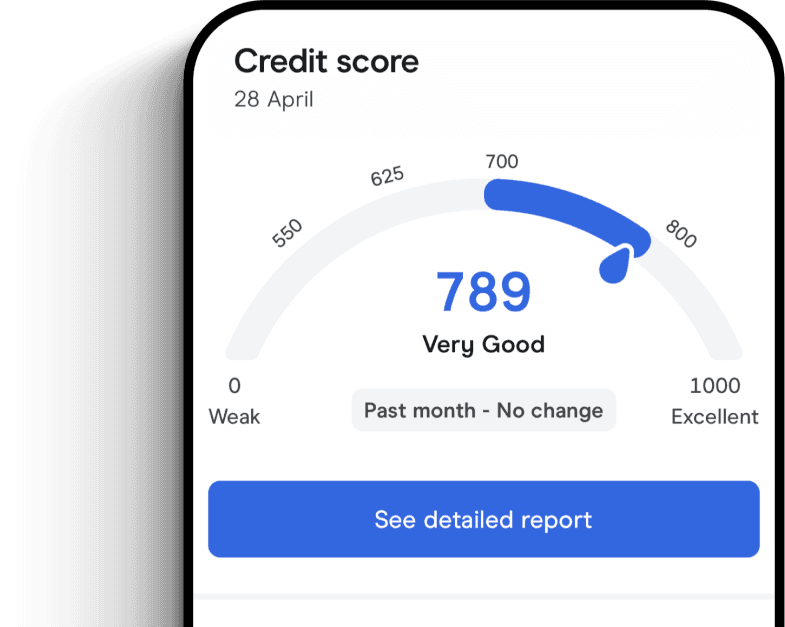

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies