Key takeaways

- You can release the equity you have in your home by refinancing or taking out a line of credit.

- The extra cash from your equity can be used as a deposit for another property, like an investment property.

- You'll likely be taking out an investment loan as well, so you should be sure you can handle this much debt.

What is equity?

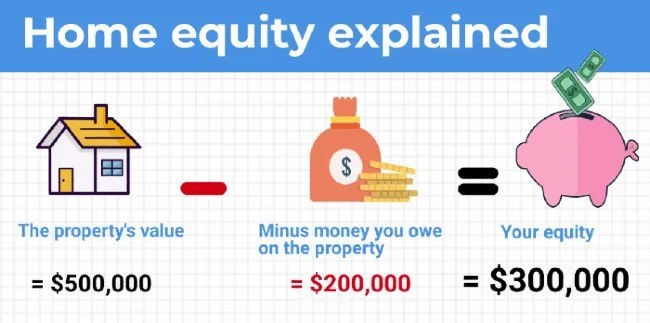

Equity is the value in your home, minus your debt. If your home is worth $700,000 and you owe $500,000 on your home loan, you have $200,000 in equity.

You build equity in your home in two ways: through making your regular home loan repayments and through price appreciation. If you've been paying your home loan for a number of years, you will have reduced the amount you borrowed. At the same time, your home may have increased in value. The combination of the increase in value and the reduction in principal adds up to equity.

How can I use my equity to invest in property?

If you have equity in your property, you can borrow against it. Assuming you have a home loan you're still paying off, you can refinance your loan and borrow back up to 80% of the property price.

The new loan pays off your old loan, but the extra amount goes back to you to use for whatever purpose you like: including as a deposit for a new property. Banks and lenders will take property equity as evidence of real savings.

If you don't want to refinance your loan, you can also take out a line of credit. This is a type of finance that uses your property as security, so you'll have a separate loan to think about on top of your home loan. It also comes with higher rates so the cost can be quite high, and for this reason it's become a less popular option.

How much can I borrow from my equity?

Home equity loans allow you to borrow up to 80% of the value of your equity (inclusive of your existing loan limit).

For example, let's say you have a home worth $800,000. If you have $400,000 left to pay on your home loan, you have 50% equity. To borrow back up to 80% of the property value, you could get a loan of $240,000.

How can I use a line of credit to invest in property?

A line of credit loan only requires you to pay the interest portion of the loan until you reach your credit limit. And you only pay interest on the amount you actually use: kind of like a credit card.

This can be a savvy move for property investors, as interest repayments on investment properties are tax deductible.

If you don't use your entire credit limit for a deposit, you can also set aside part of your line of credit for any urgent repairs or maintenance on your investment property. This can help you manage your cash flow.

You'll most likely need to couple your line of credit with an investment home loan.

What to be aware of when using a line of credit to invest in property

While a line of credit loan can help you invest in property sooner and carries tax advantages, there are some drawbacks.

First, using a line of credit loan to invest in property could potentially see you managing three home loans. Between your owner-occupier home loan, the line of credit and an investment loan, using a line of credit for property investment can be cumbersome.

Another drawback of line of credit loans is that you're using your own home as security. This means that if you run into trouble repaying your line of credit when it's due, your lender could seek recourse through your property and, in the worst case scenario, could even foreclose on your home.

What are some tips for using home equity for property investment?

Whether you're refinancing your home for more money or you're taking out a line of credit, here are some tips:

- Try to avoid using your entire credit limit. Leave yourself a buffer for emergencies, repairs or maintenance. If you're using a line of credit this also means you won't have to start making principal and interest repayments.

- Make extra repayments to your home loan debt. This unlocks even more equity, minimises your non-tax deductible debt and helps you pay down one of your loans faster.

- Use your offset account. If you've refinanced your home loan for the equity, put any funds you're not using into your offset account. This means you're not paying interest on that amount and it's easily accessible if you need it.

"Australian mortgages are so flexible nowadays and generally come with an offset or redraw on variable rates.

These accounts allow you to offset interest against any savings you have. This reduces your interest expense, providing you with further benefits of releasing equity when you can and not paying any interest whilst you don't use the funds.

I personally believe the advantages outweigh the disadvantages of borrowing money this way. However, if not managed correctly, you'll find you will never actually own your own home if you continue to release equity."

How do I compare home equity options?

If you want to access your home equity you usually have the option of a line of credit loan or refinancing your loan to borrow more.

Line of credit loans come with higher interest rates and are generally used for business purposes, rather than personal.

Refinancing allows you to take advantage of better interest rates and features, without adding another loan to your expenses (although your repayments will be higher).

Either way, you should compare your options based on:

- Interest rates. The lower the interest rate, the lower your repayments!

- Monthly repayments. Use a mortgage repayment calculator to make sure you can afford the costs.

- Fees. Check upfront and ongoing fees to make sure your loan is affordable.

- Features. Key ones to look out for are the ability to make extra repayments and an offset account.

Check out investment home loans

Frequently asked questions

Sources

Ask a question

More guides on Finder

-

Why are infrastructure developments important for property investors?

Major infrastructure upgrades are frequently associated with strong demand in local markets, as property investors often seek locations with infrastructure developments in the pipeline.

-

How to get FIRB approval when purchasing property in Australia

The FIRB has recently introduced new laws surrounding foreign investment along with new application fees and compliance policies.

-

How to maximise your tax return as an investor

Australia has a unique love affair with property as an investment class. Not only is bricks and mortar seen as a safe investment, but Australia’s tax code means property investors can see enormous benefits at tax time. To make sure you’re getting the most out of your investment property, it’s important to understand the tax benefits available to investors.

-

Investment loans versus owner-occupier home loans

Learn about the key differences between investment and owner-occupier home loans and find the right type for your needs.

-

Buying an apartment checklist

A guide to buying a unit as a property investment, plus a helpful downloadable checklist.

-

What is the property clock and how does it work?

The property clock can help you determine the perfect time to buy and sell your investment, but how exactly does it work?

-

Buying an investment property in a trust

Buying property in a trust can offer tax benefits and excellent asset protection for investors. Here's how it works and some tips to bear in mind.

-

How foreigners can buy investment properties in Australia

The laws around buying Australian property using a foreign income have recently changed, so here’s what you need to do to invest in Australian property.

-

Housing bubbles explained

Is the market downturn evidence of a housing bubble about to pop? We look at property data and expert commentary on Australia's housing market.