Compare other products

We currently don't have that product, but here are others to consider:

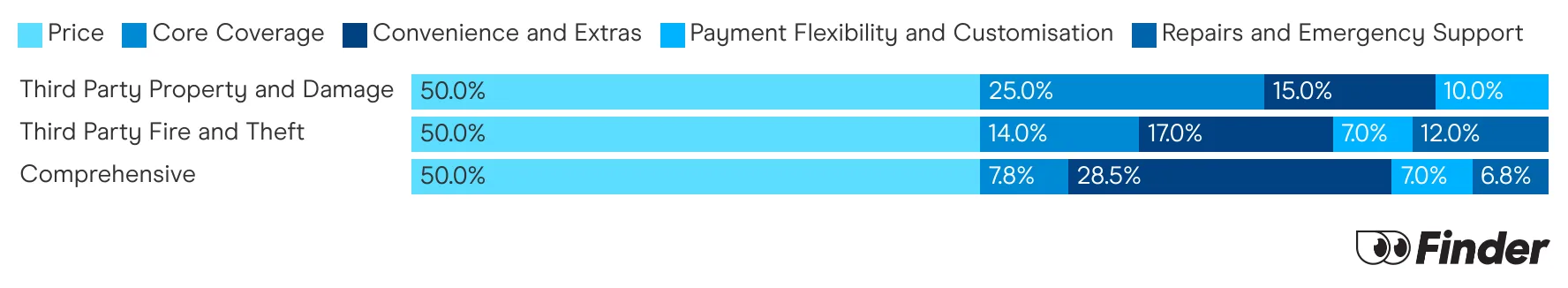

How we picked theseFinder Score for car insurance

We analyse over 30 car insurance products across insurance providers, and rate each one for price and features. We collect up to 36 quotes per product, for male and female drivers in New South Wales, Victoria, Queensland, South Australia, Tasmania and Western Australia. Quotes are collected for 20 year olds, 30 year olds and 60 year olds, assuming an excess of $850 for a 2020 Toyota Corolla 4 door sedan model, with an average 15,000 kms driven each year. While we are not allowed to display actual quotes, our Finder Score aims to serve as an indicative guide to how cost and feature competitive a product might be for you.

Our feature score assesses each product for more than 15 features across loss and damage coverage, repairs and assistance coverage, personal items coverage and policy coverage. Features we assess include but are not limited to legal liability, essential repairs, new car replacement, car hire events, roadside assistance, agreed or market value, windscreen damage and natural disaster coverage.

Depending on your answers to our car insurance quiz, we upweight the relevant price score or feature score to generate a dynamic Finder Score. Finder Score, Price Score and Feature Score are only to be used as indicative guides and are not product recommendations.

Key takeaways

- You do not need special insurance for a hybrid car. Regular car insurers will more than likely cover your vehicle.

- Your insurance might be more expensive, but this isn't always the case.

- There are some key features you may like to consider when insuring your hybrid.

How much does insurance cost for hybrid cars?

To help you understand how hybrid cars are priced in comparison to fuel cars, we've gotten quotes for both. Keep in mind, the cost of car insurance varies hugely based on a range of factors, including:

- The model of your car and how much it's worth

- Your age, gender, location

- Your driving record

- Your insurance history, like any previous claims you've made

- What level of insurance you pick and if you add optional extras

| Provider | Cost for hybrid model | Cost for fuel model | Difference in price |

|---|---|---|---|

| Budget Direct | $1,406.52 | $1,393.26 | $13.26 |

| AAMI | $2,062.20 | $1,861.49 | $200.71 |

| QBE | $2,064.36 | $1,875.95 | $188.41 |

| NRMA | $2,141.64 | $1,906.98 | $234.66 |

| Bingle | $1,005.56 | $972.90 | $32.66 |

Features to consider when buying car insurance for hybrids

You might like to consider the following features and benefits when searching for car insurance:

- Choice of repairer: If you have a trusted mechanic that knows the ins and outs of hybrid cars, you might like to opt for an insurer that lets you pick your own repairer. This means you can take your car to them in the event of an accident, rather than have your car repaired by another mechanic in the insurer's network.

- Agreed value: If your hybrid car cost you a pretty penny, it could be worth considering an agreed value. This is when you and your insurer agree on how much the car is worth in the event of a write off. Using agreed value can ensure your car is paid out for what you paid for it and not just what the market deems its value to be at the time of an accident.

- Charging specific contents: If your hybrid requires plug in charging then you might like to opt for an insurer that lists this equipment as covered. It's typically a feature of EV specific insurance but might be relevant to you based on the model of your vehicle.

Our expert says

"Insuring a standard hybrid vehicle shouldn't be difficult - it should be like insuring any other vehicle. So treat it as such. Spend time comparing your options — I like to collect a minimum of 5 quotes to get an idea of the costs out there, then I focus on what the actual differences between the policies are to help me find the best value one for my needs."

FAQs

Sources

Ask a question

More guides on Finder

-

How to register a car in Victoria

Find out how to get your car registration transferred in Victoria.

-

NRMA roadside assistance options compared

NRMA offers 3 levels of roadside assistance. We’ve compared the pricing and features of them all in this article.

-

Blue Slip NSW

Your guide to Blue Slips.

-

Car insurance multi-policy discounts

What you need to know about getting a multi-policy discount with your car insurance.

-

Rideshare car insurance

Find out what car insurance options are available for rideshare drivers, including Ubers.

-

Car insurance in NSW

Your guide to getting car insurance in NSW.

-

Car insurance for P-platers

Find affordable and comprehensive car insurance for P-platers with this handy guide.

-

Car insurance deals and discounts February 2026

Compare the latest car insurance discounts and deals to save further on your policy or access bonus offers. Discounts up to 25% for purchasing online

-

Car insurance for under-25s

Discover the steps to get affordable car insurance if you are under 25.

-

Compare third party car insurance

This article runs through the ins and outs of choosing a good third party property damage car insurance policy.