Budget Direct Contents Insurance

- 2023 Finder award winner for value

- Cheaper than many competitors

- Fire, storm and theft cover

Contents insurance is a type of home insurance. It covers the items inside your home, such as your TV, furniture or art, without providing any cover for the actual building.

You can buy contents insurance as a standalone policy or bundle it with building insurance. Standalone policies are ideal for renters and are generally pretty affordable.

Usually, contents insurance is highly customisable. You may be able to add cover for items you take outside of the home as well as for high-value items.

Most items within your home will be covered by your contents insurance. Although they vary slightly between insurance brands, the following are some common inclusions:

Many personal effects are also covered by home insurance, including the following:

Contents insurance kicks in when your belongings are damaged in a specific way. These are called insured events. Take a look at the events below so you know when you'll be covered.

| Insured event | Example | Watch out for |

|---|---|---|

| Fire | A bushfire or kitchen fire | ⚠️ Policies might not pay out for damage caused where there was heat but no flame. For example, smoke damage, scorching or melting. |

| Theft and attempted theft | Your home is burgled | ⚠️ Your policy won't pay out if the theft was by someone who entered your home with your permission. |

| Storms and rainwater | Surface run-off water enters your home | ⚠️ Unless you have flood cover, you won't be covered for water damage that's due to a body of water breaking its banks. |

| Escape of liquid | A pipe bursts | ⚠️ Contents insurance is unlikely to cover the cost of the item that caused the leak. |

| Lightning | Lightning strikes your home | ⚠️ The damage must be caused by a direct lightning strike or thunderbolt |

| Malicious damage | Someone breaks into your home and vandalises it | ⚠️ Your policy won't pay out if the damage was by someone who entered your home with your permission. |

| Impact | A tree falls on your home or a car loses control and drives into it | ⚠️ You won't be covered if you authorised a tree to be cut down and then it falls on your home. |

| Earthquake or tsunami | A tsunami hits your waterfront home | ⚠️ The tsunami must be caused by an earthquake rather than by "actions of the sea". |

| Breakage of glass, ceramic and sanitary features | A mirror breaks or the glass in a display cabinet breaks | ⚠️ Glass in TVs, tablets and mobile phones are generally not covered. |

| Explosion | Your water boiler explodes, destroying the furniture and belongings in the adjacent room. | ⚠️ Contents insurance is unlikely to cover the cost of the item that exploded. |

| The following insured events are usually optional extras: | ||

| Flood | A nearby river breaks its banks, flooding your home | ⚠️ This is usually an optional extra. You may have to pay more money for this cover. |

| Accidental damage | You spill red wine on the carpet or your dog knocks over your TV. | ⚠️ You won't be covered for general wear and tear, including chips, scratches and dents. |

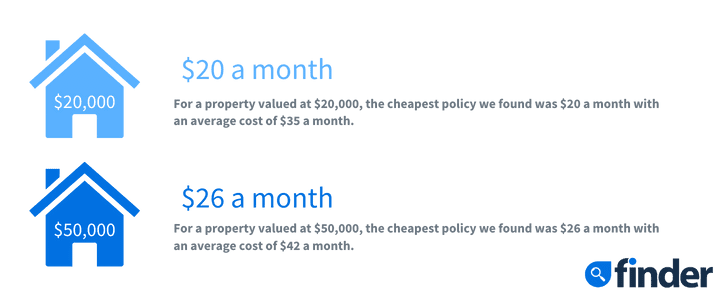

We got quotes from 14 different home insurers and found that policies can start from $23 a month.

When you get a quote from an insurer, it will probably vary from these prices because it's entirely based on the value of your stuff. But at least you get an idea, right?

Here's the rest of the research so you can see how different insurers stack up against each other on a monthly and annual basis.

| $20,000 of contents - Monthly price | $20,000 of contents - Annual price | $50,000 of contents - Monthly price | $50,000 of contents - Annual price | Get a quote | |

|---|---|---|---|---|---|

| $44.88 | 538.63 | $54.11 | $649.33 | More info | |

| $44.88 | 538.63 | $54.11 | $649.33 | Get quote | |

| $39.18 | $419.75 | $44.57 | $477.54 | More info | |

| $19.94 | $191.08 | $25.91 | $250.81 | More info | |

| $37.26 | $399.16 | $42.39 | $454.10 | More info | |

| $31.80 | $307.22 | $40.09 | $394.33 | More info |

| $24.65 | $281.70 | $25.88 | $295.78 | ||

| $25.05 | $250.51 | $31.07 | $310.75 | More info | |

| $59.47 | $713.64 | $72.59 | $871.02 | More info | |

| $34.72 | $351.27 | $37.99 | $380.30 | Get quote | |

| $33.31 | $336.05 | $35.69 | $360.82 | More info | |

| $35.04 | $354.78 | $38.29 | $384.11 | More info |

| $39.19 | $413.23 | $44.68 | $479.08 | More info | |

| $38 | $400 | $43 | $454 | More info |

| $39.51 | $396.62 | $42.35 | $429.39 | Get quote |

| $33.12 | $354.80 | $37.68 | $403.66 | More info |

| $32.81 | $354.29 | $35.16 | $379.76 | Get quote |

We rounded all the quotes to the nearest dollar. The customer profile had no previous claims and a $500 excess.

For contents worth $50,000, we found a difference of $620.21 between the cheapest and most expensive policy. Want to start saving? Compare prices and switch policies.

That's a tough one. It really depends on how much stuff you have and how valuable it is. Here are some tips on getting an accurate estimate:

Contents insurance comes with heaps of cool benefits. Some are included as standard, while others you can pick and choose. Take a look at some examples below.

If your home is unliveable, your contents insurance will pay for emergency accommodation.

Sometimes called personal effects, this extra benefit covers the things you take outside of your home. It includes jewellery and bicycles, but not phones or laptops.

Lots of policies will pay out if an insured event ruins the food in your home. For example, a burst pipe cuts the power and everything in your freezer is ruined.

This option covers you for loss or damage to electric motors, commonly found in appliances like fridges, freezers or washing machines.

Some policies will pay a benefit if your pet suffers an injury – regardless of whether it happened inside the home or out.

Contents insurance sets a limit for the amount you can claim per item. If you have any high-value items, be sure to specify them.

For the level of protection you get, contents insurance is pretty affordable. But there are still ways to cut the cost of cover and score a serious bargain.

Shop around. We compared the cost of $50,000 worth of contents insurance and found a difference of $482 between the cheapest and most expensive policy.

Look for discounts. Insurance companies often run deals to attract new customers. You can usually get up to 15% off a new contents policy. Check them out here.

Bundle cover. Some insurance brands will reduce the cost of your premium if you have more than one type of cover. Consider bundling your car insurance to save more cash.

Pay annually. You'll usually get a discount if you pay annually rather than monthly. Some insurers will also give you a discount if you buy online rather than over the phone.

Raise your excess. Choosing a higher excess will reduce the cost of your premium, but make sure the excess is affordable. There's no point pricing yourself out when it comes to claim time.

Don't be shy. Ask the insurer if there's any way you can get a better deal. They might be able to tell you about an offer that's running or give you a price cut.

Contents insurance helps in heaps of different situations, but it won't cover everything. Here are some common exclusions to be aware of:

Contents insurance covers most of your belongings kept inside the home. You don't need to insure the building since that's the landlord's responsibility.

It'll also cover some semi-permanent features – like air-con units, ovens and carpets – as long as you paid for them.

Check out our guide to renter's insurance for more information.

Landlord insurance covers both the fixtures and fittings inside your property, including built-in wardrobes, shelving units, ceiling fans and kitchen countertops.

You can also add cover for malicious damage and tenant default.

Check out our guide to landlord's insurance for more information.

You could save up to 15% on the price of your policy just by taking advantage of a sign-up offer.

Icons made by Vectors Market from www.flaticon.com

Picture: GettyImages

Shared housing is quickly becoming the answer to the skyrocketing cost of living, according to new research by Finder.

If the next Bitcoin bull run is about to start, what price can we realistically expect Bitcoin to reach?

Save up to $139 a year by using a 0% balance transfer credit card.

Find all the weekly tips from our Dollar Saver newsletter and see how you could save.

This supermarket gift card hack can earn you points while you buy a new phone.

The NAB Rewards Platinum offers up to 80,000 bonus NAB Rewards Points, a reduced first-year annual fee and other perks.

Grocery bills are a major source of stress for 2 in 5 Australians.

See if you can correctly guess the price of Bitcoin (BTC) each week and check back on Monday to see the results.

Simplify Used Car Loan.

Simplify New Car Loan.