Key takeaways

- There are a few ways to insure your holiday home but it depends on how you use it.

- If you're using the holiday home for yourself, you can choose from multiple home & contents insurance policies. If you want to rent out your home for something like Airbnb, you'll need holiday let insurance.

- Consider add-ons for your policy for more thorough coverage.

Finding holiday home insurance is easy. If you want to keep your holiday home to yourself, a home and contents insurance policy is the way to go. Just make sure to tell your provider if the place will be unoccupied for more than 60 days or you risk having your policy voided.

If you plan on renting out your place for longer than 90 days, you'll need to look for a policy like landlord insurance. For short stays like Airbnb, your best option is probably to go with a holiday let insurer like ShareCover.

Option 1: Holiday home insurance for your place

If you have a holiday home that you use for vacations and weekend getaways, you want to make sure it's properly looked after for when you're there and when you're not around. To do that, you'll need home insurance.

There's often one big difference between getting insurance for the house you're in most of the time and a holiday home — if you don't visit it for an extended period of time, it'll be considered unoccupied by the insurer. When this happens the insurer will usually either make you pay an additional excess (if you need to make a claim) or cancel your policy. This is generally around 60 days, but it can vary between insurers, so be sure to check when you're looking for holiday home insurance. Ask when you are buying a policy and you'll find that in many cases, you should be able to extend this date if you need to.

What are the benefits of getting holiday home insurance in Australia?

Holiday home insurance provides peace of mind. It can ensure that you're financially covered for the following:

- Storm and rainwater damage

- Fire damage

- Theft (or attempted theft)

- Escape of liquid (e.g. a burst pipe, especially important if you're not home)

- Lightning

- Impact at home (e.g a tree falls on your property)

- Breakage of glass and other fixtures

- Malicious damage, vandalism

- Earthquake or tsunami

- Furniture, furnishings and kitchenware

- Computers and electrical appliances

- Clothing

- Other valuables including jewellery, sunglasses and cameras

- Blinds, curtains, fitted carpets and rugs

Here's your holiday home insurance comparison

Compare other products

We currently don't have that product, but here are others to consider:

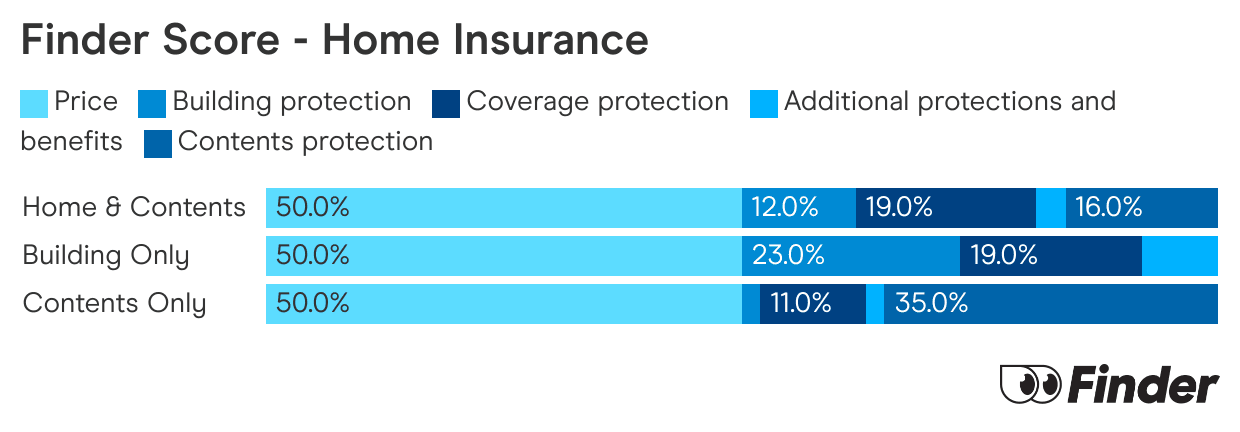

How we picked theseFinder Score - Home Insurance

We crunch eligible home insurance products in Australia to see how they stack up. We rank over 50 products on 16 different features, including price. We end up with a single score out of 10 that helps you compare home insurance a bit faster. We assess home and contents, building only and contents only products individually.

What's not included?

It's important to know what's not included when you buy home insurance for your holiday home.

- Renting out your holiday home. If you want to rent out your holiday home, a home and contents insurance policy won't cover you. You would need landlord insurance, and even then, most policies will only cover you if you're renting out for longer than 90 days.

- Failing to keep your home in a lived-in state. This might seem like a strange one, but it's for security purposes. If your house appears unkempt, for example the grass isn't mowed and the mailbox is full, it lets burglars know that nobody is home. Keep it tidy and any claims you make during this period won't be refused.

- Upsizing. If you renovate your holiday home, or add value to the property by making changes, make sure you adjust your cover accordingly. Otherwise those new additions might not be covered.

- Not looking after things. It might not be your main home, but you need to keep on top of your simple repairs. Insurers will expect you to fix leaks, holes and anything that might come under general wear and tear.

Option 2: Looking for something like Airbnb insurance?

If you want to rent out your holiday home, you generally have two options:

- Landlord insurance. Suitable for people who want to rent out their holiday home for longer than 90 days at a time.

- Holiday let insurance. Suitable for short stays like Airbnb or Stayz.

What's covered under these policies?

These types of insurance are a little like extensions for your standard home and contents cover. With it, you can be covered against:

- Malicious and accidental damage caused by tenants and their guests

- Theft by tenants and their guests

- Loss of rental income if a tenant defaults on payment

- Loss of rental income if your property is left uninhabitable following damage

- Loss of rental income if something happens to the tenant so that they are unable to pay

- Changing keys and locks if a tenant doesn't return the keys

- Loss of rental income if your property is left inaccessible and unrentable for reasons beyond your control

- Legal expenses incurred while taking certain actions against tenants

- Legal liability, such as if guests slip and fall, die, or otherwise hold you legally liable for their injury, death or property damage

- Damage to property contents that have been provided for guest use

What's not included?

These are some of the situations and events that a landlord or Airbnb insurance policy will not cover:

- For landlord insurance, you generally won't be covered for Airbnb or Stayz unless they are staying for longer than 90 days

- Some insurers will not cover you if you are only renting out a room (like on Airbnb) but are still living at the property

- Water entering the building through an opening made to renovate or extend the property

- Poor housekeeping by your tenants (e.g unhygienic or untidy living habits)

- General wear and tear, rust, mould or mildew

- Loss or damage caused by insects or vermin

- Repairs carried out by the tenant that you consented to

For a full list of exclusions, be sure to give the product disclosure statement (PDS) a proper read.

Frequently asked questions

Sources

More guides on Finder

-

Shed insurance

Shed insurance can cover sheds of all shapes and sizes, as well as their often-valuable contents.

-

Home insurance for water damage

Find out how home insurance can cover water damage and how to avoid some of the pitfalls.

-

How to cancel your home insurance

Cancelling your home insurance is actually quite simple and you can do it at any time.

-

Home insurance for an unoccupied home

It’s possible to get home insurance for an unoccupied home, you just have to let your insurer know.

-

Motor burnout insurance

Motor burnout covers those big appliances in your home in the event that they let you down. This article will show you what it is, why it's important and how much it can cost you.

-

Renters insurance

Find out what renter's insurance is, what it covers and how to find the right policy for your needs.

-

Find the cheapest home insurance and slash your premium

Follow these steps to find affordable home insurance that won't leave you stranded.

-

Best home insurance Australia

What you need to know about finding the best home insurance for you. Compare policies and learn what questions to ask when researching insurance policies.

-

Compare building insurance

Building insurance covers your home structure only, not the contents inside. Learn more about what is covered, what isn’t covered and compare your options today.

-

Compare home and contents insurance

Compare home and contents insurance - our research shows you can save up to $1,653 by switching.