If you need your tonsils or adenoids removed, private health insurance has you covered. All you need is a basic policy, and you can pick your own doctor to do the procedure. A basic policy can be quite affordable, and in addition to the tonsil and adenoid removal cover, you'll be covered for accidental injury, ambulance transport and more.

How does private health insurance cover tonsil and adenoid removal?

With private health insurance, tonsils or adenoids removal is covered with a basic hospital policy. It generally comes with a $500 excess and is classed as "surgical removal of tonsils or adenoids".

Whilst it can cost a little more, private health cover ensures your child's health is your primary concern, not the cost of treatment. There's also a lot less waiting around, so you or your child will get the procedure they need faster.

Private health insurance allows you to use the services of a private ear, nose and throat specialist (ENT), so you know your child is in the best possible hands. It also lets you choose your own doctor and when you want the procedure.

What does the operation for adenoid or tonsil removal involve?

Doctors usually place you under general anaesthesia during adenoid or tonsil removal. Because adenoids and tonsils can be accessed through the back of the throat, they don't need to make any external incisions.

The surgeon will cauterize and cut away your tonsils or adenoid tissue. In most cases, the surgery takes less than an hour, and you can go home on the same day. It's common that your doctor will remove both the tonsils and adenoids since they both cause similar problems.

What are the side effects of adenoids removal?

Although adenoid removal surgery is generally safe, the possible side effects and risks include:

- Swallowing problems

- Fever, nausea and vomiting

- A sore throat

- Sore ears

Although adenoid removal can improve sleep and reduce the occurrence of a sore ear and throat, it's important for parents to remember that they will not disappear completely.

What's the difference between a tonsillectomy and adenoidectomy at private or public hospitals?

A tonsillectomy or adenoidectomy can be performed at a public or private hospital. However, the cost, waiting times and extra benefits will differ depending on which system you are treated under.

- Public health system. While you can elect to have the surgery performed at a public hospital where the procedure will be covered by Medicare, waiting times can be as long as years and many patients don’t have the luxury of time.

- Private health system. Using the services of a private ear, nose and throat specialist (ENT) is quicker. However, the out of pocket expenses can run into the thousands of dollars if you’re not insured. Private hospital cover gives you the option of choosing the doctor you want as well as having the surgery performed when you want.

Public vs Private waiting list for tonsil and adenoid removal

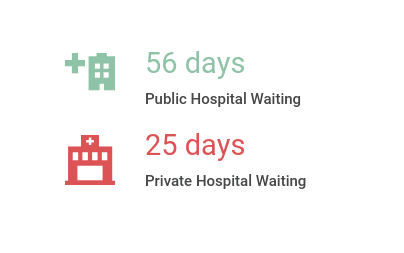

In 2016-2017, wait times for adenoid and tonsil removal in the public system was around 56 days. In private hospitals, waiting times were around 25 days.

Source: Australian Institute of Health and Welfare (AIHW) Private health insurance use in Australian hospitals 2006–07 to 2016–17

How much is health insurance including tonsil and adenoid removal?

You'll find this treatment in hospital cover. Below you will find a selection of policies from Finder partners that cover adenoid and tonsil removal. All have a 12 month waiting period for pre-existing conditions, and 2 months for new. All prices are based on a single individual with less than $101,000 income and living in Sydney.

Finder Score - Hospital cover health insurance

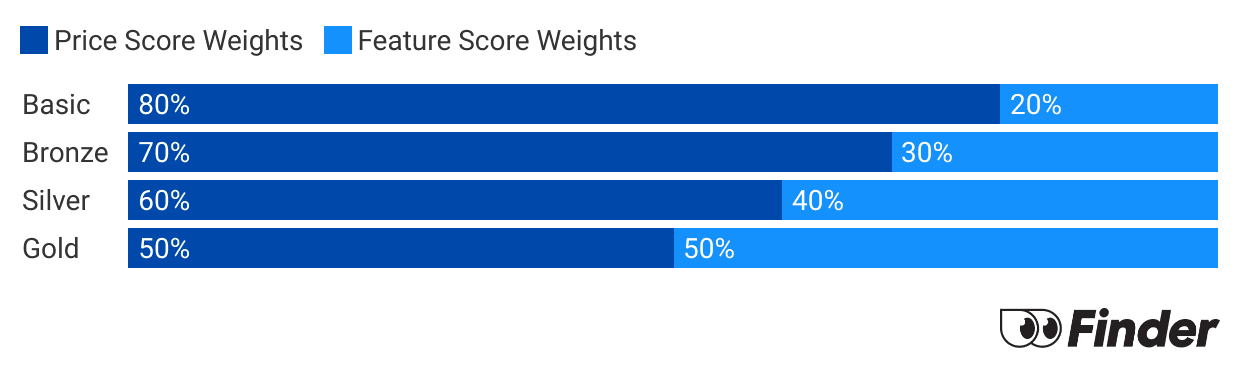

Each month we analyse our hospital insurance products and rate each one on price and features. What we end up with is a nice round number out of 10 that helps you compare hospital cover a bit faster.

Before we start scoring, we need to make sure we're comparing like-for-like. Just as it doesn't make sense to compare a bicycle with a Ferrari, it doesn't make sense to compare basic hospital policies to top-tier Gold policies. Each policy is given a price score and feature score. These are then combined to determine each policies's Finder Score.

Who can benefit from cover for removal of tonsils and adenoids?

The removal of tonsils and adenoids is a common procedure for children to have done, which makes having private health cover important for families. However, it’s not just children who have their tonsils removed, so it’s something to think about even as you get older.

Surgery to remove the tonsils and adenoid glands is covered by Medicare, but waiting lists can make public cover an unattractive option for children. This is one of the reasons why having private health insurance is so important. Not only can private health insurance help you avoid waiting lists, it also provides you with the opportunity to choose your own doctor.

What is an ENT doctor and how do you choose one?

- An ENT doctor is someone that specialises in ear, nose and throat (ENT). These doctors are also known as Otolaryngologists.

- Tonsillectomy and adenoidectomy procedures are typically performed by an ENT specialist and take about an hour to complete. Patients are required to stay overnight in hospital.

- You will need to see a general practitioner (GP) to get a referral to an ENT. Your GP may be able to recommend a preferred or trusted specialist, but you can also choose your own.

- Your insurer may be able to provide a list of ENT specialists who have a relationship or agreement with your fund. You can also check the registry of the Australasian College of Surgeons to find a doctor in your area.

Questions to ask you ENT specialist and insurer

The following questions will help you find a ENT specialist and prepare for a tonsillectomy or adenoidectomy procedure.

Questions to ask your insurer

- Do you have a list of preferred no-gap doctors?

- What is the waiting period? (The waiting period can be influenced by whether or not tonsillitis or adenoiditis is a pre-existing medical condition.)

Questions to ask your ENT specialist

- What are the costs for initial consultations, the procedure and follow up consultation(s)? (You will be given a list of the expenses you will incur and you’re required to provide consent to these charges.)

- What’s the best way to prepare for the procedure?

- What’s the best way to recover from tonsillectomy or adenoidectomy surgery?

Common questions about adenoid and tonsil removal

More guides on Finder

-

How does health insurance cover brain surgery?

Compare public and private health insurance for brain treatment.

-

Gold health insurance

Gold hospital insurance is the most comprehensive hospital cover that money can buy – starting from around $41 per week.

-

Silver health insurance

Guide to what is covered by silver tier hospital policies.

-

Health insurance tiers

Find out what health insurance tiers mean and how much you’ll pay.

-

Health insurance for home care

What is home care, is it included in Medicare and is any cover provided by private health insurance? Find out here.

-

Health insurance for drug and alcohol addiction

Addiction to drugs and alcohol is a growing problem in Australia and this guide looks at the financial assistance available to addicts seeking treatment and the role played by both the public and the private healthcare systems.

-

Inpatient and outpatient services

Find out if being treated as an inpatient or an outpatient will affect your private health insurance cover.

-

Health insurance for weight loss surgery

Health insurance for weight loss surgery comes with a 12-month waiting period, so it's worth getting sooner rather than later.

-

Basic hospital cover

Read our guide to see what is covered by Basic hospital policies in Australia.

-

Health insurance for insulin pumps

Insulin pumps are covered under all gold hospital policies, as well as on some Silver Plus policies. The details do differ between funds, however.