Finder launches app to help you save up to $8,496 per year

Finder's new app has launched with the aim to help Australians save.

Eight million Australian households are paying a hefty tax each year to stay loyal to their financial providers. Dubbed the "loyalty tax", it's costing Australians up to $8,496 per year across mortgages, savings, health insurance and credit cards and it's entirely avoidable.

Finder calculates Australians could save $253 in one year if they transferred their balance to a 0% balance transfer card (based on the average balance of $3,271). However, despite the possible savings, only 7% of Australians are planning to switch in the next 12 months.

It's a similar story with home loans. The average Australian mortgage holder has been with the same lender for 7.2 years even though the RBA cash rate has dropped 4 times since June 2019. With the average home loan balance of $494,414, Australians could save $6,826 per year by switching from the average variable home loan rate of 4.55% p.a. to the lowest rate in the market, currently 2.49% p.a.

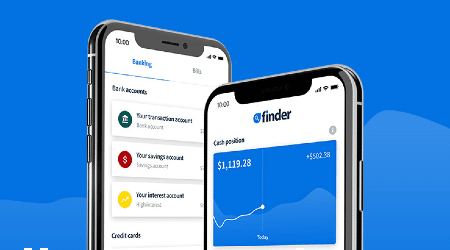

To help Australians switch from their providers and save, Finder has launched the Finder App. By connecting your bank accounts, the app will analyse your financial products and spending to notify you of possible savings across all of your credit cards, home loans, health insurance and savings accounts. It's powered by Finder's comparison engines.

Finder co-founder Fred Schebesta said with the recent economic uncertainty, the best way to recession-proof your finances is to have a good understanding of your financial position.

"As we move into a period of economic uncertainty, we urge you to make smarter decisions with your money to ensure you're not paying too much for financial products.

"The Finder App has been created to empower Australians to make better financial decisions with their own data. We want to help more people find better deals and put money back into their pockets," he said.

Finder's Loyalty Tax report found only 59% of people felt they were getting good value from their financial products but they rarely switch. On average, Australians have been with the same mortgage provider for 7 years, the same health insurer for 10.6 years, the same credit card provider for over 11 years and the same savings account provider for 13 years.

"Consumers often think it's not worth their time switching to a different bank or insurance provider, but our research shows that the average Aussie household could have over $8,000 per year by doing so," said Finder's insights manager Graham Cooke. "Based on the average savings balance of $29,270, Aussies could make an extra $2,346 in interest over three years just by switching savings accounts.

"We often say it pays to do your homework – well, the Finder App can do your homework for you."

You can download the Finder App now on the App Store or Google Play store.