Three incredible new features now in the Finder app

You asked, we listened. Help is here to find out your chance of approval before applying for a personal loan, and track more in the Finder app.

I'm so excited to tell you about some incredible new features. Not one. Not two. BUT THREE!

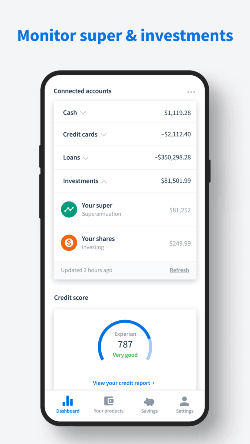

1. Connect your super funds

Do you ever wonder how your super is going? Do you want to know how much money you have in your account? Do you wish it was easier to track account activity? Now, you can.

There are 27.5 million super accounts in Australia, worth about $3 trillion. And there is $20.8 billion in lost and unclaimed super. While it's one of those things that most of us don't worry about until it reaches a substantial amount or when you're closer to retiring, your super is something worth tracking and comparing funds.

There can be big differences between the performance of super funds, which can make a big difference to how much you end up with when you retire. By connecting your super accounts in your Finder app, you'll know how your fund is doing at any time.

Steps to connect your super accounts:

- Open your Finder app on your phone and click on "Your products" at the bottom of the screen.

- You'll see a blue "+" button at the bottom right corner. Click it and then click "Connect a new account".

- Search for your super fund in the list. Once you have found your fund, fill in your login details and connect.

- Your account should now show up in your dashboard.

You can also connect your account in the "Settings" tab by clicking on "Connect account" and following steps 3 and 4 above.

2. Connect your investment platforms

There is a huge spike in people looking at investing right now, especially those who have never invested in the stock market before. We recently conducted a survey and found that 1 in 10 Australians have planned or are planning to invest in the share market during the current dip. Google trend data shows that we rank number one globally for the highest volume of searches for the term "buy shares".

With so many platforms to trade investments like stocks and other securities, it can be hard to keep track of your investments. So we've tried to make it easier by connecting with investment platforms. This will allow you to see everything together in your dashboard and to get an insight into your total investments.

Much like the new super feature and your other bank accounts, follow the same process as above to connect your investment accounts.

3. Chance of approval

3. Chance of approval

One of the most frequently asked questions on Finder is "Will I get approved?" When applying for credit, such as a personal loan, credit card or home loan, many people fear rejection and how it could impact their credit score.

And rightly so. Every credit application is recorded on your credit report and stays there for up to seven years. If your application is rejected, this will also be recorded on your file and it could even reduce your credit score and your chances of being approved for a loan.

We understand that fear and we want to remove it. We want to replace the anxiety and stress with confidence and relief so that you can find a better deal. To do this, we have built a chance of approval feature into the Finder app!

This feature helps you determine the likelihood of getting approval, starting with unsecured personal loans and rolling out to credit cards and home loans next month. It's not a guarantee that you will be approved, but it can help you narrow down your choices when comparing products.

The best part? It won't impact your credit score or show up in your credit file. And it's also completely free.

How do we do it?

Once you unlock your credit report in the Finder app – which is free to do – your credit file will be automatically analysed and compared against other Finder users.

We analysed over 250,000 anonymised credit reports over the past 5 years. This looks at credit limits, age and employment as well as defaults, late payments, bankruptcies, length of time at addresses and other factors.

When you're searching for unsecured personal loans in the Finder app, by either clicking on your existing personal loan product to do a Quick Compare or finding a new loan at the bottom of your dashboard, you might be asked for a few more bits of information and then you will see a box under each product with an emoji ranging from "not likely" to "very likely".

This is the first time in Australia where you will be able to access an ongoing chance of approval every time you compare products.

🚀I am so keen to share with you the most complete picture of your finances in Australia. You can now see all your financial products in one dashboard, get your credit report and know your chance of approval – with the help of one free app. I hope you enjoy it! 🚀

Stay up to date with all things app on the Finder app blog.

3. Chance of approval

3. Chance of approval