Week 1 tasks

Estimated completion time: 15 mins

- Get your free credit report and credit score now

- Get a clear picture of your current financial situation

- Set a realistic financial goal

When you complete these tasks you'll have a much better idea of where you're at financially.

Let's get started

Welcome to finder's financial bootcamp, a seven-week crash course that will teach you how to take control of your finances and get your money into shape for life.

Week 1 is all about becoming your own personal accountant.

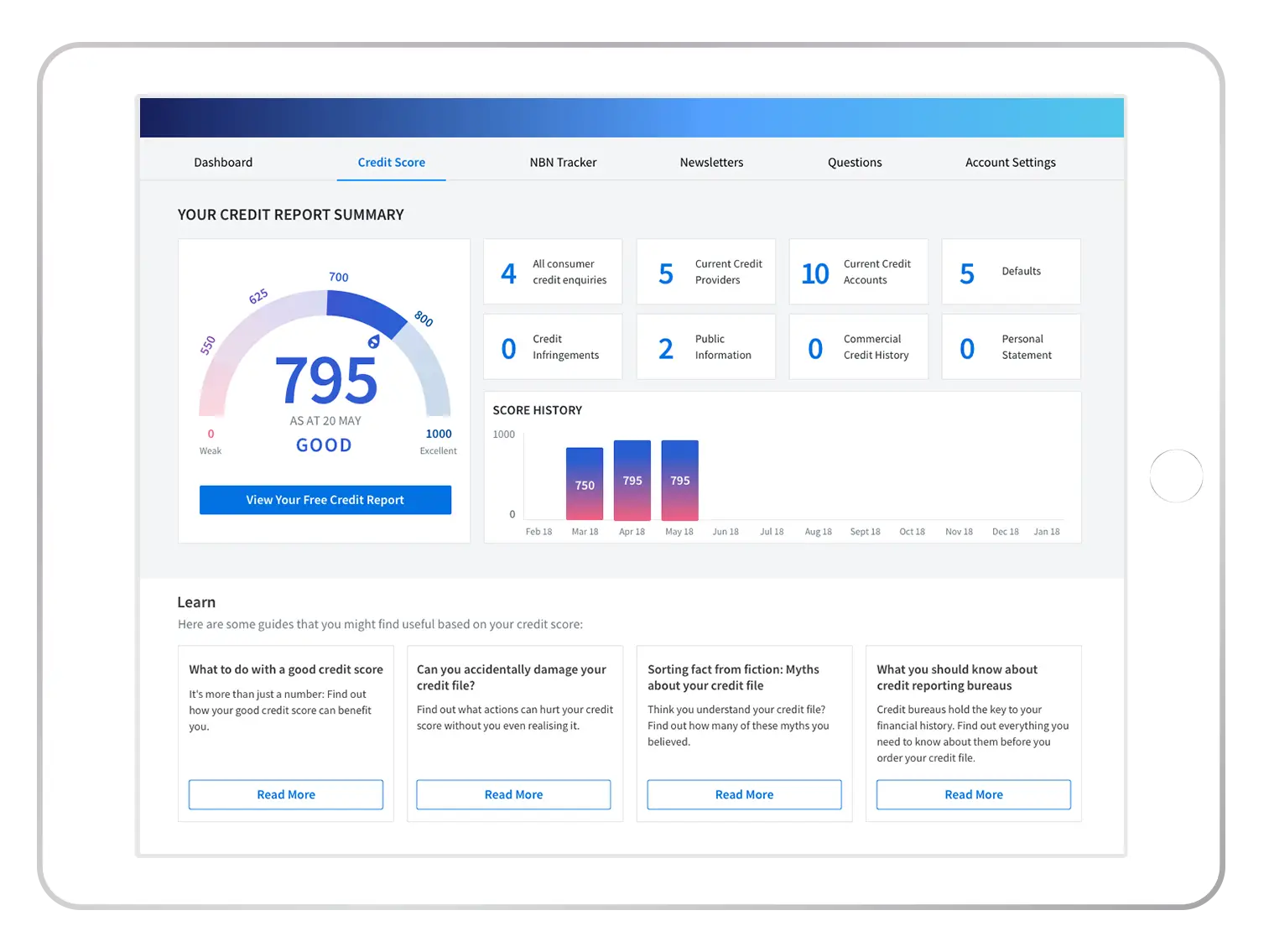

Step 1: Get your free credit report and credit score

This will only take five minutes and will let you know exactly where you stand financially. Just make sure you have your driver's licence handy as that will be used to verify your identity. Click here to get your free credit report now.

So why is it important to know your credit score anyway? Basically, a credit score is what lenders use to determine your ability to repay debt. Whether you want a home loan, a car loan or even a new credit card, a good credit score is crucial to your chances of borrowing money in the future. Once you know your score, you’ll have the full picture and you'll know what to do if you need to improve it.

Step 2: Get a clear picture of your current financial situation

Before you can start thinking about your future money goals, the first step is to get a clear picture of your current financial situation. Your credit score sums up your overall credit position. It’s calculated based on the information in your credit report, which includes details of your history of paying off credit cards, loans and other bills, such as your utilities.

Because your credit score is used to determine your ability to repay debt by lenders, a good credit score is crucial to your chances of borrowing money in the future.

So, what is a good or bad credit score? An Experian Credit Score is a number between 0 and 1,000. The higher your score, the better.

Experian Credit Score

| Credit Band | Score |

|---|---|

| Excellent | 800-1,000 |

| Very Good | 700-799 |

| Good | 625-699 |

| Fair/Average | 550-624 |

| Weak/Below Average | 0-549 |

There are plenty of simple things you can do to improve your credit score, such as disputing any incorrect listings and taking care not to submit multiple applications for credit in a short space of time. However, the most important step you can take is to understand and take control of your debt.

Step 3: Set a goal

Now that you have a better overall picture of your finances, it’s time to sit down and start visualising your financial future and what you want to achieve. At the end of this seven-week course, where do you want to be?

Are you saving towards a specific goal, like or buying a new car? Do you want to pay off your credit card debt and start putting some money aside for a rainy day? Or do you just want to finally feel like you’re in control of your finances, and that you’re not simply surviving from one payday to the next?

You’ll need to work out the following:

- What you want to achieve.

Your goal could be to save a specific amount, pay off all your debts or just get to a point where money worries don’t control your life. - When you want to achieve it by.

Putting a timeframe on reaching your goal will motivate you to take action.

Once you have a clear goal in mind, you can realistically devote yourself to controlling your spending, paying off your debts and saving for a brighter financial future.

- Have a good understanding of your current financial situation

- Have a crystal-clear picture of your financial goals

Coming up next week...

Next week, we’ll focus on making a budget and sticking to it – a crucial step on your journey to better financial health.

Back to topAsk a Question

I don’t much credit card debt but looks like I am in an never ending loop of using my credit card and this is making me hold onto this debt . How can I break this cycle in a practical manageable way?

Hi Srinivas,

Thank you for your question.

You might want to check our tips to pay off your credit card. Hope this helps!

Cheers,

Reggie

I would like to apply for a 0% credit transfer to get some credit card debt under control. I have been unsuccessful once already and not sure what i can do now

Hi Kristine,

Thank you for leaving a question.

You may refer to our list of 0 balance transfer fee credit cards. Kindly review and compare your options on the table displaying the available providers. Once you have chosen a particular provider, you may then click on the “Go to site” button and you will be redirected to the provider’s website where you can proceed with the application or get in touch with their representatives for further inquiries you may have.

Before applying, please ensure that you meet all the eligibility criteria and read through the details of the needed requirements as well as the relevant Product Disclosure Statements/Terms and Conditions when comparing your options before making a decision on whether it is right for you. Hope this helps!

Cheers,

Reggie

Will personal details such as current employer affect chances of approval from credit providers? When I got my free credit score, I can see that my listed employer is from a job I had back in 2011!!! Just wondering if I should get this fixed?

Hi Victoria,

Thank you for leaving a question.

There are a lot of factors that will affect the outcome of your credit approval. Payment history, level of debt, the age of credit history, types of credit accounts, and inquiries to your credit report. Your employment status and salary are not factors that directly impact your credit score. You may have a correction done by contacting the credit reporting agency and have the correction done. Hope this helps!

Cheers,

Reggie

How long should I have to wait for reapply home loan after declined first one when your credit score is good?

Hi Niharlika,

Thanks for your message and for contacting finder.

Sorry to hear that you’ve been disapproved of a home loan. The first thing you can do is minimize any inquiries or applications with any credit providers or lenders. Secondly, check your credit score periodically. If you are reapplying from the same lender, you may ask them how long you can wait until you can re-apply. Otherwise, if you are looking to apply for other lenders, check their eligibility criteria and requirements needed before you apply for a loan.

Hope this helps! Feel free to message us should you have further questions.

Best Regards,

Nikki