eToro adds BNB token with Binance’s blessings

This might be a major shift for BNB markets.

eToro blazed a new trail with its concept of social trading as a platform where people can copy successful traders' trades and enjoy a more social market. It's now added Binance's BNB token, with Binance's blessings, and in the process, it might become a significant addition to the BNB ecosystem.

"We are honoured and excited to be listed on eToro. With this addition, the Binance coin can reach millions more people, many of whom are more accustomed to the traditional financial industry. As a utility token, we believe in creating long-term utility and value. We will continue to do so together with eToro," said Binance CEO Changpeng Zhao.

Why it matters

OPINION

The thing about open and public cryptocurrencies like Binance's BNB token is that anyone with the means and desire can own or trade it, and any exchange with the means and desire can similarly start listing it.

But so far, Binance has naturally commanded the lion's share of the BNB market.

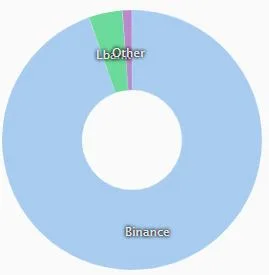

Source: Coinlib.io

The above donut shows the total trade volume of BNB. The blue is Binance, the green is LBank and the purple is everything else, of which there isn't much.

And the LBank segment should be taken with a grain of salt. Statistical analyses of wash trading in cryptocurrency tend to mark LBank as one of the more consistently outrageous offenders. It has also been accused of shadiness in other areas, such as trying to sell coins that have yet to be released.

LBank is saying it's responsible for 4.5% of BNB's trade volume, but there are good reasons to believe it really doesn't and that the green wedge of the donut doesn't really exist. That leaves the purple-frosted region, which is predominantly composed of HitBTC and its approximately 0.7% of BNB trade volume across all pairs, and a smaller fraction of a percent being reported by the Exrates exchange.

Essentially, almost all BNB trade volume is solidly locked up on Binance alone. eToro's addition will be cracking open the market for the coin much more widely than it is now. In particular, it will be reaching an entirely new audience that isn't yet on Binance and giving it solid, prominent fiat links for the first time. Binance is still working towards accepting fiat deposits, and although Exrates offers USD/BNB pairs, the volume isn't really there.

The eToro listing, therefore, stands to bring a fundamental shift to BNB markets.

Plus, the unique nature of BNB, from a speculative perspective, combined with eToro's wide user base and social trading elements, might have other interesting results.

A curious token

Binance's BNB token prices have tended to be quite robust compared to most other cryptocurrencies. Currently, BNB is only down 62% from its all-time high in January according to LiveCoinWatch. This is in contrast to an 87% and 88.5% drop for Ether and XRP respectively, and a 68.5% drop for bitcoin.

This might be because the backing and value of BNB is relatively easy to work out compared to the more ineffably valuated cryptocurrencies like bitcoin. It can be used to pay trading fees at a discount on the Binance exchange, so theoretically there should be some demand as long as Binance remains widely used. Binance is currently the world's number one exchange by volume, so there doesn't seem to be any danger of that undercurrent of demand falling off.

It also carries certain voting rights on Binance, which can be worth a lot, and going forwards it will be a gas-like centrepiece of the upcoming Binance decentralised exchange. Binance is also taking steps to encourage its use elsewhere as a kind of ecosystem token, with some light preferential treatment for third-party projects that incorporate the BNB token into their own ecosystems. Beyond that, BNB is also getting integrated into systems like TravelbyBit, which means it's a useable payment method in places like Brisbane airport and Queensland tourist trails as well as anywhere else TravelbyBit is found.

In short, it might be a tempting option for speculators where other cryptocurrencies aren't, and there are probably a lot of people on eToro who will be curious about the investment potential of this curious token.

"Despite sensational headlines about the death of crypto, we continue to believe in the potential for crypto assets, as do our clients who are increasingly looking to diversify their crypto holdings. In response, we will continue to add the leading crypto assets to our range and we are pleased to add BNB to the platform," said Yoni Assia, co-founder and CEO at eToro. "As a regulated securities broker, we have the ability to offer both utility and security tokens on our platform. We support the movement of assets onto the blockchain and the tokenisation of securities. In fact, we believe that in the future we will see the greatest transfer of wealth ever, onto the blockchain."

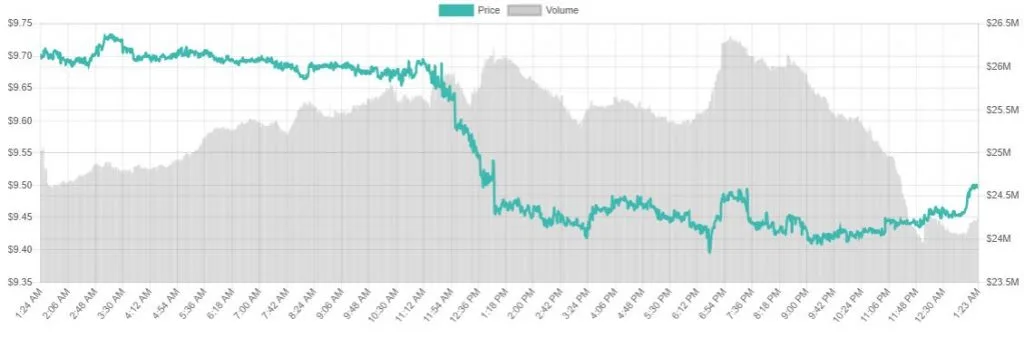

At the time of writing, BNB prices and volume have yet to discernibly respond to the new listing, but might start stirring soon. It might be reasonable to assume that things will start happening at eToro's BNB markets soon.

BNB over the last 24 hours. Source: LiveCoinWatch

Disclosure: At the time of writing, the author holds ETH, IOTA, ICX, VET, XLM, BTC and ADA.

Latest cryptocurrency news

Picture: Shutterstock