EOS’s next problem: Curbing the speculative EOS RAM trading market

EOS is currently more expensive than Ethereum after falling victim to its own block producers.

EOS might be thought of as a human-powered blockchain. Unsurprisingly, this type of system has led to a series of problems ever since it launched onto mainnet, which was itself complicated by the very human problem of justifiably apathetic voters.

It ended up having to settle a series of arbitrary conflicts between EOS community members, who gleefully turned to the dispute resolution system as a way of airing personal grievances.

"We have seen that if you give people arbitrary power to resolve arbitrary disputes then everything becomes a dispute and the decisions made are arbitrary," lamented EOS founder Dan Larimer. This was solved, in a fashion, by scrapping all arbitration powers from the system.

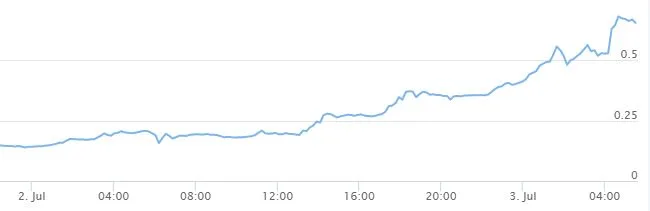

The hot new problem is now rampant speculation on EOS's supply of system RAM.

EOS is powered entirely by 21 block producers, who are responsible for putting resources like RAM into the system and setting prices for each. Each of them runs a powerful server, most of which are actually being maintained by cloud service providers like Amazon and Microsoft.

In a nutshell, the current system has block producers paying standard fees to those cloud service providers, then deliberately being a system bottleneck for the purpose of creating artificial scarcity and driving up the price of the system resources they control. These system resources have now spawned a secondary market of their own, and RAM is being traded as a speculative asset.

Anyone who wants to actually use the EOS platform needs to purchase RAM from somewhere, either by cutting a deal directly with block producers or by going through this monumentally expensive secondary market. The only real fear for RAM prices is that block producers might release a lot more into the circulating supply to crash prices, but they know exactly when and how this will happen and have little reason to devalue the asset that they can control.

At the time of writing, RAM on EOS is going for about 0.65 EOS/KB, or somewhere in the ballpark of US$5 per kilobyte. Actually trying to use the EOS platform for a large scale application is set to cost somewhere in the ballpark of hundreds of millions or billions of dollars at market prices.

As it stands, EOS is relatively cheap for users but extraordinary expensive for anyone who actually wants to develop an application for those users. Those users will have to pay the cost of creating an EOS account though, which currently stands somewhere in the field of US$20.

With developers being unable to use it and users having less than zero reasons to use it, this is very bad news for EOS.

It's also worth noting that the only reason EOS even went for all the downsides and sacrifices of a human powered blockchain was so it could sidestep the cryptocurrency scaling trilemma and create a faster and cheaper network than Ethereum – at the cost of decentralisation.

It's now considerably more expensive than Ethereum for all practical purposes.

Who's buying all the RAM?

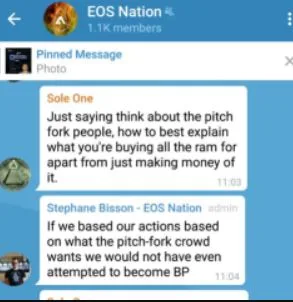

It's the new, highly speculative deflationary asset of the EOS network, so now everyone is trying to get a piece of the pie. Judging by the EOS Nation history, they seem to have been the first to kick off the trend.

Scenes ostensibly taken from their Telegram seem to confirm it, and that they know exactly what they're doing.

What's the solution?

As EOS Nation said, their goal is to make money not friends, and making money is the only reason to become a block producer in the first place. No amount of cooing about EOS's sense of community can solve this problem. If nothing else, it highlights that block producers cannot be trusted.

With EOS's current dire state of being, a rational block producer wants to make as much money as possible as fast as possible, then get out while the thing crashes and burns behind them.

The go-to solution would probably be to amend the EOS constitution again and this time ban speculative hoarding of EOS system resources, but at that point, you're well and truly in a cycle of just trying to slap down one human-made loophole after another. To make matters worse, you can't even amend that constitution without majority approval from the very same block producers who are proving themselves hostile to the system.

Another possible solution is for Block.one to use its majority control of the EOS network to handpick block producers and start running EOS as a centralised entity. But at this point, it's blatantly just a brokerage service with its own token, buying network resources from different providers and then selling it onwards at a profit to gullible users.

A third option is some sort of automated system to enforce fairer RAM prices. It would have to be tamper proof though and free from the influence of hostile block producers. Ideally, it would also be relatively cheap to run. An Ethereum contract could probably do it.

At the time of writing, EOS is the number five coin by market cap, with prices up over 15% in the last 24 hours.

Disclosure: At the time of writing, the author holds ETH, IOTA, ICX, VET, XLM, BTC and NANO.

Latest cryptocurrency news

Picture: Shutterstock