Energy suppliers are diversifying in Australia, and that’s a good thing

New gas, solar and hydroelectric power options are reaching the market.

Energy's a contentious topic, especially in Australian politics. Amidst the mudslinging, coal flashing, greenie slagging and general unpleasantness, one of the few points of agreement is that most Australians are paying too much for their power supply and prices are going up too fast. Indeed, over the last decade we've seen energy prices rise by 63%, which is way above the level of inflation.

There are no easy fixes to the problem, but coming up with more diverse sources for our power supply is definitely a good place to start. Happily, we've seen a few examples this week.

Tesla scored lots of headlines with the announcement that the project to build the world's largest lithium-ion battery in South Australia has been a big success, and will potentially be followed up with 50,000 homes in South Australia getting their own batteries and solar panels.

However, we're also seeing more traditional forms of generation expanding. AGL has begun constructing a gas-fired power station in Adelaide, which will supply 210 megawatts when completed. Having roasted through far too many SA summers, having a diversity of supply seems very desirable.

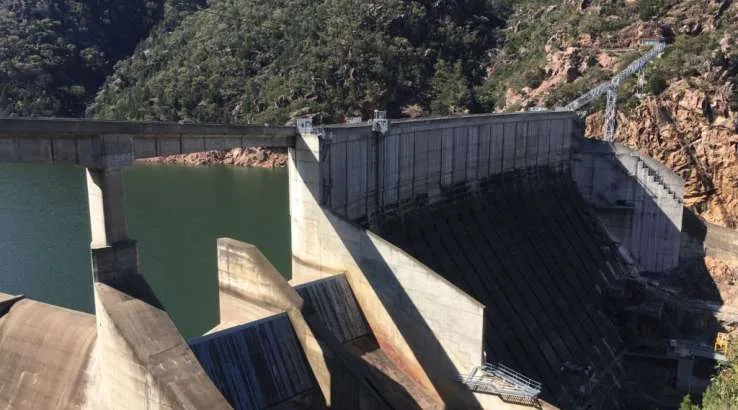

Over in NSW, Powershop announced that it had acquired three hydropower stations in Hume, Burrinjuck and Keepit. Those are the first hydro assets in the portfolio for Powershop's owner, Meridian Energy, which already has wind power generation options.

Like most suppliers, Powershop sources energy from its own assets and the national market, but it says the mix of technologies will be key to ensuring a reliable supply. "The opportunity to acquire hydro assets in Australia is extremely rare and having a balanced portfolio of wind, solar and hydro allows us to more effectively manage risk in the market," CEO Ed McManus said.

Shifting to more renewable sources is also crucial if we want to lower carbon emissions. There's still plenty of bile and rhetoric to come, I fear, but the fact that new options are slowly emerging suggests that there will be light at the end of the (wind) tunnel. In the meantime, the best thing individuals can do to cut their bills is to start comparing their options rather than just lazily sticking with their current provider.

Angus Kidman's Findings column looks at new developments and research that help you save money, make wise decisions and enjoy your life more. It appears regularly on finder.com.au.

Latest news headlines

- How high can Bitcoin actually go?

- Save up to $139 in a year with a 0% BT card | Dollar Saver tip #78

- Woolworths Qantas iPhone deal: Get 20,000 Qantas Points

- Cost of grocery staples skyrocket up to 31%: here are the most expensive items

- Card-astrophe: Australians lost almost $1 billion to scammers in past year

Picture: Powershop