Dead cat bounce or shining recovery? The RBA holds as house prices rise

Here are four things to watch in the Australian housing market.

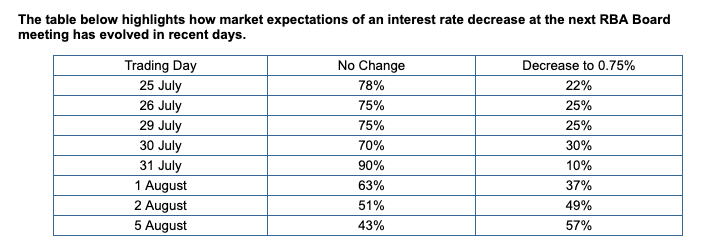

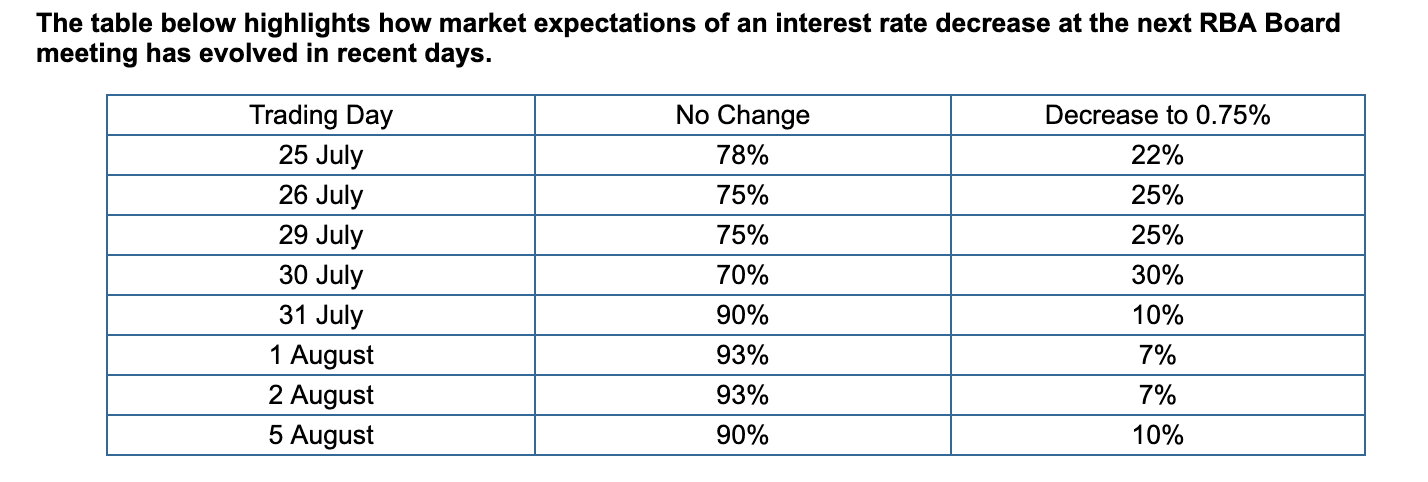

I woke up this morning fully expecting a cash rate hold as almost all (96%) of the economists surveyed by Finder ahead of this decision said they expect the RBA to hold the rate steady at 1.00%. However, with US stock markets tumbling overnight and the ASX starting off the morning by diving swiftly into the red, it looked as if the economic situation may have been worsening. The ASX's cash rate change predictor was indicating a 10% likelihood of a cut on 31 July, which increased to 57% by Monday. However, in the lead-up to the RBA decision, markets stabilised and the ASX swiftly edited its prediction page to show a 10% likelihood of a cut. In the end, the day finished relatively drama-free with the RBA holding its cash rate (and maybe its breath).

Here's the ASX's RBA cash rate predictor table at 8am on 6 August 2019:

And here's the ASX's RBA cash rate predictor table at 1:50pm on 6 August 2019:

At this stage, we're still waiting to see what the full effect of the recent cuts will be. Here are four things to keep an eye on in the housing market for August 2019:

#1 Home loan rates

Following the RBA's 50-basis-point cut, the Big Four banks cut their standard variable rate by 43 basis points on average. While I would have hoped for more, this will represent a significant saving for homeowners. An owner-occupier with an $800,000 loan could expect to save over $75,000 across a full 30 years of borrowing – however, savings for individual homeowners will depend on the amount outstanding and the rate being paid.

We are seeing fixed loans as low as 2.75% on the market right now, so there is value to be had for homeowners willing to switch and bank on no more cuts coming in the near future.

#2 Property prices

After a promising start last month, property prices continued to recover in July, albeit at a moderate +0.1% rate when averaged across the capitals.

Darwin +0.4%

Hobart +0.3%

Sydney +0.2%

Melbourne +0.2%

Brisbane +0.2%

Perth -0.5%

Adelaide -0.3%

Canberra -0.2%

We asked our panel of leading economists for their predictions of property price changes over the next 12 months. Canberra topped the growth charts, with 2.27% growth predicted on average. Hobart (2.19%) and Brisbane (1.81%) rounded out the top three. While it must be noted that these are moderate figures, it's good to see some positivity about the next 12 months.

| City | Change | Average house price, 6 months to April 2019 | Predicted average house price, 12 months |

|---|---|---|---|

| Canberra | 2.27% | $660,000 | $674,960 |

| Sydney | 1.48% | $900,000 | $913,286 |

| Melbourne | 1.57% | $730,000 | $741,471 |

| Brisbane | 1.81% | $558,000 | $568,114 |

| Perth | 0.75% | $515,000 | $518,863 |

| Adelaide | 1.50% | $485,250 | $492,529 |

| Hobart | 2.19% | $470,000 | $480,281 |

| Darwin | 0.80% | $490,000 | $493,920 |

#3 Auction clearance rates

While auction clearance rates have been relatively healthy recently, we've seen a slight decline in Sydney and a stagnation in Melbourne.

| Date | Sydney | Melbourne |

|---|---|---|

| 3 Aug | 71% | 74% |

| 27 Jul | 73% | 74% |

| 20 Jul | 77% | 74% |

| 13 Jul | 71% | 65% |

| 6 Jul | 69% | 68% |

| 23 Jun | 67% | 69% |

Source: Domain

#4 The economy: Is this a recovery or a dead cat bounce?

A "dead cat bounce" is a temporary recovery in the value of a declining asset – the last gasp for breath before a doomed trendline plunges down and to the right. Are these price increases a sign of green shoots on the horizon, or are we in the middle of a dead cat bounce?

Well, the first thing to note here is those auction clearance rates. While they look okay on the surface, they are based on only around 320 auctions in Sydney last weekend and 450 in Melbourne, depending on whose number you look at. In the last week in February this year, we saw lower clearance rates but 670 properties auctioned in Sydney and 950 in Melbourne.

One of the reasons these clearance rates are so high may be that there is so little property on the market. Separate CoreLogic data shows a 22% year-on-year decline in the number of newly listed properties, with properties staying on the market for longer than usual.

However, lenders are reporting an increase in inquiry numbers, and we've seen a jump in traffic to our home loan pages – so there definitely appears to be growing interest out there.

So, are the dog days over, or is there more misery on the horizon? The true answer is we don't really know. When we asked economists what their main economic concern was, the US-China trade deal came out on top. In fact, it was China's devaluing of its currency that caused the stock market tumbles we saw today. Prospective buyers and homeowners would be advised to keep their eyes peeled and their investment closely monitored in these... ahem... interesting times.

Graham Cooke's Insights Blog examines issues affecting the Australian consumer. It appears regularly on finder.com.au.

Picture: Getty