Important information

On June 2023, Circle Alliance Bank has merged with Bendigo Bank.

Existing Circle Alliance Bank customers will be notified directly about changes to their banking.

On June 2023, Circle Alliance Bank has merged with Bendigo Bank.

Existing Circle Alliance Bank customers will be notified directly about changes to their banking.

Set up by members more than 50 years ago, Circle Alliance Bank now offers banking products and services to more than 5,000 customers around Australia. With branches in Deer Park, Victoria, and Murarrie, Queensland, it is backed by Bendigo and Adelaide Bank.

Circle Alliance Bank is part of the Alliance Bank Group. This Group was formed following the alliance of four independent mutual entities (Circle Mutual Limited, BDCU Limited, AWA Mutual Limited and Service One Mutual Limited) with Bendigo and Adelaide Bank. This partnership means that Circle Alliance Bank can offer an extensive range of banking products on behalf of Bendigo and Adelaide Bank, but it also gets to maintain its history and presence in the community.

As well as home loans, personal loans, credit cards and insurance solutions, Circle Alliance Bank offers a number of transaction and savings accounts. These accounts combine a variety of flexible features with easy access to your funds, including the ability for Circle customers to use rediATMs Australia-wide without incurring any fees.

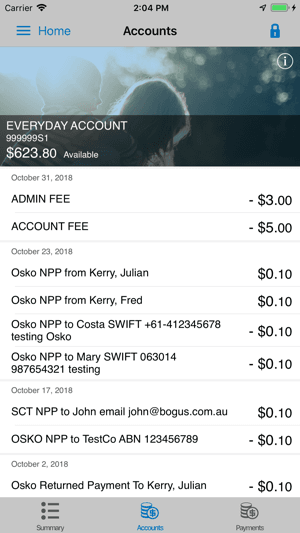

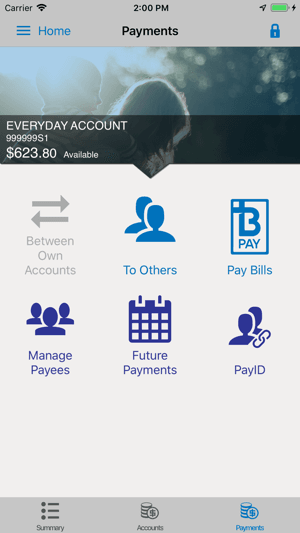

Every Circle Alliance Bank customer can manage their accounts via the bank’s Internet banking portal. This allows you to check your balance, transfer funds and update your account details online.

| Login page | Accounts | Payments |

|---|---|---|

|  |  |

A Circle Alliance Bank General Account offers a Visa debit card and provides easy access to your account via electronic and physical means. A monthly fee applies per card linked to the account and the minimum balance required is $1.

Designed to help you save money so you can cope with the cost of Christmas, the Christmas Club Account combines a competitive variable rate with no monthly fees. You can only access your balance between November 1 and December 31 each year.

Earn tiered interest on this interest-bearing account from Circle Alliance, and be rewarded with a higher rate of interest on larger deposit amounts.

Receive ongoing interest on the funds in your account, with no minimum balance or minimum opening deposit.

If you want the security of a guaranteed rate of return, Circle Alliance Bank offers term deposits with terms ranging from one month to five years. The minimum investment amount is $1,000 and interest rates vary depending on the amount you deposit and the term you select.

If you’d like to apply for a savings account with Circle Alliance Bank, click the “Apply now” link on this page and you will be taken to the Circle Alliance Bank website. You can then download an account application form. Complete this form with your membership details and the type of account you’d like to open.

If you’re a new member, a membership application form is also available from the bank’s website. You’ll need to provide your name, contact details, date of birth and proof of ID when filling out this form.

Circle Alliance Bank offers a wide variety of accounts to suit the savings and transaction needs of an even broader range of people. Compare its accounts with other products from Australian financial institutions to ensure that you find the best account for your money.

This is a business bank account with no monthly account keeping fees and a free ANZ Business Visa Debit card.

Judo Bank is an online challenger bank that offers SME financing solutions and competitive term deposit rates. Find out more about this company here.

Having a local bank account makes an international student's life easier and even saves them money.

Samsung Pay is an app that lets you make contactless tap and go payments without using your debit card or entering a PIN.

With convenient access to your funds and a host of flexible features, Bendigo Bank’s Everyday Account can help you manage your day-to-day finances with ease.

The Online Saver Account from Australian Military Bank is ideal for people who have access to the Internet and are comfortable banking online.

An easy way to ensure you save money for the holidays is by opening an Australian Military Bank Christmas Club Account.

You don’t need much to open an Australian Military Bank Teen Plus term deposit. Once you do, watch your money earn interest.

If you’re not sure of what to do with your superannuation fund, look at what this DIY Super Saver Account has to offer.

Watch your savings grow exponentially with an easy-to-manage online high interest savings account.